The iGaming industry has bifurcated into two distinct worlds. Regulated, where operators deliver sustainability through audited cash flows, licences, banked payments and once-predictable rules. And unregulated, where operators, increasingly crypto-led, enjoy higher margins thanks to near-zero tax and compliance costs. They move fast and throw off cash (read: crypto).

The trade-off is clear. Regulated businesses offer durable, if slower, returns and build genuine institutional equity value. Unregulated peers deliver rapid ROI but sacrifice longevity and rarely accumulate lasting equity.

For years, investors accepted this sustainability vs. speed equation. Recently, however, the “regulated markets offer certainty” argument has collapsed spectacularly.

Whatever happened to the grey?

The distinction between regulated and unregulated is now binary. Enforcement risk and institutional pressure have made operating in between untenable. Bet365 made headlines last May as bankers circled and liquidity-event rumours intensified. The backdrop: withdrawals from India in 2023 and China in 2025. Analysts estimated around £185 million in lost Chinese revenue – a trade-off the company appeared willing to accept to refocus on fully regulated markets.

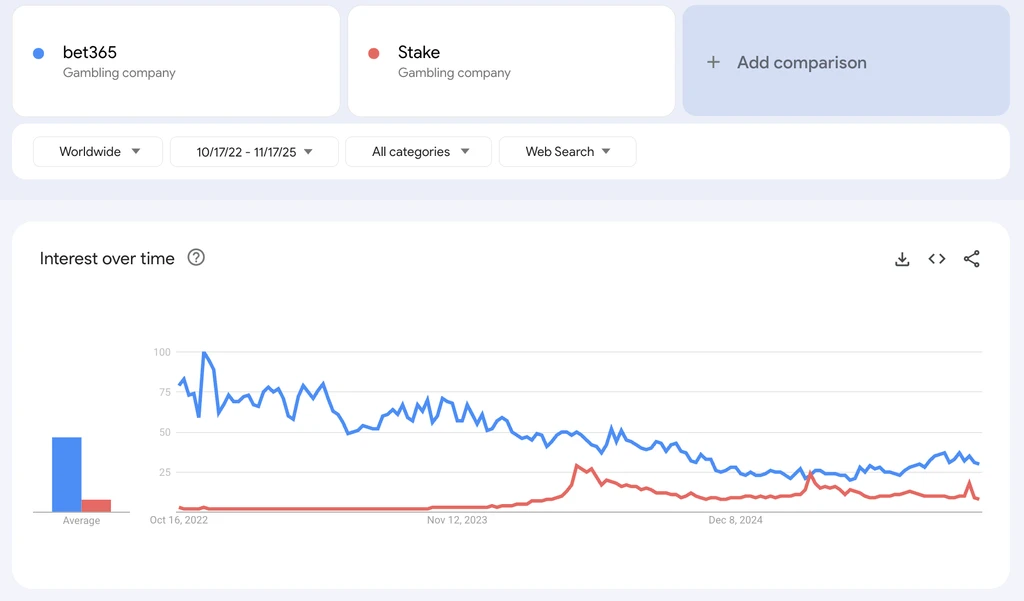

Bet365’s retrenchment underscores that institutional-scale operators can no longer justify regulatory ambiguity – and how quickly crypto challengers move to occupy the space. Stake, BC.Game and other crypto-first platforms have expanded aggressively, serving global audiences from offshore jurisdictions.

Below is a Google Trends chart which shows a stark reality of the bleed from Bet365 to Stake over the past three years.

In 2025 we witnessed eye-watering valuations for unregulated crypto iGaming startups, often trading at parity or even a premium to regulated peers. Capital is impatient. With leverage expensive and M&A markets weak, allocators prioritise near-term cash generation. The traditional “safe” bet is being strangled by red tape and legal frameworks that squeeze onshore margins and stretch ROI timelines. As players and affiliates migrate offshore, liquidity and capital inevitably follow.

