“I never thought I’d be the retiring type but I’m sure I’ll keep busy doing something,” muses Rank Group CEO John O’Reilly, who retires today, 29 January, after nearly eight years in the hot seat at the FTSE 250 business behind Grosvenor and Mecca. What that “something” involves probably isn’t a senior leadership role at another firm. “I’ve promised everyone that I’m not going to do an exec role, so I won’t turn up somewhere else full-time again,” he insists on a Teams call with EGR from Rank’s Maidenhead HQ.

“I’m leaving but I’ve had way too much fun in the gambling sector to walk away completely,” he adds. Nevertheless, calling time on a 35-year career in this industry is bound to feel strange, especially as even at the age of 65 he was still clocking up 70 hours a week overseeing a business that spans land-based and digital operations in the UK and Spain. “I’ve always worked that much. I never switch off. When I’m out for a run on a Sunday, I plan my week ahead or write letters in my head – I can’t wear earbuds or anything.”

O’Reilly departs at a time when Rank and the industry are undergoing significant change. Its Grosvenor venues are benefitting from the law now lifting the maximum of gaming machines permitted from 20 to 80; an additional 850 machines were installed across 37 of its casinos in H1 2025-26 (the six months to the end of December 2025). Since last year, sports betting is permitted in casinos, too, driving additional footfall and delivering a new revenue stream. Meanwhile, the abolition of the 10% bingo duty on land-based venues from April, announced in the November’s Autumn Budget, is a boost for Mecca’s 49 properties.

On the flipside, the UK government’s decision to nearly double remote gaming duty (RGD) from 21% to 40% as of this April is naturally a hammer blow for the sector and Rank, which operates Grosvenor and Mecca in the online arena, as well as a supporting cast of proprietary brands including Spin&Win, Magical Vegas and Lucky Pants. The group expects, pre-mitigation, the impact of 40% RGD will be £46m on an annualised basis. Management has acted swiftly, slashing above-the-line spend and TV sponsorship deals. Contracts are being renegotiated with suppliers.

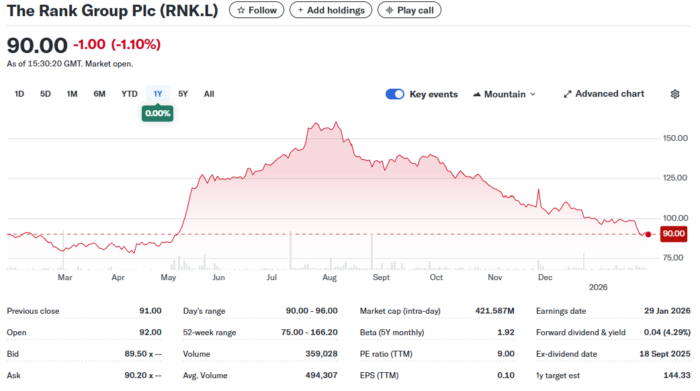

O’Reilly, who says Rank has about a 4% online market share in the UK, insists 40% RGD is “punitive” and will have a “big impact on the group”. He continues: “That reflects in the share price. It’s been disappointing the way the share price has been impacted by the [incoming] 40% tax, but I’m hopeful we are now in a period of regulatory and fiscal calm.

“While I’m retiring from my full-time role here at Rank, I certainly suspect I’ll be doing something in the sector and I’ll be encouraging government to protect the interests of an appropriately licensed, regulated and taxed marketplace rather than it going underground. The black market is already growing quicker than should have been the case.”

Climbing the career ladder

O’Reilly has been on the frontline of Britain’s most well-known operators since entering the industry in the early 90s, when he joined Ladbrokes at 31 as marketing controller of what was Britain’s biggest bookmaker at the time, run by Cyril Stein. Two years later, he was made commercial director, and he took a seat on the board of Ladbrokes UK.

In fact, O’Reilly was instrumental in the acquisition of rival retail and telephone bookmaker Coral for £363m at the end of 1997, only for the Monopolies and Mergers Commission to deem the deal anti-competitive and force Ladbrokes to sell its recently acquired asset. “We made a few quid, but it was painful. It took a year out of my life buying and selling [Coral].”

