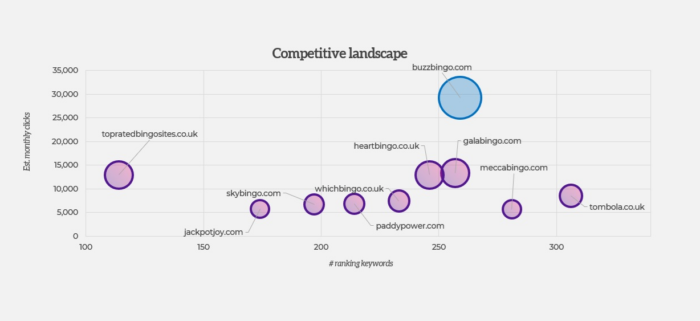

After a turbulent summer, the online bingo market appears to slowly be regaining some of its lost traffic, with an overall increase of 3,067 clicks, or 2%, since July 2025. This appears to be down to competitor strategies of consolidating core search keywords, with the result that traffic has either increased or remained steady within the top five brands despite an initially apparent loss in ranked terms.

We have also seen a change in the type of keywords searched, with generic terms like ‘bingo online’ being replaced by higher-intent terms such as ‘new UK bingo sites’, which has contributed to a rather different top 10 than could be seen last July.

Buzz Bingo maintains top spot by significant margin

Buzz Bingo has maintained its place at the top of the table by focusing on core, high-value keywords, ranking first for ‘bingo’. While the number of ranked keywords has fallen in the last six months from 320 to 259, the company has experienced a 19% increase in clicks overall, which suggests this concentrated strategy is working.

Furthermore, as previously mentioned, the keywords with the most traffic have changed significantly. Generic terms have undergone a large decrease – for example, ‘bingo online’ was searched 550 fewer times in H2 2025 compared to H1. In place of these broad keywords are very specific, high-intent keywords, such as ‘new bingo sites UK’, which was searched 220 times more in the same time period.

Buzz Bingo rank consistently high in many of these high-intent keywords. As these have overtaken more generic terms in popularity, Buzz Bingo is able to reap the rewards in increased traffic stemming from them.

Differing keyword strategies lead to a change in competitors

The concentration of focus on core keywords has also been beneficial to competing brands, with most of the top 10 companies having gained or maintained traffic while reducing the number of keywords for which they rank. The biggest winners since July have been Heart Bingo, with traffic increasing by 9,000 to more than double what it was six months ago, as well as newcomers Jackpotjoy with 5,771 new visits and Mecca Bingo with 3,667.

These competitors appear to have picked up a sizeable amount of the traffic lost by Foxy Bingo and Sun Bingo, both of which have dropped out of the top 10 altogether after losing a combined 22,517 clicks. Although at first this appears surprising given that Foxy Bingo was the second most successful competitor in July 2025, this is likely explained in part by the shift in keywords.

In July, Foxy Bingo consistently ranked in the top five for generic terms; the most recent set of results suggests a drop of several places in many of these. When we also consider that these generic terms are less commonly searched for this month, we can start to piece together reasons for such a sharp decline.

Another reason for Foxy Bingo’s drop in traffic is – although it had ranked steadily in the top five – it was seldom in first place; a trend we can now see mirrored in tombola’s rankings. Here, again, the keywords for which the two rank highest are fairly generic, and they consistently rank between second and fifth place.

This can severely impact the click-through rate, a metric obtained by dividing the number of times a link is shown by the number of times it is clicked on. The fewer keywords a company ranks first for, the fewer links a user will see and, thus, the lower the click-through rate will be.

Interestingly, tombola appears to be bucking the trend for core keyword consolidation, gaining 39 new ranking keywords since July. Given the market has experienced a rise in traffic overall, it will be interesting to see whether its broad coverage strategy can be converted into more first-place rankings and a better click-through rate.

Aggregator advantage grows

Aggregators have also made significant gains in the past six month, largely due to the shift in keyword trends, with Which Bingo gaining 1,342 visits and Top Rated Bingo Sites showing a traffic increase of 1,847. Together, these have accounted for 0.67 percentage points of all new traffic in the market.

These sites in particular have made gains from the emergence of keywords such as ‘new UK bingo sites’, which alone saw 220 more searches than in our last analysis. Given the nature of their offering – assisting users in selecting operators across an incredibly competitive field – these competitors consistently rank highly among these searches, as well as scoring highly on Google’s freshness metric due to their changing and dynamic nature: new offers and comparisons are consistently appearing from multiple avenues.

Another reason for the aggregators’ growth is undoubtedly the rise in searches for ‘free bingo’ and related terms, with an estimated uptick of 300 searches apiece. These competitors are uniquely placed to collate free or highly discounted games, many of which can be played in demonstration mode, thus appearing towards the top of the search results for these queries and increasing their click-through rate.

Overall, here are three key takeaways from what we have seen in the bingo market:

- Core keyword consolidation appears to be a winning market strategy, with a focus on quality rather than quantity proving successful for many of our top 10 competitors. Despite ranking for fewer keywords overall, the most successful sites are ranking higher in their selected search terms and thus increasing their click-through rates.

- Changing trends in the types of keywords searched have vastly impacted the bingo market landscape, with a strong lean towards new sites and new offers which has greatly benefitted the affiliates on the scene.

- Market share is also shifting based on keyword adaptation. With a downward trend in searches for generic terms, the most successful competitors are those with the highest ranking for longer-tailed, high-intent keywords. This has led to significant shifts in the makeup of the top 10, with newcomers on the scene replacing previously high-ranking competitors.

To find out more about how Stickyeyes could help your brand to establish and maintain organic growth in the football market and beyond, please reach out to William Conboy, director of iGaming by Stickyeyes at William.conboy@stickyeyes.com.

The post SEO tracker: Bingo market showing tentative signs of recovery first appeared on EGR Intel.

Analysis by Stickyeyes finds Heart Bingo and Jackpotjoy are the “biggest winners” of the last six months as they picked up traffic lost by Foxy Bingo and Sun Bingo

The post SEO tracker: Bingo market showing tentative signs of recovery first appeared on EGR Intel.