This analysis examines European gaming behaviour across four key markets: Greece, Spain, Italy and the United Kingdom.

The data reflects trends from September 2024 to September 2025 and is based on an average of 6.2 million active players per month. The analysis covers five key performance indicators: monthly deposit amount, sports betting amount, casino betting amount, player activity days, and customer retention rate.

Key findings

- Greek players bet high and often: Greece consistently leads in average monthly deposits, sports betting amounts, customer retention, and is the most frequent player group with the highest activity days. Their high spending, engagement, and loyalty suggest they are a highly valuable player segment.

- Spanish players appear to be more volatile: Spain dominates in casino betting, but its lower customer retention rate indicates potentially inconsistent bettor behaviour.

- UK players are the most casual: The UK consistently records the lowest average betting and deposit amounts. This lower spending is coupled with one of the lowest retention rates, suggesting a base of casual, lower-stakes players.

- Italians are loyal but can be disengaged: Italy generally occupies the middle ground across most metrics, including betting amounts and deposits. Their retention rate is the second highest, but their activity days are the lowest, suggesting loyalty, but not consistent engagement.

- Seasonal trends in betting: Sports betting saw a notable dip for all countries during at least one of the summer months (June, July, or August), likely corresponding to the offseason for major European sports leagues. Conversely, casino betting remained more stable and even saw an increase in average bet value during the same period.

- September status: September 2025 data show a healthy increase in retention rates for all countries following the summer dip. However, sports betting activity remained similar to August, even with the major leagues restarting their activities.

Category: average deposit amount

Key finding: Greek deposits almost double other European nations

Overall, Greece stands out with significantly higher deposit amounts than the other nations, consistently staying above the $400 mark. Italy, Spain, and the UK are clustered much closer together, generally fluctuating between $200 and $300. The trend for most countries remained relatively stable with minor fluctuations, though Italy saw a gradual increase in the second half of the period. Comparing September 2025 to the previous month, all four countries experienced a slight decrease in their average deposit amounts.

- Greece:

September 2025: $529

12-month trailing average: $495 - Italy:

September 2025: $272

12-month trailing average: $270 - Spain:

September 2025: $258

12-month trailing average: $259 - UK:

September 2025: $240

12-month trailing average: $226

Definition of average deposit amount: The average deposit amount is calculated by taking the total sum of all deposits and dividing it by the number of sports and casino bettors (players) who have made at least one deposit.

Category: total monthly casino betting amount

Key finding: Spaniards and Greeks spend more on igaming

Spain and Greece are the clear leaders in casino betting, with their average wager amounts significantly higher than those in Italy and the UK. Spanish players, in particular, show the highest average spending, surpassing Greece in 10 out of 12 months. The UK consistently has the lowest average casino betting amount.

Unlike sports betting, casino betting does not show a strong seasonal decline during summer; on the contrary, the category seems to show an increase in the average value of bets during these months. For September 2025, all four countries saw a slight decrease in total monthly casino betting compared to the August average.

- Spain:

September 2025: $2,850

12-month trailing average: $2,662 - Greece:

September 2025: $2,700

12-month trailing average: $2,546 - Italy:

September 2025: $1,650

12-month trailing average: $1,731 - UK:

September 2025: $1,100

12-month trailing average: $1,046

Definition of total monthly casino bet amount: The average casino bet amount is the total sum of all casino bets divided by the number of bettors who have placed at least one casino bet.