When not brokering acquisitions, O’Reilly was charged with running Ladbrokes’ busy telephone operation, which laid bets from some of the biggest punters in the world. “That was huge pressure because of the volatility of the stakes.” What’s more, he oversaw the build and launch of Ladbrokes.com at the turn of the Millennium, while functions encompassing everything from business development and property to public affairs and trading were his responsibility at one time or another. “I did everything during my 19 years at Ladbrokes apart from running the HR and finance functions.”

He left the business in 2010 and was part of a consortium that narrowly lost out in 2011 to Fred Done in the auction process to privatise the state-owned Tote. Though it was frustrating to be pipped to the post, O’Reilly took it on the chin. “You’ve got to be a good loser in life, otherwise you can’t enjoy it when you win.”

It was in 2011 – a year to the day after his non-compete clause with Ladbrokes expired – when he was hired by Gala Coral as managing director of Coral Interactive in Gibraltar. This was a period when the shift to mobile was having a profound effect on all consumer-facing digital industries, not just betting and gaming. Four years later, in 2015, he felt it was “about time to return home”, so he departed Coral and took up the role of chair at software development company Grand Parade (bought by William Hill in 2016).

A non-executive director position at Hills came in 2017, yet the following year, during the Cheltenham Festival in March, a call lit up his phone “completely out of the blue” enquiring if he would be tempted to take the top job at Rank Group (CEO Henry Birch had announced his intention to resign from the role). Becoming CEO of a publicly listed business like Rank was too good an opportunity to pass up. “Within a couple of weeks, I was signed up,” he says.

Man about the in-house

Installed in May 2018 as the boss of a casino and bingo business straddling gaming venues and online, key priorities included an increased focus on the customer, driving cost efficiencies, improved organisational capabilities and growing the online division. At the time, the company had around a 2.5% share of the UK’s remote gaming market. “As a Rank customer looking in before I joined, I thought, ‘I’m not sure they understand the digital world and the digital consumer’. After I joined, I found some really talented people here, but the technology was the weakness.”

To accelerate scale and revenue growth, it became abundantly clear Rank Digital needed to migrate off its third-party platform and take the tech in-house. In late 2018, a subsidiary of Stride Gaming was fined £7.1m by the Gambling Commission over money laundering and player protection shortcomings, the result of which was AIM-listed Stride’s shares cratered. Sensing this UK-focused casino and bingo operator was an undervalued asset, O’Reilly picked up the phone, and an agreement was reached with Stride’s directors for Rank to acquire the business and, more importantly, its proprietary tech. The 151p-a-share deal, worth around £115m, completed in October 2019.

The same month O’Reilly arrived, Rank acquired QSB Gaming Ltd, the owner of leading Spanish bingo site YoBingo for a total consideration of €52m. Today, that platform powers YoBingo, YoCasino and YoSports in Spain, a market where Rank also owns multichannel business Enracha.

While the integration of Stride into the UK-facing part of Rank Digital suffered hiccups along the way, the process was completed around three years after the acquisition closed. “We’ve made huge progress, though there’s still a long way to go,” O’Reilly affirms. “The Stride platform is about 17 or 18 years old today but we’re modernising it gradually, bit by bit.”

As for progress in Rank Digital’s financial performance, underlying like-for-like (LFL) net gaming revenue (NGR) climbed 10% to £235.7m in the 12 months to the end of June 2025. Of this, £208.8m was down to the UK online operations. Underlying LFL digital operating profit jumped to £33.3m, up 41% YoY (UK digital rose 47%). That momentum carried on into H1 2025-26, with underlying LFL online revenue and operating profit up 8% to £123.7m and 12% to £17.8m, respectively.

Grosvenor online has seen “particularly strong growth” (NGR up 17% YoY), Rank stated in the H1 earnings report. Grosvenor’s online generates average weekly NGR of £1.6m and has 250,000 active customers, Rank chiefs told an audience of sell-side analysts gathered at a Capital Markets Event at ‘The Vic’ casino on Edgware Road in October.

