Recent deals with Bally’s Twin River, Live! Virginia and Bally’s Chicago boosts Gaming and Leisure Properties

Gaming and Leisure Properties improved its fourth quarter revenue by 4.5 per cent year over year to $407m, while AFFO grew 7.5 per cent to $290m.

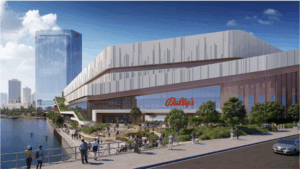

The company has got off to a strong start to the year, buying the real property assets of Bally’s Twin River Lincoln Casino Resort for a purchase price of $700m and agreeing to fund up to $440m of real estate construction costs for the Live! Virginia Casino & Hotel, having acquired the project land for $27m. The quarter also saw it provide development funding for Bally’s Chicago of $201.6m.

Peter Carlino, Chairman and Chief Executive Officer of GLPI, commented: “Our record fourth quarter and full year 2025 results reflect recent acquisitions and financing arrangements and growth from our expanding base of leading regional gaming operator tenants and tribal relationships. Together, these factors are expected to drive accelerating growth in 2026. Long term tenant stability remains the bedrock of our approach to underwriting. To this end, lease coverage across each of our five largest tenants remains strong. Our record results and the strength of our leases continue to highlight the diligence of our underwriting and our ability to deliver relationship-driven innovative financing solutions to current and prospective tenants.

“Despite the difficult transaction and financing environment in 2025, we executed three new transactions, totaling approximately $876m of capital deployment, at a blended cap rate of over nine per cent while also deploying incremental capital for previously announced transactions, such as those with PENN Entertainment and Bally’s. Our current pipeline, which includes the ongoing development funding for Bally’s Chicago, Live! Virginia, and our tribal partnerships, as well as several projects with PENN Entertainment, amounted to approximately $2.6bn of future capital outlays, as of December 31, 2025, at a blended cap rate over eight per cent. We kicked off 2026 with the $27m land acquisition for the Live! Virginia Casino & Hotel development, the first stage of the $467m total commitment to The Cordish Companies, and completed the acquisition of the real property assets of Bally’s Twin River Lincoln Casino Resort for $700 million, at an eight per cent cap rate. Post these transactions, our net debt to adjusted EBITDA ratio remains below the low end of our target range.

“During the fourth quarter, we provided $201.6m in funding for Bally’s Chicago, leaving $738.4m of investment remaining on our $940m commitment as of December 31, 2025. The project continues to advance consistent with our expectations and timeline toward its 2027 opening. In addition, the land-based conversion of Bally’s Baton Rouge concluded with a successful grand opening in early December, as we capped off our $111m investment in the period.

“As we look over the medium-term, with a strong in-place pipeline, our balance sheet remains well prepared to accommodate the aforementioned $2.6bn of committed financing. At period end, our net financial leverage stood at 4.6x, well below our target range of 5.0x to 5.5x. This balance sheet positioning allows us to fulfil our financial commitments, without equity, and remain at the low end of our target range, while driving accretive and accelerating AFFO growth. As such, we believe GLPI is well positioned for long-term growth, driven by our strong gaming operator relationships, our rights and options to participate in select tenants’ future growth and expansion initiatives, an environment conducive to supporting a healthy pipeline of new agreements, and our ability to structure and fund innovative transactions at competitive rates. We further believe that our tenants’ strength, combined with our balance sheet and liquidity, positions the Company to grow cash flows, support dividend growth, and build value for shareholders in 2026 and beyond.”

The post Gaming and Leisure Properties enjoys another record quarter appeared first on G3 Newswire.

Recent deals with Bally’s Twin River, Live! Virginia and Bally’s Chicago boosts Gaming and Leisure Properties Gaming and Leisure Properties improved its fourth quarter revenue by 4.5 per cent year over year to $407m, while AFFO grew 7.5 per cent to $290m. The company has got off to a strong start to the year, buying…

The post Gaming and Leisure Properties enjoys another record quarter appeared first on G3 Newswire.