Super Group has reported a 30% year-on-year (YoY) jump in Q2 revenue to $579.4m (£433.3m), driven by gains in Africa, Europe and Canada.

The figure represents a new quarterly record for the New York-listed firm, up from Q2 2024’s revenue of $446.5m.

Adjusted EBITDA increased 78% YoY to $156.7m, while pre-tax profit amounted to $38.8m, up from $22.1m.

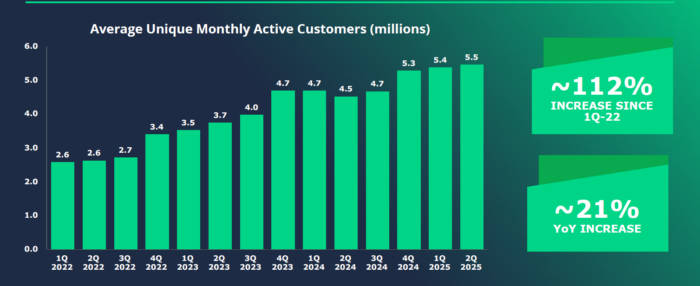

Monthly active customers jumped 21% YoY to 5.5 million for the Betway and Spin parent company.

Online casino continues to be the main source of revenue for Super Group, with the vertical accounting for $454m of the Q2 total, up from $348m last year.

The firm said there had been an “increased focus on enhancing product and games”, with a 58% revenue increase in Europe and a 42% leap in Africa. The UK saw the most growth, rising 75%.

Sports betting revenue rose from $91m to $116m, while brand licensing and other segments made up the remainder.

The UK, again, showed standout growth, with sports betting revenue rising 120% YoY. Super Group said improvements to trading and pricing had helped.

Geographically, Africa and the Middle East remains key for the business, with 40% of Q2 revenue coming from the region.

Revenue in the segment jumped from $165m to $229m, with Super Group holding seven podium positions in Africa with its Betway brand.

North America, driven by the group’s Canadian operations, accounted for 34% of group revenue at $199m.

And while there was record growth in the US with its igaming proposition, Super Group announced during the quarter it was planning to exit the market.

Having already pulled out of the online sports betting race last year, the operator was live in New Jersey and Pennsylvania with icasino only.

However, regulatory pressures and rising costs will see the company pull the plug.

Bosses said Q2 saw it pay $22.6m in relation to “onerous contracts” and a $63.9m goodwill and asset impairment on a non-cash basis.

In Q3, a cash cost of around $6m will be made as a final closing cost for US operations.

Elsewhere, Europe revenue hit $109m while Asia-Pacific was down slightly to $37m. Latam was also down to $5m.

Super Group said a poor performance in Mexico, its exit from Brazil and headwinds in New Zealand had impacted those regions.

On a H1 basis, revenue rose from $858m to $1.1bn, while adjusted EBITDA increased from $139m to $268m.

Looking ahead to the remainder of 2025, full-year adjusted EBITDA guidance has been raised to between $470m and $480m.

Non-US adjusted EBITDA should hit between $500m and $510m, up from greater than $480m issued in the prior guidance.

Super Group also announced $20.2m worth of dividends was paid to shareholders during the reporting period.

Neal Menashe, Super Group CEO, said: “We had a super first half of 2025, driven by a record-breaking second quarter.

“The quarter’s success was fuelled by strong execution across our key markets, a full calendar of global sporting events, increased deposits, high customer retention and margin expansion.

“While our decision to exit the US was difficult, we believe that this step demonstrates our commitment to capital efficiency and long-term profitability.

“With continued focus on scaling our technology globally, Super Group should be even better positioned for sustained, profitable growth.”

The post Super Group reports 30% jump in Q2 revenue first appeared on EGR Intel.

Betway and Spin parent company cite gains in Europe and Africa as key drivers, with full-year 2025 adjusted EBTIDA guidance having been increased

The post Super Group reports 30% jump in Q2 revenue first appeared on EGR Intel.