In June 2025, Mattias Wedar became the first person to serve as LeoVegas Group CEO and lead its 1,900-strong workforce other than the operator’s long-term boss Gustaf Hagman, who co-founded the casino-first business in 2011 alongside fellow Swede Robin Ramm-Ericson. Hagman had been CEO for 14 years, leading the operator from humble beginnings through to an IPO in Stockholm in 2016 before the business was eventually snapped up by land-based gaming group MGM Resorts International in 2021 for more than $600m.

Wedar, who served as chief product and technology officer (CPTO) from 2019 and deputy CEO since April 2025, oversees a business propelled by the financial backing of MGM Resorts. Last year’s purchase of Tipico’s US-facing sportsbook tech to build out an in-house platform, and the 2023 acquisition of games studio Push Gaming to provide a content edge, are helping to futureproof LeoVegas Group.

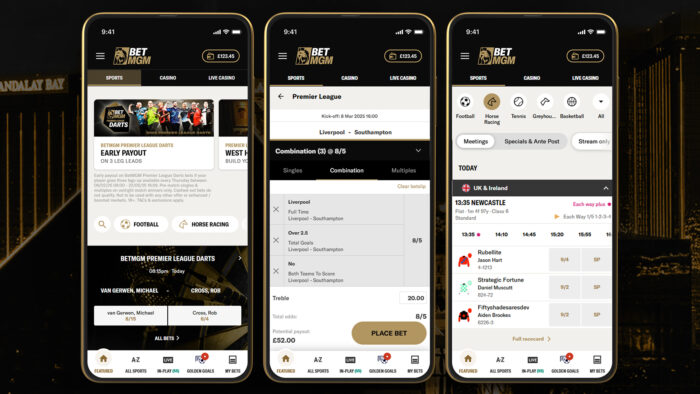

BetMGM, which outside North America is powered by LeoVegas Group’s tech and know-how, is live in the UK, Sweden and the Netherlands. Earlier this year, BetMGM launched in regulated Brazil through a joint venture (JV) with media conglomerate Grupo Globo. Including BetMGM, LeoVegas Group’s portfolio boasts a total of nine brands, comprising BetUK, expekt, Pink Casino and the eponymous LeoVegas.

As per MGM’s Q3 presentation at the tail end of October, LeoVegas Group is targeting at least 5% market share of the $34bn total addressable market in its core markets: the UK, Sweden, Denmark, Italy, Spain and the Netherlands. The eventual aim, Wedar informs EGR, is to transition from a Nordic-centric operator into an international tier-one player. Indeed, MGM bosses have enthused about the prospect of the unit delivering $1bn in annual revenue.

“Surround yourself with great people, that’s the best advice I can give,” Wedar muses when asked what he would tell his younger self. “You need to have a company that shares your values, and as long as you do that, you can have a great career,” he adds. That strategy has led the Swede to the top of LeoVegas Group, and now all eyes are fixed on how he steers the ship as its new captain.

EGR: How does it feel to be CEO?

Mattias Wedar (MW): I feel proud and honoured. It’s a personal recognition that people wanted me to take the next step – both Gustaf and the owners, MGM Resorts International. Some things are in line with what I expected [but] a few things are different. Overall, I’ve been filled with new energy. It’s really fun to open the door to the office and feel excited to drive things and try to take them to the next level.

EGR: When the idea of you stepping up to the top job was first floated, did you have any fears or concerns?

MW: Maybe not fear, but obviously consideration. Would Gustaf still play a role? What would my mandate be? But it was clear the day I was announced as CEO; Gustaf stepped out. Aside from that, it was, ‘Do I have what it takes?’ You never really know before you try. I thought I had the capabilities, and I have a lot of things to prove to myself and to the owners and the organisation.

Working on the product and technology side for six years is just one side of the business. There are other sides where I need to get much closer: commercial, compliance, operations and find out what their true challenges are. That’s not a fear, but I do need to be extremely humble because those are areas I have far less skills and experience in.

EGR: How hard is it follow in the footsteps of someone like Gustaf?

MW: He’s been here day and night for 14 years. It’s his legacy. It’s his company that he founded. They are very big shoes to fill. He focused on building a fantastic company culture and building a strong brand. And he focused on building the best products. I can’t simply step in his shoes and do that, [but] I am putting my own twist on it.

Gustaf backed me 100%, but the last thing he said was to take care of the people. I’ve never worked in a company with a culture this strong. It’s more than what you see in other places. This place means something to the people here. That legacy and heritage; I want to polish and sharpen it.

EGR: So, your version of LeoVegas Group is the existing company, yet a touch more refined?

MW: It’s doing things we are good at but even better. So, continuing to invest in product, technology and people as well as making sure we take our very strong Nordic position and build on that in additional geographies. We want to compete with the global tier-one operators. I think we have the right to do so. We just need to do things a bit better and a bit differently.

