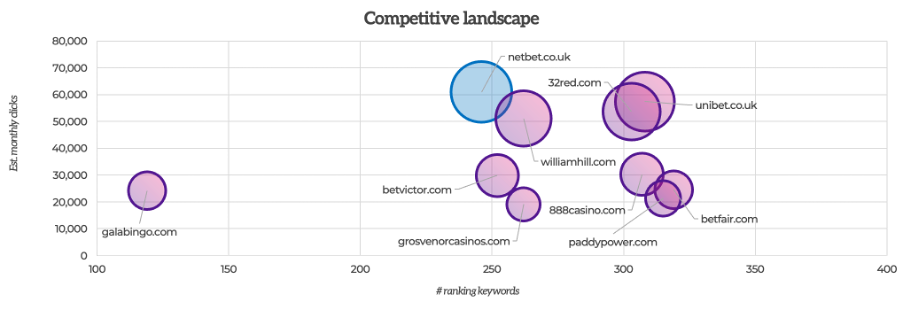

In a much-changed casino market, NetBet finds itself as the new leader in the organic rankings, overtaking previous leader 32Red and sitting as the most visible brand in a sector that has seen a 10.3% increase in search volume since July 2024.

On top of there being a new leader, the overall complexion of the organic market has changed considerably in that time. Previously, 32Red received over 22,000 monthly clicks more than NetBet, and among the top five brands, none were within 8,000 clicks of their nearest rival.

Now though, the top four brands are separated by less than 10,000 monthly clicks. And while there is a big gap after these top four brands, another sign of this sector becoming increasingly competitive comes from 9,000 clicks covering the next five brands.

NetBet takes lead as rivals fall back

New organic leader of the sector, NetBet has seen traffic increase in line with the overall market increase. This indicates that the brand had a strong platform already, which was set up to benefit from any growth in interest but also resistant to competition.

This is also shown by the brand now ranking for 16 fewer keywords than in July last year but improving its average ranking, which means that the keywords it is no longer ranking for were low-ranking keywords that the brand had no need to compete for.

While NetBet actually ranks for fewer position one keywords than in our last analysis, it has crucially held on to the ranking for the keywords with the highest search volume. This includes maintaining its ranking for ‘casino’ and improving from position two to position one for ‘online casino’.

NetBet will be keen to avoid any further losses at the sharp end of the organic rankings, but continuing to rank top for the biggest keyword in the sector and improving for another of the most searched-for terms shows the strength of NetBet’s position.

Since NetBet’s traffic growth was in line with the overall market trend, it needed 32Red to perform below the market average in order to overtake it at the top of the rankings.

Unfortunately for 32Red, its 31.4% decrease in organic traffic enabled both NetBet and Unibet to overtake it. While being the third-most visible brand in the sector is a good position to be in, it is still a drastic change from being the leading brand by an estimated 22,670 monthly clicks in July 2024. So, what has changed?

On the surface there are no dramatic shifts to suggest where traffic has been lost, with both the number of keywords 32Red ranks for and its average ranking position remaining consistent.

However, when we look at the area that 32Red was previously dominant in, slots, we see where traffic has been lost. Falling from position one to three for ‘slots’ has cost the brand an estimated 7,217 monthly clicks on its own, while further losses from medium-volume terms such as ‘slots uk’ compound the issue.

Despite this, 32Red has actually seen slight increases in the number of terms it ranks for in both position one, and in the top three positions. This suggests that the losses from the slots market could be due to changing business priorities or stronger sector-specific competition, as it has managed to improve its visibility elsewhere, including new position one rankings for ‘uk casino’ and ‘online casinos’.

As a brand that saw so much traffic brought in from one area of this sector, how 32Red fares in the slots market will have an outsized impact on its overall visibility compared to other casino brands. However, stronger results elsewhere suggest that its influence in the sector could be broadening.

Unibet, Gala Bingo and William Hill see huge traffic growth

As we’ve mentioned, Unibet also overtook 32Red in the past year, but whereas NetBet was already 32Red’s closest challenger, Unibet has seen a 154% increase in traffic to go from being the ninth-most visible brand in the sector to being less than 4,000 monthly clicks behind the leader.

The key to Unibet’s success has been improving its existing rankings. While it does now rank for more keywords than in our last analysis, the more significant change has come from its average ranking position.

Of course, as a brand that was already among the most visible in the casino sector, Unibet was already seeing some strong ranking positions such as position one for ‘casino gaming’ and position three for ‘casino’. It only ranked in position one for four keywords, but it kept a consistent presence towards the top of the rankings for a range of medium-volume terms.

This broad base with a few strong results gave Unibet the platform to improve its rankings, most notably for keywords with a higher search volume than those it was already ranking highly for. Unibet now counts ‘uk slots’ and ‘casinos’ among its 20 position one rankings, while ranking in the top 10 for other high-volume search terms such as ‘casino online’, meaning that there’s further room for growth and increased traffic if it can continue its trajectory.

Unibet wasn’t the only brand to see significant traffic increases in the casino sector, with William Hill and Gala Bingo seeing 574% and 639% growth respectively to enter the top 10.

Both brands saw hugely increased visibility, but William Hill’s came from improving existing ranking positions, whereas Gala Bingo’s growth was largely driven by ranking for new keywords.

Despite still having a smaller keyword profile than its rivals, Gala Bingo has increased its number of ranking keywords by 56.6%, and has benefitted considerably from a position one ranking for ‘slots’. As we have seen with 32Red, losing ranking positions for such a significant keyword can have outsized effects on visibility, but Gala Bingo has been strengthening elsewhere to avoid overreliance.

Losing presence for ‘slots’ would still have a huge impact on overall visibility, but having seen its number of top three rankings increase from five to 33, Gala Bingo is reducing the risk of that happening, as well as giving itself more opportunities to grow.

William Hill, meanwhile, will look to continue improving its ranking positions, as its already strong keyword profile meant that the clearest way to visibility improvements was optimising what the brand already ranked for. With top three keywords for a range of the sector’s most searched terms, the brand is in an excellent position to continue growing and challenge the leaders in the casino sector.

Overall, here are three key takeaways from what we have seen in the casino market:

- Big wins can come from improving already strong rankings. Unibet and William Hill both previously ranked in the top 10 positions for a number of terms, but improving those terms to be right at the top of search results helped them become two of the most visible brands in the sector.

- Increasing keyword diversity builds resilience. As we’ve seen from 32Red, increased competition or changing business priorities in an area you previously dominated can have a large impact on overall clicks. Ensuring that your brand ranks for a diverse range of keywords is hugely beneficial in this scenario.

- More isn’t necessarily better. NetBet saw greater organic traffic despite ranking for fewer keywords. While having a broad keyword profile is crucial, focusing on the most important terms within that is what will bring you the most visitors.

To find out more about how Stickyeyes could help your brand to establish and maintain organic growth in the casino market and beyond, please reach out to William Conboy, director of igaming by Stickyeyes at William.conboy@stickyeyes.com.

The post SEO Tracker: Growing search interest increases casino competition first appeared on EGR Intel.

Stickyeyes data shows NetBet out in front as the most visible brand, overtaking previous leader 32Red

The post SEO Tracker: Growing search interest increases casino competition first appeared on EGR Intel.