As the digital betting landscape evolves, esports has emerged as one of its fastest-growing verticals, attracting increasing attention from operators, players and regulators alike.

Estimates suggest global annual esports betting revenue will have reached $2.8bn by the end of this year – a 12% year-on-year increase and more than double the figure of just four years ago. Next year, the total is projected to surpass $3bn.

This sharp growth in the 2020s has led to an inevitable increase in regulatory scrutiny. However, the relatively nascent nature of the vertical has left many watchdogs playing catch-up.

In many jurisdictions, there is a lack of regulatory clarity that appears to be borne out of an intrinsic lack of understanding of esports, as well as esports betting. Nowhere is this more apparent than in the US. Despite the growing popularity of esports, traditional sports wagering is still legal in more than twice as many states as esports betting, and 19 states are considered grey states, meaning they lack specific legislation related to esports betting.

Building understanding and trust

Across the world, regulatory oversight of the vertical is still in its infancy in many territories. For esports betting solutions supplier Oddin.gg, the challenge is to work with policymakers in different regions to build understanding and ultimately trust.

“We are trying to educate regulators about what esports actually is,” Oddin.gg co-founder and managing director Marek Suchar says. “We are locally present [in different markets] so essentially our staff are on hand to address concerns in native languages.

“The goals are different for different regulators, so we are trying to have open discussions and do the educational part at the same time as building relationships with regulators. Many times it is about addressing the mainstream perception of esports betting.”

One of the key misconceptions regarding esports is that the activity engages those under the legal age to bet.

“There have been a lot of misconceptions around esports betting. Many of those are tied to mass media messaging.”

Whilst it is true that esports has long been touted as a vehicle to engage a younger audience, with the 18- to 43-year-old age group accounting for 87% of the activity’s betting audience, the average age of an esports bettor is comfortably above the lower threshold in regulated markets.

For instance, the average age of an esports punter hovers between 29 years old for League of Legends and 31 for Counter-Strike – two of esports’ most popular titles.

“There have been a lot of misconceptions around esports betting,” Suchar says. “Many of those are tied to mass media messaging – the assumption is that there is underage betting because the players themselves are underage. That is not true.

“We have run our own analysis and found that, out of the top 100 esports teams, only one would have been classified as underage. Furthermore, when it comes to underage bettors, the operators require proof of age.”

Worldwide experience

Oddin.gg provides a range of esports betting solutions spanning odds feeds, risk management, iFrame solutions, marketing and more for leading iGaming operators like Betway, Yolo Group and Aspire Global in a range of markets. This worldwide experience allows them to draw upon substantial know-how and share their learnings with operators and regulators in different jurisdictions.

“Each region has a different perception about esports betting, but the concerns are often similar,” Suchar adds. “We can usually tell regulators how we have already answered these questions in other markets, so we have the narrative prepared.

“At Oddin.gg, we hold multiple licences across the world. In North America, for example, we are licensed in Arizona, New Jersey, Colorado, West Virginia, Ohio, and Ontario – and that gives us credibility if we start speaking to regulators in other states.

“We are basically saying, ‘look, we are already regulated across multiple jurisdictions and we work with reputable brands’. When it comes to betting, we understand the trends and we understand how the industry works.”

That understanding extends to the nuances of the esports sector, which, unlike traditional sports, does not have a universally recognised international governing body to provide ultimate oversight.