EGR: How did your time as CPTO prepare you for the role?

MW: It taught me a lot. At the end of the day, it’s about the product we sell. I’m coming from a very important part of the business. There’s the importance of building things of very high quality because, if you don’t, things can go south quickly. You need to put your best people in the room and say, ‘How do we interpret this? What can we do within this framework? What’s allowed, what’s not allowed?’ Having those years in product gave me confidence on how to navigate complex spectrums.

EGR: It’s been more than three years since MGM Resorts International acquired LeoVegas Group. What are the benefits and changes you’ve witnessed since?

MW: It’s been great to be honest – and this is not me just saying nice things to our owners. It was obviously a big shift from being publicly traded in Sweden and now reporting into a Fortune 500 company. Things are different but MGM want us to do what we do. They’re running us as an independent business.

They have deployed a lot of capital. We recruited staff, built new brands, launched in new markets and we feel we are a very important part of their portfolio. They want to continue to invest, and they have very high ambitions for us. What people see is the willingness to invest. There were two big acquisitions in Push Gaming and Tipico US – we have truly delivered on the promise that this is a growth and investment journey.

EGR: Why is LeoVegas Group committed to the UK, including the launch of BetMGM in 2023, given the market’s challenging conditions and increasing regulatory pressures?

MW: It’s a huge market. It’s huge, complex and fierce. You’re competing with flagship brands that have been there for a long time. We’re coming in as the new kids on the block. What we’re trying to do is to provide more entertainment by using the ‘Vegas’ way of communicating with our customers. We made a few mistakes. We got some things right. I think at the moment we are seeing good momentum in the UK.

In the grand scheme of things in the UK, we’re quite small, but we have ambitions to be a tier-one operator in the next couple of years, with a fairly big market share. That’s our ambition. We’re trying to navigate, build the product, figure out how to do retention and CRM, and we’re learning every day. The future will prove if we’re right, but I think we are on to something really good.

EGR: What is your reaction to the new UK tax hikes for remote gaming duty and online general betting duty?

MW: Black markets have already grown substantially, and higher taxes will inevitably add further fuel to the fire by making illegal, unlicensed operators more competitive and attractive to consumers. These operators can offer stronger incentives and prices, as they do not invest in compliance or safer gambling and, of course, do not pay tax.

The end result is that they can attract players, many of whom are unfortunately the most vulnerable, while providing none of the player-protection safeguards present in the regulated market. Perhaps there will be a short-term increase in total tax revenue collected, although experience in other countries casts doubt on this as well. But what are the long-term costs?

EGR: How have you been impacted by last year’s tax increase in Sweden from 18% to 22% on gross gaming revenue?

MW: We’re taking market share continuously. We are now clearly the biggest private operator in the market. The way we position the brand is our promise of being the strongest mobile operator in Sweden, which has served us very well. We’ve been in the market for 13 or 14 years. We know this industry so well. We have a big database. To answer your question, we have been able to absorb the tax increase in Sweden very well.

EGR: Is it disappointing the Nordics is no longer the epicentre of igaming in the way it was 20 years ago?

MW: I get the reason for that. The Swedish gambling market is much, much smaller than the UK. Finland is still under a monopoly and Denmark is a fairly small country. What’s interesting with the Nordic markets is a very well-developed digital agenda, from a KYC banking perspective.

All this stuff with proof of address or manual documents, it just doesn’t exist. You do credit checks online and KYC is through [Sweden’s electronic identification system] BankID, so it has some really beautiful elements to it. Norway is not on the table; there are no signs of regulation there. We’re very happy with our Nordic position and, with Finland regulating, I think we have the ambition to be a strong operator there, too.

EGR: In the Netherlands, where you are also licensed and live, a significant tax burden and other regulatory restrictions make it a particularly tough market. Is there any serious consideration given to exiting the country as a result?

MW: There are other aspects in the Netherlands as well with the [net] deposit limits [€700 per month, or €300 per month for under-24s, before mandatory checks kick in]. It’s difficult but, on the other hand, it’s a very level playing field. We have some market share in the Netherlands, but we’re not Unibet – I still think the Netherlands is very attractive. There are currently no exit plans. We will do our best to absorb that tax [set to rise from 34.2% to 37.8% from 1 January 2026].

EGR: Are there any other markets you’re interested in exploring?

MW: We’re continuing to evaluate. If you compare our footprint with what’s out there, there are markets in Europe, South America and elsewhere. At the moment, we have a lot of stuff to do where we are. We have a lot of things we can improve.

There are no immediate plans but we’re always looking, and if the right opportunity comes and we feel we have the capacity and the right to win, we will go in, because obviously there are new revenue streams that we would like.

