It’s been nearly a decade since Australia’s Sportsbet launched what was dubbed the first ‘same-game multi’ (on the 2016 AFL Grand Final) just as Sky Bet was making waves in the UK with its Twitter-driven ‘Request a Bet’ product, which let customers suggest combination bets involving correlated outcomes. Those innovations led to a wave of bookmakers rolling out what is now referred to as bet builders (same game parlays in the US). The impact, especially on football betting, cannot be understated.

“For customers, it’s created entirely new ways to enjoy a match, with a far wider range of markets that can be combined to build something genuinely personal,” says Eoin Ryan, BVGroup director of sportsbook and egaming. And there’s data to prove it. Entain announced that in Q2 2025 there was an 80% year-on-year spike in pre-match football bet builder turnover.

The Ladbrokes, Coral and bwin parent company wrote in an article posted on its corporate site in May 2025 that Spain leads the way at Entain with bet builders, accounting for 20% of all football bets, while up to almost 40% of wagers staked on domestic clashes in Brazil are these types of bets.

The operator said that it transitioned to its proprietary bet builder back in September 2024 and, following product upgrades, bet builder share of bets doubled in the first half of 2025, while its share of turnover doubled to 12% in the markets where it’s available.

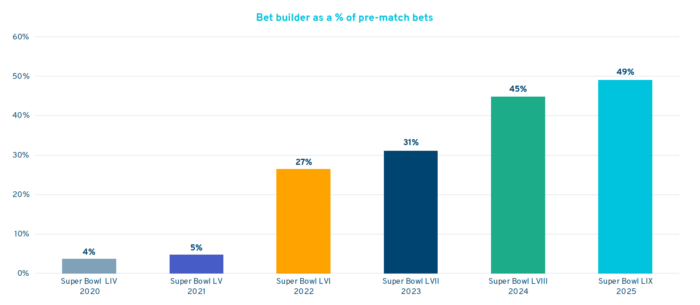

Meanwhile, Kambi’s latest Sports Betting Trends Report, released at the start of 2026, noted SGPs accounted for almost half (49%) of all pre-match bets on Super Bowl LIX last February. That was up from 45% the year before, and almost 10 times the percentage (5%) the supplier recorded across its network in 2021 for Super Bowl LV. What’s more, 24% of pre-match Champions League bets in 2025 were bet builders.

While bet builders are football-led in Europe and NFL-centric in North America, operators have been broadening their offerings in recent months. For instance, William Hill announced in November the launch of a horseracing bet builder for UK and Irish customers, while bet365 added in-play volleyball bet builders with cash-out at the end of November, and Kambi introduced a darts bet builder for the 2026 World Darts Championship. But what’s the next big innovation for

the product?

For Mark Hartley, head of product at Betfred, one avenue for innovation is increasing the understanding of what the customer base wants. “We need to make the process simpler, faster and more intuitive so people can get the selections they want into their slip quickly and confidently,” he says.

The next logical step, suggests Adam Matues, head of sportsbook at BOYLE Sports, is to make customisable bets more like accumulators, which he labels “the king of football betting”. “Of course, there are already capabilities to do this, but how these are built by the user still doesn’t replicate that of the traditional acca,” he observes.

And it’s live

Another area of opportunity for operators is to meet the demand for in-play bet builders. According to Kambi’s 2024 report, bet builders as a percentage of total live bets jumped from 5% in 2023 to 11% a year later. But for Betfred, the option to not offer live bet builders is a “conscious decision”, explains Hartley.

“Coming out of our platform migration [Betfred absorbed Sharp Gaming in April 2024 after the supplier completed the bookmaker’s £100m switch to a proprietary platform], we’ve had to be ruthless about how we sequence enhancements and where we place our focus. In-play bet builder is something we haven’t prioritised yet.” But he notes an in-play product would complement what is already in place and that it could be implemented in the future, but only “when the time is right”.

For players with a BetVictor account, in-play bet builders – along with cash-out – are a feature that parent company BVGroup plans to introduce ahead of this summer’s FIFA World Cup. Ryan says: “Building a robust in-play pricing model is a major challenge – accuracy across every market depends on high-quality data and reliable probabilities. But we’re confident it’ll be a growth area. Football fans already consume live stats and player metrics as part of the broadcast experience, so the link between data and betting is only strengthening. As in-play products become more intuitive, engagement will naturally rise.”

Over at BOYLE Sports, Matues admits there is a demand for in-play bet builders but insists that it will never replace the pre-match alternative. He says: “The user experience and user interface are key in making this appealing to customers due to the fast-changing nature of in-play betting.”

With in-play capabilities developing, attention turns back to the foundations: how customers build these bets and how that process can be improved. When creating a bet builder from scratch, customers often have to navigate between multiple menus, tapping through extensive lists of markets and, on occasion, odds that don’t change when selections are added (if markets are related). The setup can be confusing and off-putting for some casual and first-time bettors.

But Ryan foresees a change coming. “The dedicated bet builder tab will likely fade away [but] complex, related combinations within the same event will be handled directly through the betslip, enabling smoother integration into cross-sport multiples, builder-to-builder combinations and reward tokens,” he says. Operators still have a job to do in explaining the intricacies of the product, such as why adding selections can sometimes result in no change in the odds, admits Hartley, but improvement could come from “how customers are steered around correlated selections,” he adds, due to some customers finding sports betting “overwhelming”.

“There’s also still a huge opportunity around how data and insight are embedded into the experience,” he continues. “We know customers are more analytical than ever, yet many are still jumping back and forth between third-party stats sites while building their bets because operators don’t surface that information well enough.”

