Tallinn-based Coolbet and its president, Endre Nesset, had an eventful 2025, the highlight being parent company GAN’s acquisition by Japanese video games company Sega Sammy in a deal (completed in May) worth $96m.

Coolbet, which made its debut in the EGR Power 50 at the tail-end of 2025, had been owned by GAN since 2021, when the North America B2B software provider purchased Coolbet’s parent company, Vincent Group, for $175.9m.

Despite being a key piece of the jigsaw in a complex acquisition last year, plus various regulatory shifts across Latam and Europe, Coolbet still made gains across key metrics for the 12 months to the end of June 2025, according to financial data shared privately with accounting and advisory firm BDO as part of the Power 50. It was this performance, “basically breaking every record we could” in Nesset’s words, which partly earned Coolbet its place at number 50 in the ranking.

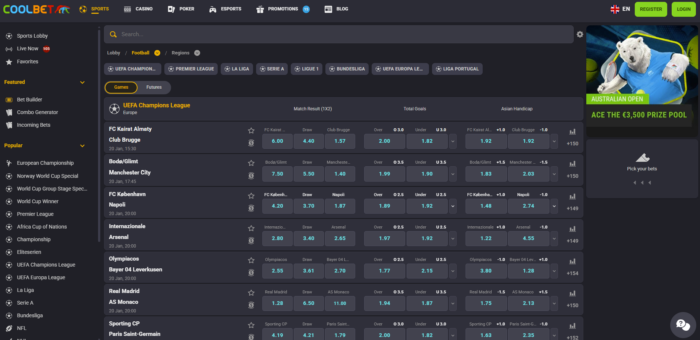

Since then, Nesset, who hails from Norway, says the operator has grown across all three of its verticals: sportsbook, casino and poker. He attributes this success to Coolbet’s ability to localise its products to different markets, facilitated by in-house tech, to identifying when a market might be more trouble than it’s worth, and to the environment of trust the brand builds with customers.

EGR: What does Coolbet’s inclusion in the EGR Power 50 say about the progress of the company?

Endre Nesset (EN): It’s obviously a huge testament to all the work that’s been done. The 2025 performance has been outstanding, especially given the quite challenging market conditions, both from a competitive and regulatory perspective. So, I’m extremely proud of the work that’s been done, and I’m very proud of the company’s performance – basically breaking every record we could.

EGR: How would you characterise the performance of the business in 2025?

EN: Since we’re publicly listed, we shouldn’t talk too much about the full-year performance, but we can say we’ve been trending very, very positively in multiple markets, which is good. I think the long-term strategy that we set out has been bearing fruit. We’re reaching all-time highs in sportsbook, casino and poker. So, all three verticals and multiple markets are driving the growth. We’re not a one-trick pony.

EGR: How do you adapt your product to local markets?

EN: Coolbet has always taken a lot of pride in being a very local product. We try to localise campaigns and we try to localise the offering. Due to the fact that we own and control our entire ecosystem with our own tech platform, we have the ability to localise more than our competitors, which has been one of Coolbet’s main USPs, both for acquiring but also for retaining customers and ultimately market share. There’s no real secret sauce. In that sense, I think in every market, we like to have personnel who are dedicated to the local market. I think that might be a opposite to the direction the whole industry is going in, because a lot of the industry right now seems to be going down the route of making everything super lean and efficient. And we think there’s a place for us to be a bit more local.

We could take Chile as a prime example. We went into a fairly uneducated Chilean market and started setting a new standard. There was no offering available for the lower tier sports, nothing outside of the main football leagues. And I think we set the new standard for lower tier football. We also set the new standard for esports in the region.

In 2023 we had the Pan American Games [a multi-sport competition in the Americas] – an event that’s popular from a TV broadcasting perspective, but again, with very little betting engagement. So, we went in and we created a whole new level of engagement around those types of events. We get the benefit from a first-mover advantage. That’s just one example of how our local approach has kind of changed the landscape.

