Planned increases in UK gambling taxes will yield approximately £800 million ($1.06 billion), only half of what the treasury has forecast, according to new analysis by H2 Gambling Capital (H2GC).

The betting and gaming consultancy questioned some of the figures put forward by the Office of Budgetary Responsibility (OBG). Previously, the OBG said the changes could bring in up to an additional £1.6 billion in tax receipts.

This figure, however, was reduced to £1.1 billion when accounting for “behavioural change” expected among consumers due to tax increases. These reflect a possible fall in player demand due to a reduction in bonuses as operators seeks to mitigate the impact of higher tax, with some users also turning to the black market.

However, H2GC said the increase in tax receipts would be more modest. Its own estimates place the rise at around £800 million by FY28, after accounting for behavioural change among players.

That said, prior to behavioural change, H2GC noted that its estimates were in line with the OBR at £1.6 billion in additional tax income.

Behavioural changes by to hit GB gambling tax take

The most variation appears within the iGaming sector, which faces the higher rate of 40%. Based on its own calculation, H2GC said the ‘static’ increase – prior to behavioural change alterations – would be £1.35 billion by FY28. However, it placed the adjusted figure at £649 million, almost half the initial, static figure.

As for sports betting, which will see its tax rate rise to 25%, the static estimation was £204 million. After behavioural change, the adjusted figure was considerably lower at £149 million.

Chancellor Rachel Reeves confirmed the tax increases in the autumn budget announcement on Wednesday. These include a rise in remote gaming duty from 21% to 40%, which will come into effect in April 2026.

A new general betting duty for remote betting will also be introduced in April 2027 at 25%, up from 15%. This will apply to online betting profit but exclude self-service betting terminals, spread betting, pool bets and horse racing bets.

Higher tax could push revenue down 14%

H2GC also compared the impact of higher tax rates on gross gaming yield (GGY) and gross gaming revenue (GGR) in the UK. It said both would be impacted by operators withdrawing from the UK, due to the rise in tax, and an increase in players switching to unlicensed sites in search of better bonuses and promotions.

By FY28, GGY – based on the market after the tax increases – would be around £6.69 billion. However, if rates were to be kept the same, GGY would reach approximately £7.79 billion. In total, H2GC said GGY would drop £1.1 billion, or 14%, if the tax rise goes ahead.

Again, iGaming would be the hardest hit, with a 16% drop in GGY expected after the new tax rules come into effect. Sports betting GGR would be 8% lower based on the same estimates.

In terms of GGR, current regulations means this could hit £9.14 billion by FY28. After the tax rises, GGR would be approximately £7.12 billion, meaning a decline of £1.97 billion, or 22%, as a direct result of higher tax rates.

H2GC said iGaming GGR could be as much as 25% lower in FY28 if the tax rise goes ahead. Sports betting GGR would be 11% lower, with the rate increase here coming into effect later than for iGaming.

Black market in Great Britain to double in size by FY28

Much of the behavioural changes accounted for by the consultancy relate to players moving to black market sites.

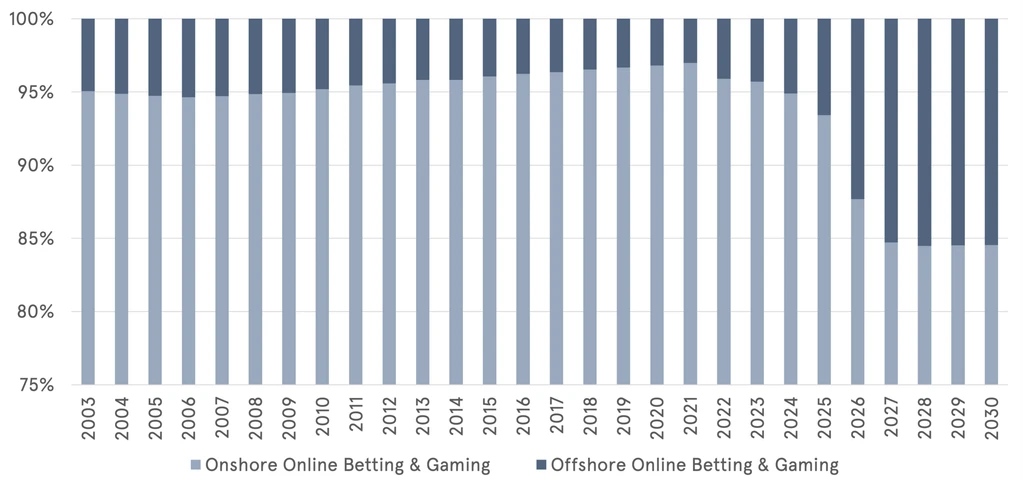

Based on current taxation rates, total channelisation for the online market will be 94% by FY28, in terms of GGY. This would reach 97% for sports betting and 93% for iGaming. However, after the new rates, channelisation for the entire market could be as low as 87%, H2GC said. Sports betting channelisation could drop to 94% and iGaming 83%.

As for GGR, based on current taxation, channelisation is on track to be 93% in FY28, with a split of 97% for sports betting and 92% iGaming. Should the tax increase go ahead this would be around 84% for the whole online market, with sports betting at 93% and iGaming 80%.

In essence, H2GC said the black market could more than double in size based on the new tax rates. Offshore GGY would be 111% higher by FY28 if the changes takes place, with offshore GGR also rising 110%.

“We have little doubt that, if the direction of these forecasts materialise, then a reduction in the onshore market will be viewed by politicians as a major victory,” H2GC said. “Not only have they been able to curb the size of the onshore online gambling industry, but they have increased tax revenue at the same time.

“However, what will be completely ignored will be the at least doubling in size of the illegal market and all the negative implications this has, not least on player welfare.”

Industry hits back at planned changes

The tax increases announcement, unsurprisingly, led to criticism from the industry. Many major operators hit out at the decision, saying this would not only impact their own business but also have a detrimental impact on the wider market.

Primary concerns included increased traffic to the black market, a reduction in bonus offers and cut-backs on spending, with some businesses warning jobs could be lost as they seek to mitigate the impact of higher taxes.

Exclusive data from H2 Gambling Capital also found GB black market could double in size by FY28.