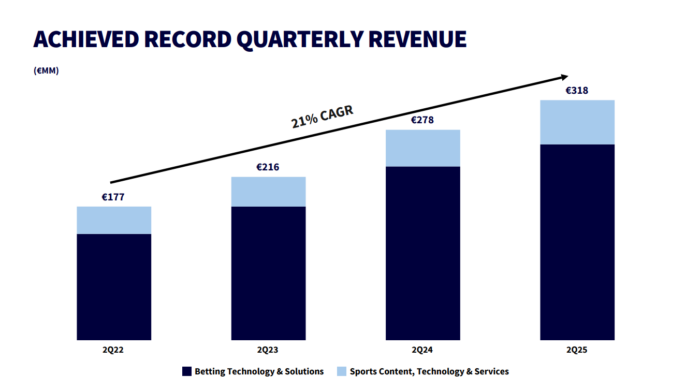

Sportradar has posted record quarterly revenue of €317.8m (£276.5m) for Q2 2025, marking a 14% year-on-year (YoY) rise, thanks partly to significant US growth and increased client spend.

The top line figure represents a 14.2% increase from the €278.4m generated in the corresponding quarter of last year.

The data supplier’s betting technology and solutions divisions contributed the lion’s share of the total, posting €258.8m in revenue, up 12% YoY.

Within the segment, a mixture of existing and new customer uptake, as well as US growth, meant that betting and gaming content revenue climbed 10%, while managed trading services reported growth of 21% due to increased turnover and higher trading margins.

The company’s sports content, technology and services arm generated the most significant increase, with revenue rising 22% YoY to €59m.

That increase was aided by growth within the marketing and media services segment, which grew 16% courtesy of an increase in spend from technology and media companies partnered with ad:s, Sportradar’s marketing service, as well as an expansion of the firm’s affiliate marketing capabilities.

Meanwhile, Sportradar reported adjusted EBITDA growth of 31% YoY to €64m, which was attributed to an improvement in company revenue and operating leverage. Adjusted margin expanded to 20.1%, up 254 basis points compared to Q2 2024.

Profit came to €49m, a steep €51m rise from the €2m loss that Sportradar posted in the same period last year. That turnaround was inspired by a foreign currency gain of €54m, though this was partially offset by income tax of €12m.

Breaking revenue down by geography, US operations climbed 30% YoY to €88m, while the market accounted for 28% of companywide revenue – up from 24% in the prior quarter. Sportradar’s Rest of World revenue rose 9% YoY to €229.8m.

As part of its Q2 earnings release, Sportradar also provided an update on its acquisition of IMG Arena and its sports betting rights portfolio, which includes 14 sports from more than 70 global rights holders in over six continents.

The deal, which is due to close in Q4 2025, will see IMG Arena parent company Endeavor pay Sportradar $125m (£94.6m) in cash payments over a two-year period.

Within the quarter, Sportradar also bolstered its partnership with German football’s Bundesliga, with the league deploying the supplier’s live match tracker and player market technology.

Sportradar also expanded its football offering to provide global betting rights to all 63 fixtures played at the FIFA Club World Cup in the US this summer.

On the back of the Q2 performance, management raised full-year 2025 revenue guidance to at least €1.28bn, which would represent yearly growth of at least 16%.

Adjusted EBITDA is now expected to amount to at least €284m, or YoY growth of at least 28%.

Carsten Koerl, Sportradar CEO, said: “Our second quarter results, including record quarterly revenue, expanding operating margins and significant cash flow reflect our sustained operating momentum and execution against our growth strategy.

“Our industry leading scale, including our premium content and product portfolio and leading technology and AI, is driving customer uptake and above market growth.

“The inherent leverage in our business, combined with our focus on efficiencies, is driving sustainable margin expansion and cash flow generation.”

On the outlook for the rest of 2025, he added: “Looking ahead, given our momentum we are raising our full year expectations and anticipate the acquisition of IMG Arena will further expand our capabilities, creating even greater value for our clients, partners and shareholders.”

Despite the positive financial results, Sportradar’s shares fell almost 9% to around $27 in early trading on the Nasdaq in New York.

The post Sportradar shares slide despite 14% year-on-year rise in revenue first appeared on EGR Intel.

Sports data supplier’s adjusted EBITDA jumps 31% to €64m, while bosses raise top and bottom line full-year 2025 guidance

The post Sportradar shares slide despite 14% year-on-year rise in revenue first appeared on EGR Intel.