Better Collective co-founder and co-CEO Jesper Søgaard is looking ahead. While the Danish affiliate reported an 18% decline in Q2 revenue, the performance was in line with expectations amid tough comparisons in Brazil and North America. The exec said the company is planning on “reaccelerating topline growth” in 2026, as the lay of the land eventually settles.

The settling, of course, will depend on if the Brazilian authorities further tinker with a regulated market that only went live in January. Increased taxes and marketing restrictions have been proposed, while concerns around the growth of the black market remain. For Søgaard, it is about finding the balance to support the state, stakeholders and consumers.

In the US, the plan is still to reap the rewards of revenue-share deals, while FanDuel’s recent announcement it has partnered with CME Group to expand into prediction markets could open a new revenue stream for the business. And while 2025 guidance has remained unchanged, a World Cup next summer has the affiliate licking its lips in anticipation.

EGR: What’s your reaction to the report? You said it was in line with expectations, but revenue and EBITDA were still down year on year.

Jesper Søgaard (JS): It wasvery much as expected. The biggest market transition we’ve ever seen – from a dotcom market to a local licensed market in Brazil – I think we’ve managed that that well. There was a lot of uncertainty heading into this year; we tried to guide on that and we are now basically seeing it panned out more or less as we expected and guided for.

That has really required a lot of work from our business development teams to land contracts to actually be able to do business in this newly regulated market. A lot of compliments to the teams working on this, my colleagues, they really have done a great job.

The efficiency programme we announced end of last year, to the tune of €50m, we have now successfully completed. It is a big milestone and a lot of credit to the organisation for stepping up and meeting that challenge. It has left us with a lean, agile organisation.

EGR: Brazil had “stronger-than-anticipated player retention and wagering activity”, but do you trust the authorities in the market not create more headaches with tax and marketing restrictions?

JS: I think this goes for all regulated markets. It’s such a fine balance of getting regulation right, where you achieve the highest possible consumer protection, are able to see the maximum tax income for the state, while still allowing for a free market that works.

If you tighten too much, you will just see increasing leakage to the non-licensed market. Right now, there is a ban on sign-up bonuses in Brazil, and that has obviously led to many Brazilians deciding to go elsewhere where they actually can get a bonus. And unfortunately, consumers are not all always aware whether an operator is licensed or unlicensed. They are more focused on a bonus.

We are dependent on regulators finding the right balance. We do our best to explain and educate on what we’ve seen in many markets. We are actually the first touch point for consumers when they consider where to gamble, and unfortunately, we are in competition with some other parties that also promote unlicensed options. So again, that’s why we need the right conditions for the regulated, licensed market.

EGR: In the US, how do you see the landscape shaping up given the slowdown in state launches? Is it a case of waiting for the revenue-share deals to kick in?

JS: We are still focused on building the revenue share base and on developing products and content offerings that cater to the retention of players. We will always be sending new customers to our partners, but equally, we’re focused on being relevant from a retention aspect, with the consumers coming back to our brands, consuming our content, using our apps, including odds comparisons and bet placement functionality. All of that is our way to drive retention for our partners, which is, I think, where the direction of travel is. Having said that, we will still see state launches. It’s just very hard to predict when they will come.

EGR: Are prediction markets a potential revenue stream to explore given the lack of state launches?

JS: We just had the announcement from FanDuel that it’s making a pretty significant step in the direction of prediction markets, and we are basically aligning ourselves with our partners. So, for us, that’s really interesting to see. Back to the audience that come to us, they are clearly the target group for prediction markets. We have the relevant audience, so we will keep close to prediction markets and see how that evolves. I think it was quite a significant step by FanDuel.

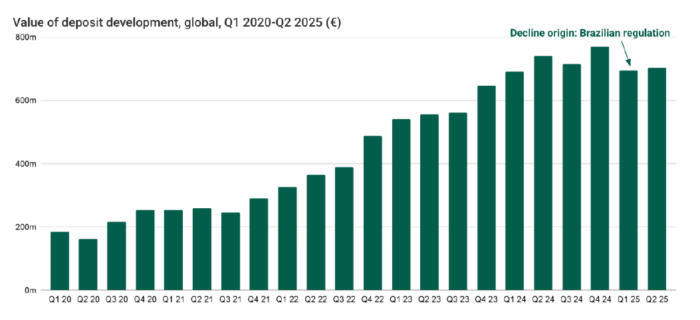

EGR: Can you speak a bit more about the ‘value of deposit’ KPI and why this is now being disclosed? Is this a truer metric than NDCs?

JS: We get a lot of questions from investors about the revenue share. We think the deposit metric is a pretty good indicator of the development of these customer databases. At the same time, the revenue share buildup in the US, which we have been speaking about for several years, is where we’re not really seeing it in the commissions yet because of big bonuses being granted.

But you can tell in the deposit figure that it keeps rising. It’s a way for us to show that what we’re saying about that buildup, despite not materialising in significant revenue yet.

EGR: Another segment broken out for the first time was esports. Could you touch on your expectations for the division?

JS: Due to the size of the division and esports having its own management, there was actually requirement for us to have it as a separate segment. But it’s also a very exciting area. FUTBIN and HLTV are some very big brands, with really engaged and dedicated audiences, so we are excited about that opportunity.

We think there’s still a lot of unrealised potential in that business and, by splitting it out, it gives further focus.

EGR: Looking at 2026, you spoke about reaccelerating topline growth in the earnings report, what will help in that regard?

JS: With Brazil this year, it is about finding the base of that business and then growing from there. Back to our previous topic of regulation, obviously, we are dependent on how that eventually settles.

The 2026 World Cup is a super big event, especially for our business, being focused on Europe, North America and South America. It couldn’t really be a better World Cup for us, with North America being the host countries and South America and Europe naturally being super engaged with the World Cup.

We are already full on in preparation for the World Cup. It will be a very significant event for us next year, no doubt.

The post Q&A: Better Collective co-CEO on prediction markets and hopes for Brazil first appeared on EGR Intel.

Jesper Søgaard tells EGR the affiliate is keeping a close eye on the sector in light of FanDuel’s partnership with CME Group, while he remains optimistic Brazilian regulation will not further restrict the legal market

The post Q&A: Better Collective co-CEO on prediction markets and hopes for Brazil first appeared on EGR Intel.