Fine margins

When bet builders first started to gain traction, early versions had very high – yet opaque – margins, sparking fears customers would be put off by a lack of perceived value. And while there didn’t seem to be any significant player churn, Hartley recalls the first iterations “weren’t particularly efficient”, noting that “the compounded overrounds could make value hard to find at a time when competition was limited”.

But he stresses that the type of customer who favours a bet builder “doesn’t think in terms of overrounds” and that the product can still deliver fairness and a great experience. “When someone feels in control of their bet and trusts the experience, that is what drives repeat engagement,” he explains.

This point is echoed by Ryan, who says churn is not a “systemic issue” for the product. “Bet builder fans tend to be recreational, low-staking customers with realistic expectations,” he says. “And thanks to the broader range of rewards available today, even a losing bet can still deliver enjoyment or a bonus back.” Ryan highlights that margins have fallen over the years, not only because more operators joined the bet builder party, but because features such as Flutter’s ‘Super Sub’ (bets roll over to the substituted player) were introduced, giving customers “extra value”.

But while they may have fallen in the UK market for some operators, research by Deutsche Bank found that margins on FanDuel’s same game product in the US increased from 13.1% in 2019 to 18.5% in 2023, as customers added more legs to their bets. That product now includes ‘YourWay’, which allows users to adjust lines and customise player props for NBA and NFL bets. Speaking during the FanDuel parent company’s fireside chat with equity research publisher Moffett Nathanson in August, Flutter Entertainment CEO Peter Jackson said the product “is going to be really transformational”.

“It’s a fundamental sort of rewriting of the core infrastructure for our business from a sports perspective,” he added. Although working out how to package such a product and make it available to consumers hasn’t been “straightforward”, it has “started to deliver through the sliders and some of the individual optionality we give to people”.

Giving further insight into YourWay’s pricing and the effect it has had on customers, Jackson said during the operator’s Q3 analyst call in November: “The more sophisticated approach we have to pricing is helping improve an increase in bets cashed out year-to-date, which is making a big difference.”

Over time, operators have improved their models, pricing is stronger, automation is better and the introduction of more data has allowed odds to remain consistent. While the next wave of innovation will come from more transparent pricing, smoother bet building and a product that the customer feels is fair, there will also be scope for an operator to innovate with a sport that hasn’t received a great deal of love in recent years from a product perspective.

At the post

William Hill’s launch of its Racing Bet Builder at the end of November makes it one of the few operators to go to market with a horseracing product in this space. Offering outcomes including race winner, finishing position and winning distance, it is designed to make the experience simpler and more flexible for customers, as Hills spokesperson Lee Phelps highlights: “It allows customers to create their own bet from different angles within the context of one race. In a 16-runner handicap, it can really help simplify the betting opportunity.”

That ability to combine finishing positions with head-to-head outcomes opens the door to bettors new to the sport or casual racing punters who might normally avoid trying to find the winner of races involving big fields and/or complicated handicaps. While the rollout focuses on letting punters build their own combinations, Phelps says pre-packaged bet builders are on the horizon given “football versions are really popular with customers”.

This fits with a broader ambition to make the product accessible to both experienced bettors and complete beginners. Phelps notes: “Racing Bet Builders are there for all customers to enjoy – whether you have trawled through the form book and think two or three will finish in the top three or four, or you are a novice and want to have a fun bet on the outcome of a race without necessarily having to find the winner.”

Even so, the evoke-owned bookmaker is clear that Racing Bet Builders will be different from their football counterparts; they will have fewer legs than typical football bet builders for a start. “The two products are very different in that football bettors place a bet builder that engages the customer for the full 90 minutes of a game, whereas within racing, the timespan of the bet is more limited,” continues Phelps. And with races over in a few minutes, or less on the flat, in-play options would be a “technological challenge” if not “impossible,” he insists.

Bet365 launched its horseracing bet builder product last March, shortly before The Grand National, with four main markets: win and place, matchups, horse and race winning distances and either of two runners to win. Phelps says it is “inevitable” that other operators will introduce their own bet builder on the sport but, right now, the bookmaker is focusing on being the best in its own lane. “The ultimate challenge for us all is trying to change the behaviour of racing customers to think about races from a different angle, which is a key driver for us at William Hill.”

The launch of the Racing Bet Builder came just two days before the UK industry was shaken to its core by the Autumn Budget announcement of a rise in remote gaming duty from 21% to 40% from April 2026, while online sports betting tax will jump from 15% to 25% from April 2027. Horseracing betting tax remained unchanged at 15% however, potentially opening the door for more operators to follow suit by investing in innovation, including with bet builders, as a way of maintaining margin on the product.

As one operator works to reshape longstanding customer habits, others remain focused on keeping punters at the heart of future innovation. “The player [on the field] will become the hero,” predicts BOYLE Sports’ Mateus. “Not the teams or the match events. Bet builders will start with the player before the match.” Hartley agrees the next phase will be about making bet builders “simpler, smarter and definitely more personal”.

Add to that the ongoing development of in-play functionality and the rise of curated builders, and the direction of the product’s evolution begins to take shape. Despite being available at virtually all sportsbooks, bet builders are still a relatively young product, and operators see plenty of room to refine, differentiate and push the experience forward.

The post Built to last: Bet builders reshaped sports betting, but where do they go next? first appeared on EGR Intel.

These customisable bets have become a staple across sportsbooks globally over the past decade, yet despite their ubiquity, meaningful innovation has seemingly stalled

The post Built to last: Bet builders reshaped sports betting, but where do they go next? first appeared on EGR Intel.