After going public in January 2022, Super Group held its first Investor Day yesterday, 18 September, at its brand-new HQ in central London. The event gave the Betway and Spin parent company the opportunity to pull back the curtain on its global operations in a way it hadn’t done before.

And, with full-year 2025 guidance having been upped before management took to the stage, there is a sense of Super Group being on the ascendency. Fronted by CEO Neal Menashe, the operator claims to be the dominant force in Africa, has pulled out of loss-making markets like the US, and is laser-focused on efficiency.

Here, EGR explores the key talking points from the mammoth presentation, with insights from Menashe and his senior leadership team.

Kings of Africa

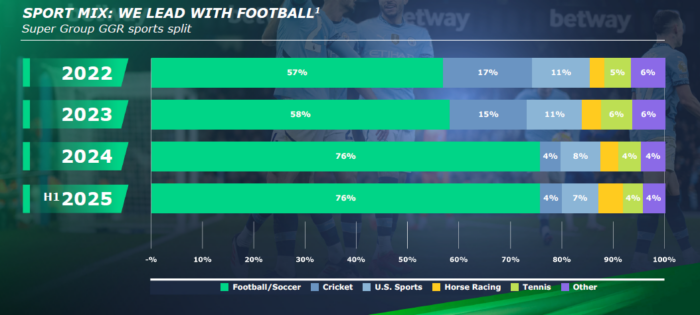

“Africa, as you can see, is the new frontier,” concluded Betway Africa CEO Laurence Michel as his presentation came to a close. And it’s hard to argue against that position. The continent accounts for 39% of Super Group revenue. Betway has a podium position in seven of the eight markets it’s live in, while a shift to a new platform, Synapse, has sped up frontend performance with positive knock-on effects. Football dominates, as do bet builders, with parlays accounting for 90% of Betway Africa’s gross win and 67% of wager amount.

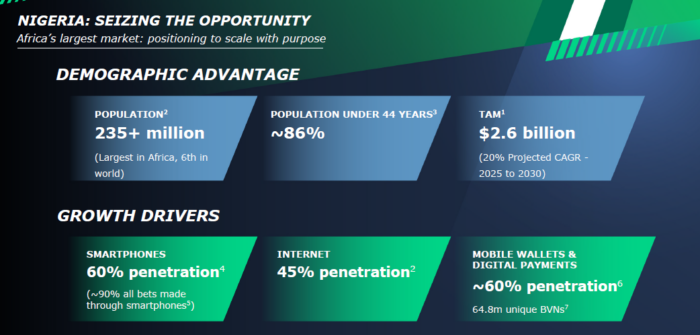

Expansion remains on the agenda; the Ivory Coast, Ethiopia, Angola and Namibia are being sized up as potential new markets. The operator’s presence in Nigeria is where it doesn’t yet occupy a podium position, but the transition to Synapse is earmarked for Q4. This, bosses said, will be a key differentiator in a market where 86% of the population is under the age of 44 and Nigeria’s total addressable market (TAM) is $2.6bn.

Casino is also ramping up, with a 757% increase in wagers in Africa since Q1 2022, and the Jackpot City brand live in four markets. Expansive payment options, a wide sponsorship portfolio and local teams on the ground were all championed as core drivers of growth.

Michel added: “We are not just operating in Africa – we are winning locally in Africa.” Winning on a continent with a TAM of $12bn, according to the presentation, is not a bad place to be.

Believe the hype

As with any publicly listed company with a high reliance on tech, Super Group took the opportunity to showcase its implantation of AI across the business. Operators have been trumpeting its use cases, with the likes of FDJ United and DraftKings having banged the drum at their own earnings reports and Capital Market Days this year.

For the Betway parent company, management shared snippets of AI-led impact, including manual KYC checks falling 85% and machine learning tools monitoring real-time fraud alerts. Around 56% of customer service responses are automated, while AI is being used in trading to “optimise odds and margins”. Predictive models in marketing are targeting customers and automating journeys, too.

Menashe said: “We’re implementing AI and crypto capabilities. This isn’t hype – this is truly real. The future is AI-powered and people-led. At Super Group, we are combining human expertise with smart technology across marketing, compliance, customer support and operations.”