Around a fifth (22%) of Grosvenor’s online clients play once a week, though 5% of Grosvenor’s venue customers also play with the brand online. For Mecca, it’s 10%. And yet, these cross-channel cohorts are Rank’s most profitable players; 27% and 18% of online NGR is attributable to cross-channel Grosvenor and Mecca players, respectively. “They [5% and 10%] don’t sound like enormous numbers but there’s a huge ‘Pareto’ [principle that around 80% of profits often come from 20% of customers] in a casino business,” O’Reilly notes.

“We have lots of people who pop in on a Friday or Saturday night to our casinos after the pubs or clubs shut, have a beer and stick £10 in a slot machine – or maybe they don’t even stick £10 in a machine. They just have a beer with pals, but they are casino customers […] we are never going to get large percentages of Grosvenor – or for that Mecca – customers playing with us across channels.”

For O’Reilly it’s about ensuring a “seamless cross-channel experience” for those who play both live and online, whether it be a shared wallet and loyalty rewards, or being able to bet at an actual roulette table in a Grosvenor Casino while at home on a laptop or mobile device. A new livestreamed slots product is being rolled out to expand the omnichannel offering.

“Our most popular online tables are the ones we stream from our venues. Where we’d like to get to is every casino is streamed online, so if I’m playing in the Grosvenor in Hull I can go home and play on the same table I’ve been playing in the venue. We’re some way off that at the moment, but that’s what we want to achieve.”

Theory of evolution

As the boss waves goodbye to Rank and brings down the curtain – at least probably on a full-time basis – on a career stretching over more than three decades in the industry, what are his reflections as to how the sector has evolved during his time? With little hesitation, he replies: “When I started all those years ago, I had no consciousness of problem gambling. Almost zero. But since then, there has been an [industry] shift.”

Rank itself joined GamProtect, a cross-operator data-sharing scheme to block highly vulnerable players, last year, while its proprietary online customer monitor system ‘Hawkeye’ is why the company took the safer gambling initiative award at the inaugural EGR Europe Awards last March. Facial recognition will be trialled in venues later this year to identify customers who may present a higher risk of harm, bosses have said.

O’Reilly also flags how advertising has made gambling far more conspicuous compared to when he entered bookmaking in the 1990s, though he does wonder whether certain sports being plastered with betting logos is a good thing. Despite Ladbrokes, where he was working at the time, launching the first-ever TV gambling ad, in 2007, which featured a bunch of ex-professional footballers and former player and TV presenter Jimmy Hill, O’Reilly had urged restraint prior to gambling advertising being permitted as part of the Gambling Act 2005.

“I went before the DCMS Select Committee – this is on record – and I said you need to be careful allowing unbridled broadcast advertising of gambling because you might end up with more gambling ads than you would want.” Rank’s outgoing CEO continues: “Gambling has become more public than it’s ever been […] there’s probably more exposure to gambling advertising than people would ideally prefer.

“That has provided quite a lot of oxygen for the public health lobby who think gambling per se is a bad thing. I think gambling per se is a wonderful thing; gambling harm is a bad thing. That’s why society has made the choice that it ought to regulate and tax gambling and put it in the hands of responsible people.”

For now, the search is underway for O’Reilly’s successor. CFO Richard Harris is running the group on an interim basis, though Harris would be the retiring boss’ first choice if it was his decision. “Richard’s super-bright, capable and a lot more than a CFO […] the Rank board will have to run a process, but I really hope Richard is appointed on a permanent basis as CEO of Rank Group. I’m leaving it in very good hands.”

So where does Rank rate in terms of gambling businesses O’Reilly has worked at? “Being the CEO running Rank is where I’ve probably had the most fun. Rank and the people here are very special.” Reminiscing on his career overall, he adds: “I’ve had a ball. A great career. My kids when they were growing up always told their friends I had the best job in the world. I’ve always thought that, too.”

The post Top Rank: retiring CEO John O’Reilly insists he’s “had a ball” first appeared on EGR Intel.

The outgoing boss of Rank Group discusses his eventful career stretching over more than three decades, positive momentum in the digital arm and why the business is “in very good hands”

The post Top Rank: retiring CEO John O’Reilly insists he’s “had a ball” first appeared on EGR Intel.