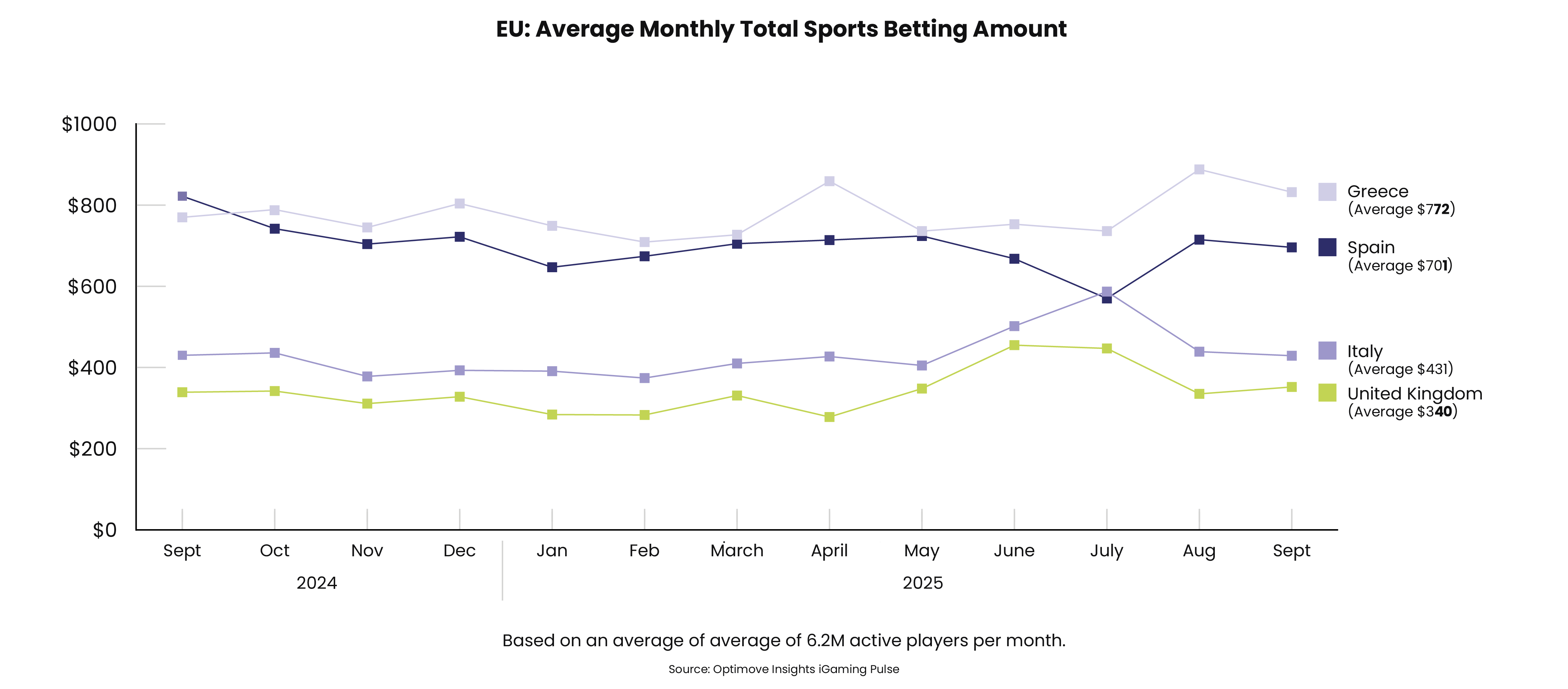

Category: total monthly sports betting amount

Key finding: Greeks and Spaniards bet more on sports

Throughout the 12-month period, Greek and Spanish players consistently wagered the most on sports, with Greece holding the top spot for most of the year. A clear seasonal trend is visible across all countries, with a significant dip in betting activity during at least one of the summer months (June, July, or August), followed by a sharp recovery in Greece and Spain. September 2025 shows similar numbers compared to August for all four countries.

- Greece:

September 2025: $820

12-month trailing average: $772 - Spain:

September 2025: $700

12-month trailing average: $701 - Italy:

September 2025: $430

12-month trailing average: $431 - UK:

September 2025: $350

12-month trailing average: $340

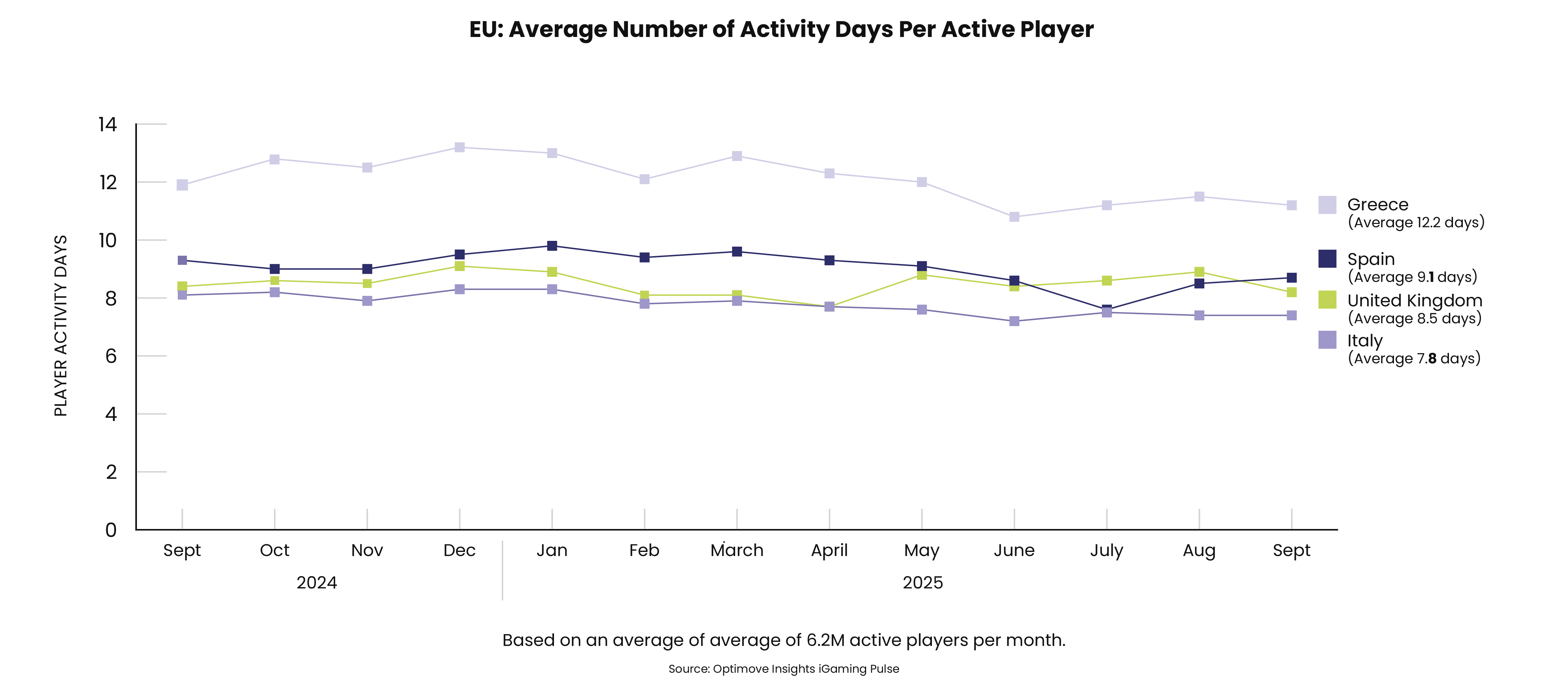

Definition of total monthly sport bet amount: The average sport betting amount is the total sum of all sports bets divided by the number of bettors who have placed in least one sport bet.Category: average number of activity days per active customer

Key finding: Greek players are the most frequent bettors

Greek players consistently averaged over 10 activity days per month. Spanish and the UK players follow, showing similar levels of activity, while Italian players typically range between 7 and 8 days per month.

The general trend shows relative stability for most countries, with minor seasonal fluctuations. In September 2025, Greece and the UK saw a slight decrease in activity days compared to August, while Italy remained flat, and Spain saw a minor increase.

- Greece:

September 2025: 11.2 days

12-month trailing average: 12.2 days - Spain:

September 2025: ~8.8 days

12-month trailing average: 9.1 days - UK:

September 2025: ~8.4 days

12-month trailing average: 8.5 days - Italy:

September 2025: 7.4 days

12-month trailing average: 7.8 days

Definition of average activity days: The average number of activity days is the total number of activity days divided by the number of bettors who have at least one activity day.