Web3 wins

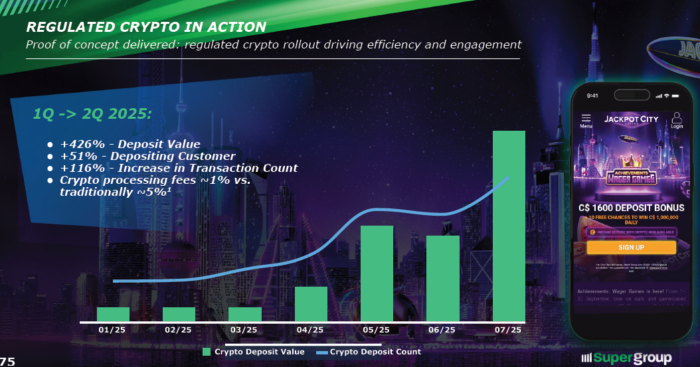

Sticking with emerging tech, Super Group bosses lifted the lid further on the operator’s crypto aspirations, having told analysts in August they were “actively looking” at digital currencies. Between Q1 2025 and Q2, crypto deposit value at the firm soared 426%, while there was a 116% increase in crypto transactions and a 51% surge in the number of customers using this deposit method. Crypto deposits continue to be hugely popular in Africa, management added.

Menashe said: “Someone who has crypto is a different cohort of customer. In the regulated space, some of the regulators are only recently now allowing us to have crypto, which sounds absurd.

“In Africa, you can even take crypto and convert it into [South African] rands, but even moving the money now with crypto has become seamless. We’ve got some really good ideas. We have to wait, but crypto is a massive opportunity.”

Craig Hovey, MD of Super Group subsidiary DigiOutsource, noted: “We’re pushing hard on marketing this to our existing customers. There’s a whole new cohort of customers that are looking for our offering but haven’t been able to use it because they’re a crypto-native. Now we’re incentivising them to come into our casino and have a great experience.

Keep it core

When asked by Macquarie’s Chad Beynon if Super Group was planning on any “tuck-in acquisitions” to expand into new verticals, Menashe’s answer was definitive: sports and casino make the company’s world go round. Casino alone is 80% of Super Group’s revenue. It seems appetite to expand into lesser verticals like bingo or poker is not there.

The CEO said: “We tried poker all those years ago. We had an open network, [but] it didn’t work. What it really was about for us is that we are casino and we are sports. It is all about those two verticals and how we become the best in those two verticals.

“Moving forward, it’s about looking at those verticals and how with our marketing and acquisition we can deliver in that. That’s where product becomes key. It’s all about scale. We still have got a little bit of a bingo product. Poker [is not] where the money is. The money is being core to what we are.

“We stick to what we do. And I think that is what’s key to why we are here today. It’s actually sometimes much harder to say no and that’s what we’ve learned.”

Build it and they will come

The success of Betway’s higher margin bets, like bet builders and accumulators, in Africa is also serving as a blueprint for operations elsewhere. With with 10-leg or 20-leg bets commonplace and hopes of mega payouts on small stakes, learnings have been taken on board. The aim, much like Betway’s peers, is to continue to expand the margin, which in H1 was 14%, up from 12.6% in H1 2024.

The volatility, of course, could come back to bite, but as bet builders and accumulators continues to take up more share of stakes, and an outsized portion of revenue for Super Group, the push will keep coming.

Kevin Kovarsky, Betway Global COO, said: “On the sports side, we have recently improved our recommended bet section. They are very popular, and they promote our bet builder product.

“As a result, we have seen bet builder handle increase by 36%, and this handle carries a much higher margin than a single bet. What we’ve seen be so successful in the African market on parlays is something we are now emulating with our bet builder product, and we’re going to look to enhance that even further.”

On those product enhancements, the COO added: “Coming up soon, cross-match bet builder will allow customers to wager on multiple matches in one bet builder selection. Soccer is the big winner from bet builder and our aim is to have a soccer product which rivals the market-leading product, and we aim to have this in place before the start of the World Cup in June next year.”

Despite management’s insight into the business and where it is headed, Super Group shares slumped nearly 9% on the day to close at $11.69.

The post Five things we learned from Super Group’s Investor Day first appeared on EGR Intel.

News editor Joe Levy picks apart management’s four-hour-long presentation, including plans to dominate African markets and tap into AI and crypto

The post Five things we learned from Super Group’s Investor Day first appeared on EGR Intel.