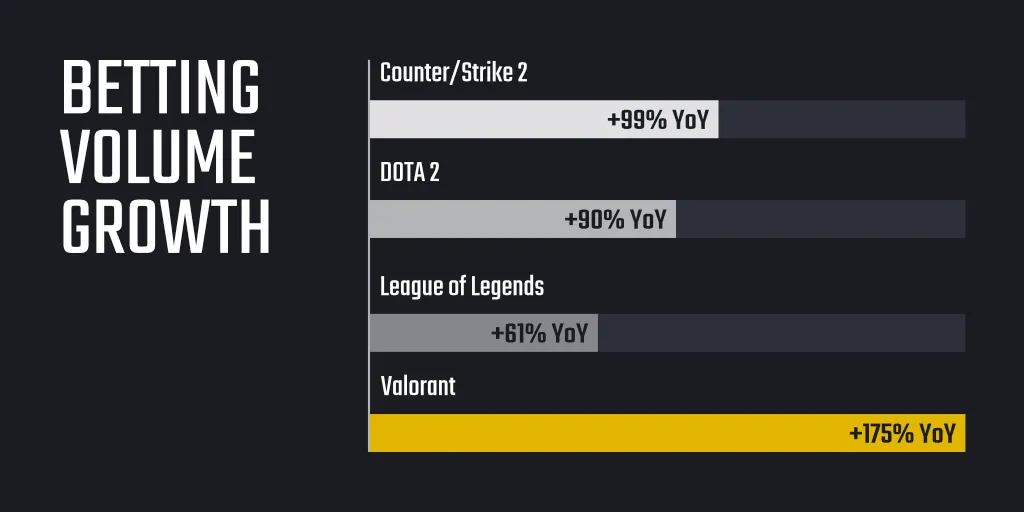

Given the growth of esports, regulators in this vertical will likely need to move fast to keep pace with the industry. According to Oddin.gg’s Esports 2024 report, betting volume climbed sharply year-on-year, with one major title recording up to a 175% increase and average bet count rising by 131%. Total wagered amounts and average stakes also climbed across major tournaments compared to 2023, underlining the strength of the game publisher-dominated landscape.

The broader esports umbrella goes beyond games like Counter-Strike 2 and League of Legends to include fast-bet e-simulator games, which offer a completely different proposition. Understanding these distinctions is crucial not only for operators, but also for regulators seeking to design effective frameworks.

“The core esports audience for the likes of Dota 2, Counter-Strike and League of Legends is different as they have been playing and watching these games for years and are heavily invested in the games and what they bet on,” Suchar says. “Then you have a separate audience which bets on electronic simulators such as e-football and e-basketball where it is essentially these sports being played in a studio on a console.”

What’s important for operators and regulators to understand is that esports fans represent an attractive segment of the market. They are more likely to be in full-time employment and have a university degree than the general public, and nearly half earn more than $100,000 per year, according to an executive at a prominent esports team.

The importance of education

However, there is still work to be done on educating esports followers, as well as gambling regulators. It is noteworthy, for example, that one in three esports fans who do not wager on the action say they are ‘unsure how betting works’, according to iGB’s Esports Betting Report 2024.

A step in the right direction can be taken by considering the consumption habits of younger adults, who represent the primary market for esports betting.

“When we are looking at millennials and Gen Z bettors, what is critical for them is having content on demand,” Suchar says. “If they want to watch a movie, they just go to Netflix. If they want to listen to music, they go to Spotify. If they want to consume a certain type of content, they go to YouTube.”

This ‘always on’ element is one of esports’ biggest advantages over traditional sports, which have natural breaks in the schedule and calendar throughout the day, week and year.

“With esports, they can bet almost all the time, and we have more than 15 live markets for the titles that we trade,” Suchar explains. “There are multiple opportunities to bet within each game.”

In the final quarter of last year, nearly half of all Counter-Strike bets were placed during contests, while the proportion of wagers that were props increased to 13%, showing a growing interest in the players at the heart of the competitive action.

“In sport, many of the players have a bigger following and fan base now than the teams themselves – and this trend is even greater in esports,” Suchar says. “So there are lots of reasons why bettors can come and stay engaged.”

A question of integrity

Collaboration with partners and regulators alike is a vital element of Oddin.gg’s strategic approach. With this in mind, the integrity question is one that has to be addressed openly and honestly from the outset, with the provider working closely with organisations like the International Betting Integrity Association (IBIA).

“In terms of match-fixing, robust risk management systems are in place with the right algorithms and the right personnel, so we are able to identify in real time any suspicious activity and inform our partners,” Suchar says. “On an annual basis, we see perhaps a couple of billion euros bet on our lines – and the question is, are we able to identify suspicious patterns when we look at the gameplay, like with traditional sports?

“What we see in esports is that we are able to identify those patterns, because we can analyse data from our traffic and our partners and compare it with previous events. If something is potentially suspicious, our title experts will then look into the gameplay and provide feedback to our partners on whether anything has happened that requires further investigation.

“With the tournament organisers and the integrity bodies, this is how we are trying to build confidence in the ecosystem – by showing that we are taking care and can produce a paper trail of evidence if something happens.”

“It is vital to educate regulators about how esports betting should be regulated, because they do not want it to go underground.”

Suchar is adamant that nurturing a “three-pronged partnership in terms of regulator, bookmaker and provider” is essential for success.

“Especially in a highly regulated market, this kind of collaboration is a critical element,” he adds, citing Oddin.gg’s recent work with its partners in Brazil.

“It is vital to educate regulators about how esports betting should be regulated, because they do not want it to go underground.”

Ultimately, Oddin.gg’s mission is about more than compliance. By combining technological sophistication with advocacy and collaboration, the company is helping to shape a safer and more sustainable future for esports betting.

Marek Suchar, co-founder and managing director, Oddin.gg

As esports betting continues to grow, iGB speaks to Oddin.gg co-founder and managing director Marek Suchar about how the provider is taking the lead in educating regulators and addressing misconceptions in a bid to shape the industry’s future.