EGR: The threat posed by the black market has become a key talking point across Europe. Is it a genuine and serious concern from your perspective?

MW: One hundred percent. The channelisation in some markets is extremely low. The black market is a problem. I think when there is no enforcement from the authorities in terms of payment blocking and/or when there are restrictions where you can’t offer certain products, then the playing field can get very uneven simply because the black market can offer something that we can’t.

In Sweden, the black market can offer larger welcome bonuses. I don’t have a problem with us not being able to offer that, but when [legislators] restrict our content, then it becomes hard to compete. We can talk about the black market as much as we want, but we also need to focus on how we can innovate and drive business within the frameworks. Let’s work out how can we drive innovation, customer journeys, touch points, user experience and innovation. I think there’s still a lot for us to do as an industry.

EGR: Is there an actual fix? How does the regulated sector innovate in the face of illegal operators with far fewer compliance costs and regulations to adhere to?

MW: Payment blocking is probably the one I would look into, [though] I understand that’s complex. If you can get to the payment, a lot of things would fall in place. B2B licences would be a good way, too. Innovating is difficult. I think with the whole customer journey, we need to find a way to improve this. If you take the neobanks, they’ve taken customer-centricity to the next level. They don’t have the legacy we have but they have a different approach, which is really interesting.

EGR: Turning to M&A, what was the rationale behind the Tipico US acquisition in 2024?

MW: We have always been proud of our technology. One thing that was not proprietary, though, was our sportsbook. Kambi has been a fantastic partner over the last few years, but being a customer to a supplier gives you some disadvantages. It’s hard to drive innovation and a unique player experience.

The opportunity with Tipico came up and we went to see them. It was a very good match, technically and culturally. We can now innovate the product, do pricing in a more innovative way and integrate it seamlessly into our offering. We are live with it in Denmark, and we see some fantastic results on the product. We believe we have the best sportsbook in Denmark. I’m really proud to say that, and now we’re continuing to roll it out in new markets. It’s been one of the best M&A integrations I’ve seen. They have brought fantastic people with great experience. This was a merger of equals.

EGR: Is there a divide separating those operators with in-house tech and those using third parties?

MW: If you want to be a true tier-one operator, I think you do better with your own technology in-house. Our philosophy is ‘control your technology, control your destiny’. With a big part of that offering being completely outsourced, it made a lot of sense to bring it in-house.

EGR: LeoVegas Group has always been a casino-first business. How do you innovate in that vertical?

MW: LeoVegas Studios and Push Gaming is one way to innovate. We also launched [progressive jackpot] LeoJackpot [in 2020]. I think the social aspects of tournaments is an area where we can innovate. And then obviously generosity and boldness and different types of retention. There is much more we can do in gaming.

Everyone is talking about personalisation. I don’t think anyone has really cracked it yet, to be honest, but obviously serving different content based on your profile is something we are doing. You also need to have a very fresh portfolio that is constantly serving new titles. There’s a localisation trend, so you need to build an ecosystem that can serve different content and different players in a very effective way.

EGR: How are you deploying AI?

MW: We have a 86% adoption rate of people [here] using it on a weekly basis. It’s everything from proofreading CRM to automating repetitive tasks to building monitoring tools. Everyone is talking about it, but I honestly believe it will change the industry. Not only ours, but every industry, to make sure things are faster, more automatic and we can focus on cognitive skills that you can’t use AI on in the same way, such as innovation, product development and strategy.

EGR: It’s very difficult, if not impossible, to integrate crypto as a payment option for regulated operators like LeoVegas Group. Do you wish regulators would change their stance?

MW: We don’t accept crypto now for the simple reason it’s not allowed in our jurisdictions. I saw movements from a few operators trying to move into crypto payments, and I welcome it, as long as we can make sure there are very clear guidelines on regulations. There’s a broad adoption of crypto. We know there are strong elements of KYC and traceability when you use crypto. As long as we set a clear and level playing field, I’m all for it, for sure.

EGR: What does the future for LeoVegas Group look like under Mattias Wedar?

MW: What we’re trying to do is continue to invest in our strong asset. From regional to global is something we want to do. We want to be out there and compete with the big guys and take market share in regulated markets. As long as we have that focus every day, the rest will play out.

The post The lion king: CEO Mattias Wedar on turning LeoVegas Group from regional to global first appeared on EGR Intel.

Mattias Wedar is treading new ground at LeoVegas Group, having replaced co-founder Gustaf Hagman as CEO this summer. In his first major interview since replacing Gustaf Hagman in the top job this summer, Wedar discusses tax rises, the importance of in-house tech, and how the casino-first business can “compete with the big guys”

The post The lion king: CEO Mattias Wedar on turning LeoVegas Group from regional to global first appeared on EGR Intel.