DraftKings has posted a record revenue total of $1.5bn (£1.1bn) for Q2 2025, marking a year-on-year (YoY) growth of 37%, with bosses hailing healthy customer engagement and increased hold as key factors behind the performance.

When pitted against last year’s second quarter, DraftKings’ topline figure in the latest reporting period jumped $408m.

An “efficient” approach to acquiring new customers was cited as a reason behind the strong revenue growth, as well as some operator-friendly sports results.

The Boston-based operator also produced record adjusted EBITDA of $301m, nearly doubling DraftKings’ previous record of $151m in that metric.

Monthly unique payers (MUPs) climbed 6% YoY to 3.3 million customers, an uptick attributed to “strong unique payer retention and acquisition across DraftKings’ Sportsbook and igaming product offerings”.

Additionally, the impact of Jackpocket, the lottery courier firm DraftKings acquired for $750m in February 2024, was also identified as a reason behind the MUP increase.

A more notable rise was reported when analysing DraftKings’ average revenue per monthly unique player (ARPMUP), which climbed 28% YoY to $151, courtesy of an improved sportsbook hold percentage.

Excluding the impact of the Jackpocket acquisition, ARPMUP increased by 30% YoY.

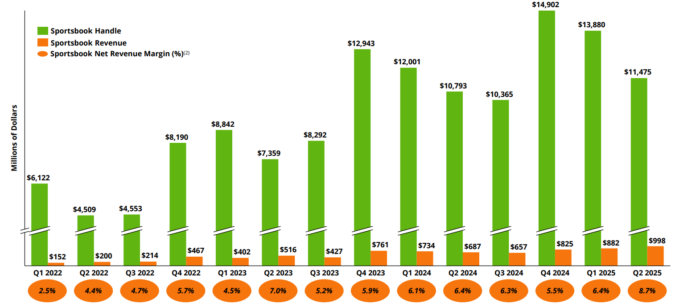

Breaking the operator’s revenue down by vertical, DraftKings’ sportsbook division once again led the way in terms of contribution, generating $997.8m, alongside a corresponding net revenue margin of 8.7%.

That figure represents a significant 45.3% YoY climb from Q2 2024’s $686.8m, with CEO Jason Robins noting that the vertical’s output “exceeded expectations” in a letter to shareholders.

Sportsbook handle also increased, rising 6.3% YoY to $11.5bn, with live betting handle reporting an increase of 16% YoY.

On live betting, DraftKings said it had achieved 90% uptime for MLB and NBA live markets, with more than 1.5 million customers engaging with its live bet tracking tool this year.

Structural sportsbook hold percentage hit 10.9%, while parlay handle mix jumped 430 basis points compared to Q2 2024. Actual sportsbook hold was above 11.5% due to positive results for the firm.

DraftKings’ igaming efforts continued to report growth, producing a record revenue total for Q2 of $430m, up 22.6% YoY thanks to an increase in active igaming customers.

As a result of the positive earnings, DraftKings has confirmed it is maintaining its fiscal year guidance for 2025, with revenue expected to land between $6.2bn and $6.4bn.

However, the operator noted it is on course to deliver revenue towards the higher end of that range as a result of favourable sporting outcomes in Q2.

The fiscal year revenue forecasts represent YoY growth of 32%, while adjusted EBITDA is anticipated to come in between $800m and $900m, with DraftKings on course to achieve earnings at the midpoint of that range.

For the first time, the company’s guidance now takes into account DraftKings’ plans to launch sports betting in Missouri later this year, as well as the recently announced tax hikes in New Jersey, Louisiana and Illinois.

The operator noted that the guidance does not factor in the potential impact of launching a prediction markets offering.

In his letter to shareholders, Robins shed more light on the topic, adding: “We continue to monitor events surrounding federally regulated prediction markets and are actively exploring ways to enhance shareholder value through this opportunity.

“As always, we value our relationships with both industry stakeholders and policy makers and will work collaboratively as we evaluate next steps.”

At the time of writing, DraftKings’ online sports betting offering is accessible in 25 US states as well as Washington DC, giving the operator the potential to engage with around 49% of the nation’s population.

DraftKings’ igaming offering is accessible in five US states, which translates to 11% of the population.

Assessing the quarter, Robins reflected: “We set records for revenue, net income and adjusted EBITDA in the second quarter, driven by an acceleration in revenue growth to 37% year over year.

“We are pleased to be maintaining our fiscal year 2025 guidance, with revenue expected to be closer to the high end of our range, highlighting the strength of our platform as we prepare for an exciting new state launch.”

The record revenue and adjusted EBITDA totals have sparked a near 7% rise in DraftKings share price, according to pre-market trading figures, with it now valued at $45.36 per share.

The post DraftKings’ Q2 revenue surges 37% to reach new high first appeared on EGR Intel.

Business achieves all-time quarterly highs on the back of positive sports results, as CEO Jason Robins says management is “actively exploring ways” to enhance shareholder value via prediction markets

The post DraftKings’ Q2 revenue surges 37% to reach new high first appeared on EGR Intel.