Prediction market platform Kalshi experienced a surge of users attempting to deposit to wager on the Super Bowl, but many were left frustrated by delayed deposits. Despite the troubles, the site saw huge trading volumes, with over $500 million traded on the moneyline and hundreds of millions going on novelty halftime show markets.

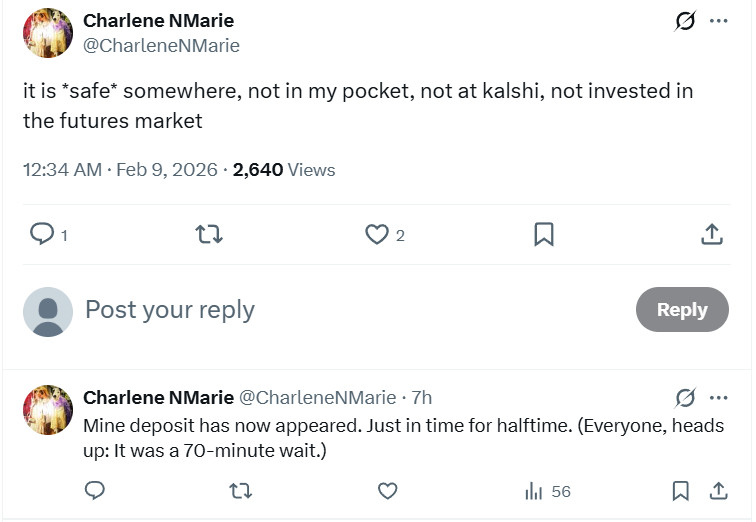

Amid the site’s troubles, co-founder Luana Lopes Lara took to social media to apologize to users whose deposits had disappeared. Her assurance that money was safe provided little consolation to users who were attempting to wager on the game.

Many replied with angry comments, with users citing delays of up to 70 minutes for deposits to appear in accounts.

The delays appear to have been caused by a flood of users visiting the site to wager on the Super Bowl. For residents of certain states that have not yet legalized sports betting, it could have been the first time they could legally wager on the biggest sporting event in the US.

Kalshi saw over $500 million traded on the moneyline market. Trading volume differs from betting handle, as users match their money peer-to-peer and can also trade against other users. Still, it demonstrates significant growth in prediction markets since the company started offering sports contracts for last year’s Super Bowl. In 2025, just over $27 million was traded on the game.

Almost double that ($52.2 million) was traded on the MVP, with Kenneth Walker III a surprise winner. He was given just a 2% chance of taking the award before the game, disappointing bettors who had backed each team’s kicker to win the award.

Novelty Markets Attract More Users

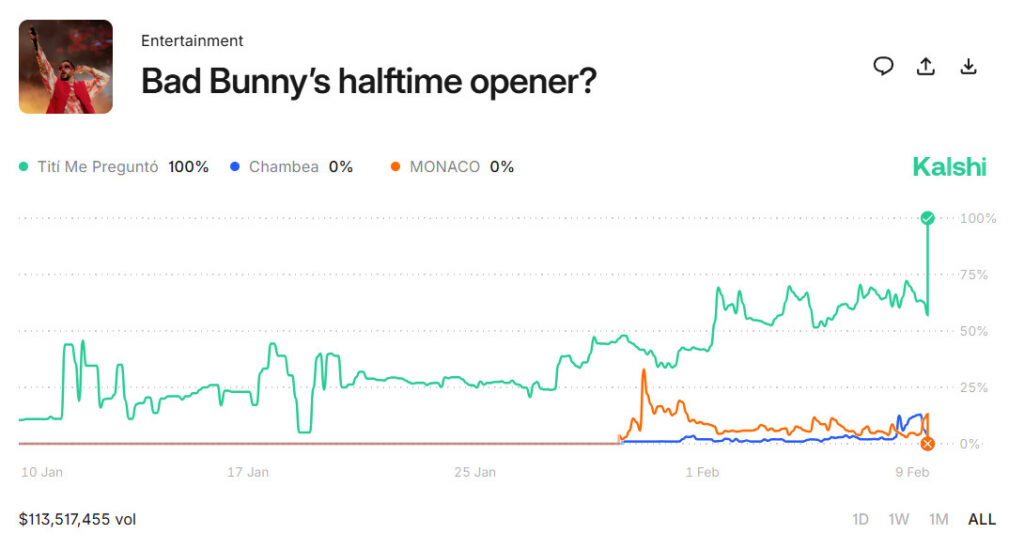

Last year, users could wager only on the Super Bowl winner. This year, however, there were a plethora of markets on player props, total points, spreads, and novelty markets connected to the event. The halftime show attracted particularly high trading volumes.

Over $47 million was traded on who would perform at halftime. That was surpassed by $113 million of trading on Bad Bunny’s halftime opener.

In total, well over $1 billion was traded on Super Bowl markets. Had users been able to deposit and trade more quickly, that figure could have been considerably larger.

Multiple users replied to Lopes Lara’s post, saying they did not trade on the markets due to the delay. The company did not respond when contacted for comment on the delays. While there will be frustration that things did not go smoothly, the vast volumes that were traded will no doubt be celebrated.

The post Kalshi Users Frustrated By Delayed Deposits, as Super Bowl Sees Huge Trading Volumes appeared first on CasinoBeats.

Prediction market platform Kalshi experienced a surge of users attempting to deposit to wager on the Super Bowl, but many were left frustrated by delayed deposits. Despite the troubles, the site saw huge trading volumes, with over $500 million traded on the moneyline and hundreds of millions going on novelty halftime show markets. Amid the

The post Kalshi Users Frustrated By Delayed Deposits, as Super Bowl Sees Huge Trading Volumes appeared first on CasinoBeats.