As legislators, regulators, company reps, lobbyists and other stakeholders from around the gaming world descended on Louisville for last week’s National Council of Legislators from Gaming States summer meeting, several pressing industry debates were top-of-mind.

These ranged from prediction market uproar to federalist furore, tax increase malaise and beyond. Despite the attention drawn to more recent issues, however, a more enduring discourse still permeated throughout the conference: the online-retail revenue cannibalisation debate.

For several years, land-based casino and iGaming interests have become increasingly polarised, with the former frequently lobbying against the expansion of the latter. These efforts to squash new legalisation have been successful of late.

It’s now been two years without the passage of any new iGaming bills, after a flurry of activity from 2013 through 2021. Meanwhile, online revenue in existing markets like New Jersey and Pennsylvania – both of which also have substantial casino industries – has soared compared to retail revenue, especially since the start of 2025. This trend has added fresh fuel to the longstanding debate.

In May, for example, New Jersey casinos posted GGR of $265.3 million, a solid total up 10% from last year. But comparatively, the state’s iGaming GGR of $244 million was an all-time record for the sector and a 28% YoY jump. May’s record was 1.2% ahead of the previous mark, which was just set in March.

Pennsylvania, meanwhile, set a new statewide monthly gaming revenue record with $601.8 million in May, led by online revenue growth of 33% YoY, compared to a 5% increase in retail slot revenue and a 4.6% decrease in table games.

You get what you pay for?

On Thursday, Macquarie senior gaming analyst Chad Benyon presented numbers showing the overall legal US gambling industry generated total revenue of $172 billion in 2024, up 3.3% year-over-year.

Despite that positive news, what caused some agita was an estimate that iGaming does cannibalise retail revenue by about 15% in the first few years post-legalisation. However, by the three-to-four-year mark, the market’s combined GGR is about 40% higher than it was pre-expansion, Benyon said.

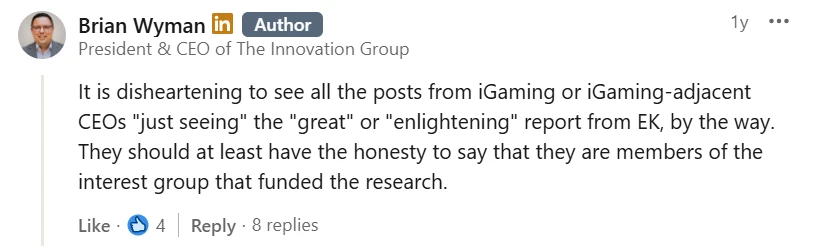

His assessment mirrored findings from an Innovation Group study commissioned by the state of Maryland as it was considering iGaming last year, when no bill was passed. Other studies from about the same time, however, have reached different conclusions. Among them were research from Analysis Group and Eilers & Krejcik Gaming, and the EKG study even directly criticised the IG study as “flawed”. NCLGS founder and former Florida senator Steve Geller lamented last week that such conflicts give the impression of research that is bought by competing interests.

Presenting shortly after Benyon on Thursday was gaming attorney Jeff Ifrah, who is among the leading proponents of online expansion. Ifrah co-founded iDEA Growth, a trade group representing leading online operators including FanDuel and DraftKings.

“We don’t see that [iGaming] stunts growth,” he said. “We don’t really see that there’s a decrease or layoffs to employees, and we don’t see that it’s hurting the bottom line of land-based casinos and their online partners.”

The tenor of the debate has shifted over the years and seems to have settled right around where Benyon and Ifrah landed: revenue trends have led most to acknowledge some level of change, while proponents continue to point to overall market and tax revenue growth rather than direct cannibalisation.

Group vs group

Despite the fact that many companies now offer both retail and online products, numerous brick-and-mortar operators have taken hard stances against online expansion. These range from top-line developers like Las Vegas Sands and Wynn Resorts to regional specialists like Monarch Casino, Churchill Downs and Cordish Companies.

Those latter three, as well as others, have gone a step further by forming their own action group, the National Association Against iGaming. The title of the newly formed entity speaks for itself. On Friday, representatives from both iDEA and NAAiG took to the stage to rehash the debate directly.

“The reality is that no states have done this in two years,” said Shannon McCracken, senior director of government relations for Churchill. “In 2024 and 2025, over 20 iGaming bills have been rejected by states. So the momentum is not there. People are really giving pause to that as the data comes out on cannibalisation and especially the social harm.”

Increases in problem gambling and associated harms have been a lynchpin of the anti-iGaming argument. McCracken called iGaming “the most addictive form of gambling” due to its ease of access. This is especially true among those ages 17-23, who “shouldn’t even be gambling at all”, she said.

A question of harm

John Pappas, iDEA’s state advocacy director, in response called this “shocking” hypocrisy from Churchill, which he dubbed as “the largest online gambling company in the country”. The company operates TwinSpires, an online horse betting platform available in nearly 40 states.

McCracken, expecting such an argument, shot back that horse racing is “fundamentally different” from iGaming. It is event-based, she said, with longer run times between races and wagers instead of “a non-stop slot machine in your pocket”.

For iDEA and other online advocates, one retort to the question of harm is that the illegal market is already prevalent everywhere. A frequently used tactic has been to encourage show attendees to take their phones out and search for illegal sites at that moment. Thus, they argue that legalisation is the best way to bring those activities to the regulated market, where there are RG safeguards and resources.

Legalisation also gives teeth to enforcement efforts, as states with legal iGaming have been more successful in rooting out unlicensed sites than those without it.

“A good result is when you give the consumers a place to go, rather than the illegal market,” Pappas argued. “Enforcement without regulation is really just going to continue to drive people to even sketchier, shadier underground operators.”

Keeping up with the Joneses

Another oft-cited argument in favour of iGaming has been the overall evolution of consumer trends to embrace digital. In this vein, Betr government affairs chief Andrew Winchell rhetorically asked McCracken Friday if governments should outlaw mobile banking to protect bank tellers.

For the land-based industry, the counter is that casinos are significant economic drivers for communities across the country. Retail gaming provides jobs, draws tourism and is a substantial taxpayer, all of which stand to be impacted by widespread online expansion.

The breadth of properties now operating in the US also makes it unlikely that all would benefit from the addition of iGaming. The playing field is far from even, something that led Wynn Resorts CEO Craig Billings to pen an op-ed on the subject last spring.

“The properties that might actually be able to compete with the digital native online gaming providers are those that are owned by the large national gaming operators,” Billings wrote. “What about everyone else? Market share will shift. In land-based gaming, there will be market share winners and losers. No doubt in my mind. As an operator, the TAM doesn’t pay my bills, my share of it does.”

Time will tell if this argument will continue to hold up – the casino lobbying force has done well to hold the levy. But the fact remains that revenue, and subsequently tax contributions, are of chief importance to states, with the onslaught of recent online sports betting tax hikes being the simplest example. To that end, iGaming is hitting its stride, frequently posting new records and double-digit YoY increases.

“I’m not going to argue that iGaming is a great job generator,” Pappas said Friday. “It’s a great revenue generator. And I can tell you what it’s not: it’s not a job killer. It is not taking jobs out of casinos, it is allowing them to grow together.”

There were plenty of fresh, new debates at NCLGS last week, but sometimes you just have to play the hits.