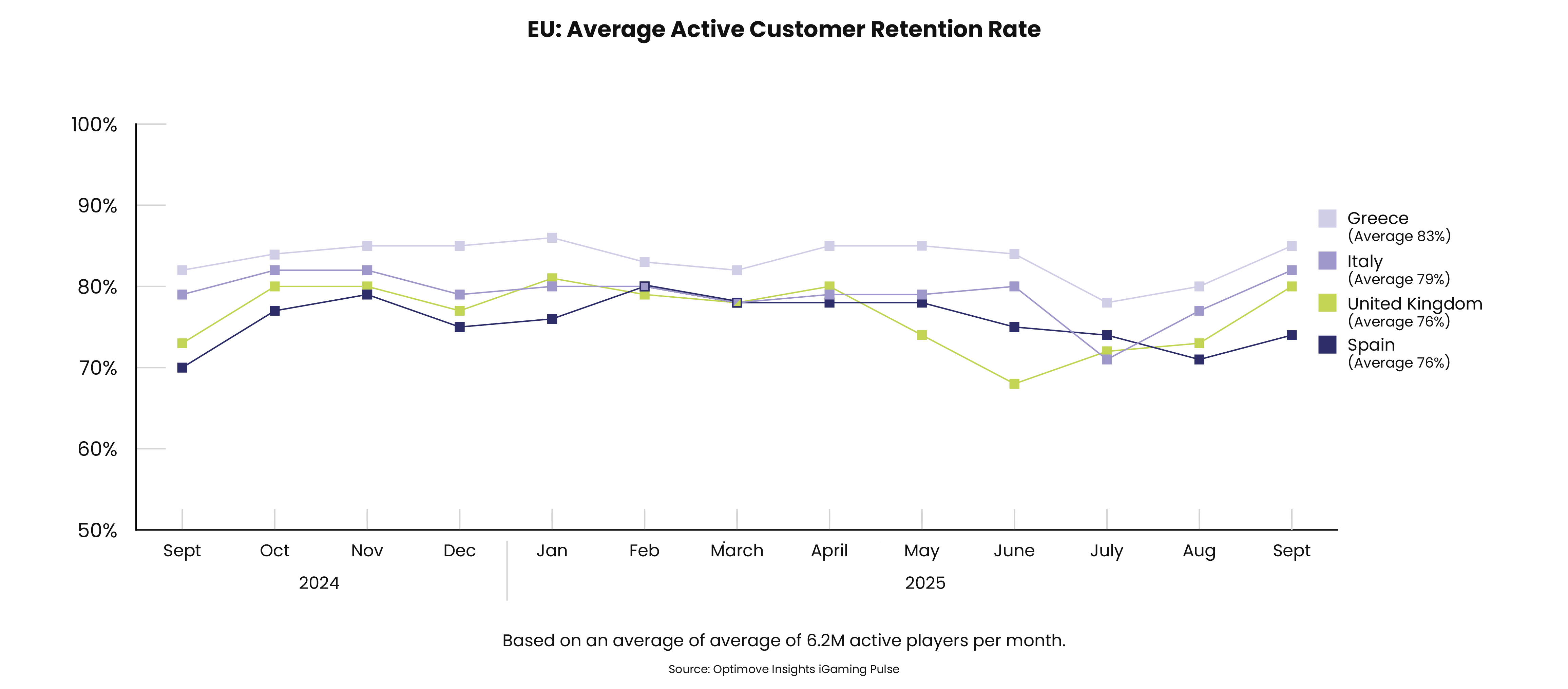

Category: average active retention rate

Key finding: Greece demonstrates the highest and most consistent customer loyalty

Greece leads this category with an average retention rate of 83%. Italy follows with solid retention rates, averaging 79%. The UK and Spain have the lowest retention rate of the group at 76%, despite Spain having the second most active players.

A common trend is a dip in retention during the summer months, which was particularly pronounced for Spain in August, Italy in July, and the UK in June. Following this dip, all countries experienced a healthy increase in their retention rates in September 2025 compared to August.

- Greece:

September 2025: 86%

12-month trailing average: 83% - Italy:

September 2025: 82%

12-month trailing average: 79% - UK:

September 2025: 78%

12-month trailing average: 76% - Spain:

September 2025: 74%

12-month trailing average: 76%

Definition of active retention rate: The percentage of bettors who were active in the preceding month and remained active in the current month.

For more insight, visit iGaming Pulse.

The post Optimove Insights: “Healthy increase” in retention rates across main European markets first appeared on EGR Intel.

Marketing research analyst Oren Elias also finds that the UK continues to record the lowest average bet and deposit amounts compared to Greece, Italy and Spain

The post Optimove Insights: “Healthy increase” in retention rates across main European markets first appeared on EGR Intel.