You can be first movers on an emerging sport, and you can be first movers on what’s relevant in the news. Again, due to our local approach, we are in a prime position to be able to act on local news. We have people on the ground, so we have the ability and the skill to be able to jump on trends – to ride momentum.

EGR: What is the rationale behind staying out of the regulated Brazilian market?

EN: Brazil was always a tricky one. There was talk about regulation for a long time, and when the regulation hit, I think it just seemed way too expensive to enter the market. Especially as a small company, to go in with a very, very high licensing fee [BRL30m] competing against some of the largest companies in the world – it just didn’t seem like a smart thing to do for us.

We are not the biggest company, so we are okay with leaving those opportunities untapped from our perspective and focusing instead on other areas. In hindsight, I’m very happy that we didn’t go for the licence. If you ask a lot of the companies who went for, or who are still going for the licence, it was a big undertaking and maybe even more challenging than they were expecting. So, I’m happy with the decision to not go fighting in Brazil.

EGR: How do you expect Estonia’s cut in gross gaming tax from 6% to 4% for online operators by 2029 to affect your business?

EN: First, I would like to give some credit to the Estonian regulator. I am not Estonian, but I live in Estonia, and I have gotten to love this country. It’s typical for the Estonian way to be sensible and to look forward, to think, ‘How can we actually grow this business?’ It’s amentality that’s shared among a lot of Estonian companies, and I think that’s also why Tallinn is the largest startup city in Europe. If you look at other regulators around the world, it’s all about increasing tax rates and making things more difficult, which ultimately leads to a lot of different challenges in terms of black markets and whatnot. But EMTA (Estonian Tax and Customs Board) has taken a different approach.

They are very happy to engage in conversations, and they are very eager to learn. They are very humble in their approach as well. The fact that they went down this route, which is kind of opposite to what everybody else is doing, is remarkable, and we’re lucky to have a solid regulatory effort like this. It could be a lot worse.

As for the impact on us, it’s a gradual decrease; it’s going to be half a percentage point over the next four years. So of course there is a little bit of a tax benefit, but it’s not a groundbreaking change for us. Estonia is still a fairly small market with a population of 1.3 million. I think it’s more the statement to the rest of industry that Estonia is a place where you can be supported in doing business, which is the biggest thing.

EGR: What does Chile’s recent clampdown on unregulated platforms mean for your operations in that jurisdiction?

EN: It doesn’t do much, to be fair. The regulatory landscape in Chile has been complex for quite some time. We are in good conversations with local lawyers. There was just a presidential election in Chile, so we are waiting to see the position of the new government, but so far it’s been business as usual.

Tying in our previous topic about having local staff, local experts on the ground makes navigating an ever-changing landscape a lot easier. So, we are relying heavily on the people on the ground; we’re very lucky to have them. There continues to be a good market for us, and we’re seeing no changes in terms of user behaviour, so it’s pretty much business as usual.

EGR: Is there a realistic hope that the new administration there will have an open approach to online gaming?

EN: I think everybody was hoping that the market would regulate – that’s going to be the best for everybody. But for now, we do not know how high on the priority list the online gaming space is for the new government. The new government will be formed over the next couple of months and take power from March. We should then know a little bit more about how the market develops.

EGR: In 2024 you mentioned your revenue split was 55% casino, 45% sportsbook. Has this changed, and if so, how?

EN: Coolbet has always been positioned as a sports book, so we are expecting to have a little bit higher share of revenue coming from sportsbook than our main competitors. But the reality is that both verticals are performing well at the moment. We are in the range of maybe 60% to 65% casino. Internally, we have a healthy competition between the two verticals. And, of course, marketing is supporting both verticals. We like to have a little bit of an internal competitive environment, so the guys are always trying to beat each other, but obviously without sacrificing any customer experiences. I think the vertical split is fairly similar to how it was in 2024.

EGR: As you have mentioned, Coolbet prides itself on being an open and transparent business. In what sense does this manifest itself?

EN: I think we’re very fair, first and foremost. We’re happy to book your bet, and we always pay out. It’s pretty crazy that I have to actually say that but there are unfortunately more unserious operators, not to throw anybody under the bus. But we are a bookmaker; we take bets and we pay out our [winning] bets, which is very, very important. We have functionalities on the site which showcase incoming bets, our positions, et cetera.

One of the things we did with [third party self-exclusion tool] BetBlocker was to donate funds so the tool could be translated into Spanish. The Spanish online market is more emerging. You have a lot of customers who might not know exactly what this is, compared to in Europe, where you have more of a history and a more educated customer base in general. It’s something that’s been rolled out now in multiple Spanish- speaking countries since we made that donation.

EGR: On your site, you say 90% of withdrawals over €100 are processed within minutes. How do you maintain your withdrawal processing speeds while competing with crypto operators?

EN: People should be able to expect payouts instantly, right? So, this is probably one of the challenges we have as an industry, especially because we are fiat operators. How do we compete against, say, the crypto operators, which are able to move funds a bit quicker?

We have to recognise that there is a competitive element here. But whatever we can do in processing payments, it’s a case of the quicker, the better for our customers. We already operate with very high retention rates, which is something we’re very proud of. Customers who play with us, stick with us. I can say very confidently that we are above the industry average in terms of retention.

EGR: What are the tangible benefits to your product being in-house?

EN: There’s nobody who tells us what we can and cannot do – if we want to develop something, we can. There are no third-party limitations, there’s no third-party platforms telling us, ‘No, you can’t do this’. If I want to move a box on the frontend from here to here, I can.

EGR: How is Coolbet progressing in its quest for a Finnish licence?

EN: There are still technical requirements that we are awaiting information on, but we are looking to protect our position in Finland. We are looking into how we can best do it, given the new framework that comes into place. So, we’re still in our investigative phase. Finland is one of our core markets, and we are expecting it to continue to be so post regulation.

Obviously, the big change is that we’ve been acquired. Sega Sammy, the Japanese company, acquired us at the end of May this year, so we’re still in the honeymoon period with them, so to speak. So far, we have a good partnership with them. They’re very much supporting us and letting us do what we want to do.

EGR: How was the Sega Sammy transaction different from the 2021 acquisition by GAN?

EN: The Sega Sammy acquisition took forever, which was not good for the business, and frankly, it made operating a little bit hard, because when you’re in the middle of a due diligence process and closing process, you have to be a little bit more cautious with your spend. So, the fact that we made the EGR Power 50 this year makes me even more proud.

Also, we managed to showcase significant growth in an established business with fairly tricky market conditions. It makes the achievement even better in my eyes and makes me even more proud of it. It was almost a relief to get the deal closed, just because we could finally start moving forward. We played defence for a year and a half – now it’s time to play offence and now we can really attack moving forward. We have high expectations for the future.

EGR: Why did the acquisition take significantly longer this time around?

EN: We were a bigger business because they also acquired our B2B arm, the GAN side of the business, which held a lot of the US licences and all the barriers that came with those. US regulators request their own approval process of any closing deal, but when GAN acquired Coolbet back in 2021 there was nothing like that. We could just agree on a price. I think it took about three months. This time it was five times longer. I’m not saying this as criticism towards anyone, I think the process just took forever, given all the approvals and everything. So, we’re just very happy to have the deal closed.

The post Coolbet’s president: “We played defence for a year and a half – now it’s time to play offence” first appeared on EGR Intel.

Endre Nesset discusses the importance of localisation, building trust with customers and why this northern European and Latam operator isn’t a “one-trick pony”

The post Coolbet’s president: “We played defence for a year and a half – now it’s time to play offence” first appeared on EGR Intel.