The protagonist: Tax and compliance burden

In key markets, the public take now exceeds 50% of GGR on certain products. Pennsylvania taxes online slots at 54%. New York takes 51% of sports-betting revenue. Germany taxes turnover on slots and poker, forcing operators to cut RTP and pushing players to unlicensed sites where their money goes further. The Netherlands hiked its online gambling tax to 34.2% this year and 37.8% in 2026. These policies wreck channelisation. Players chase value; affiliates chase traffic; investors chase cash.

Governments treat online gambling like tobacco or alcohol, forgetting that gambling lives on a borderless internet where VPN use is second nature (global data shows VPN penetration exceeding 40% in several key iGaming territories). Tobacco and alcohol cannot be consumed online (joking aside).

By copying policies built for physical vice markets, regulators ignore the elasticity of demand. When taxation and restrictions rise, players don’t stop gambling; they simply move to unregulated sites that offer better odds and familiar product features. Over-taxation and blunt restrictions will ultimately reduce treasury revenue while undermining player protection. Offshore operators often ignore responsible gaming tools and aggressively target vulnerable users. Until policymakers wake up, the gap between the regulated and unregulated sectors will only widen.

Reality cheque, please

Today’s hot thesis promises juicy yields, but is it worth the risk? Australia offers a sobering reminder. Since 2017, the ACMA has blocked approximately 1,000 illegal sites, resulting in more than 200 offshore exits.

One rule change or a coordinated payment squeeze can flip economics overnight. Crypto is no invisibility cloak – blockchains are traceable. The moment value hits a KYC off-ramp, identities attach. That limbo leaves a paper trail.

So why are valuation multiples converging? Two forces are at play: First, public-market compression: Regulated gaming stocks trade at roughly half the multiples of average tech peers, reflecting regulatory headwinds and slower growth. Private regulated deals anchor even lower. Public buyers can’t pay up without diluting their own stock unless synergies are ironclad. That structural ceiling compresses valuations across the regulated M&A chain.

Second, cash-yield hunger and scarcity. Unregulated valuations are driven by capital rotation and simple supply-demand dynamics. Investors are buying yield streams, not future listings. They price cash-flow yield, not blue-sky equity. The strongest bids go to businesses with high double-digit growth, minimal capex, unrestricted product features and borderless reach.

Unregulated assets can still sell, but the buyer pool shrinks with scale and multiples drop to low single digits. Policy sets the spread. Turnover taxes and GGR rates above ~35% crush onshore margins. Ad bans and product restrictions inflate CAC and shrink LTV.

Germany compounds the pain with stake limits and strict advertising bans, making market recovery nearly impossible. The result is more capital chases grey cash cows while they last.

The US has delivered shocks before: UIGEA (2006) and Black Friday (2011) reset online poker overnight. A similar jolt would reprice unregulated assets.

Operator signals matter. Tim Heath pioneered crypto-first betting withSportsbet.io and Bitcasino; his public pivot toward licensed frameworks is telling. If you want a strategic exit or institutional capital, play by the rules. The market ultimately rewards cash-generative and licensable over cash-generative and opaque.

What’s persistent, what’s transient?

Persistent (micro): As long as regulators overreach, then high taxes, blunt limits, weak channelisation and a vacuum remain. Nimble unregulated players will fill it, and risk-tolerant capital will fund them for yield.

Transient (macro): 2025’s volatility should fade (absent black swans). Falling rates and looser liquidity typically lift gaming equities. Cheaper capital also makes regulated cashflows more valuable, pulling pricing back toward licensed, auditable businesses. In the near term, quality assets may see narrow spreads; overtime, the premium should drift back to licensed operators as enforcement and traceability tighten.

As liquidity cycles turn, risk capital will again chase the highest yields, until policy/enforcement resets the spread. Each cycle brings the same lesson: yield can price anything until it can’t. Every yield has a half-life; know which one you’re buying.

Takeaway for capital allocators?

Don’t overpay for cash cows. If equity value and capital appreciation are capped, price for run-off, not fairy-tale exits. Price the licence. Value credible paths to regulated revenue; without them, expect earnouts and holdbacks. Audit the rails. Payments and AML posture determine bankability – weak rails mean a governance discount.

Assume traceability. The “anonymous” premium is gone. Investment always sits somewhere on the risk spectrum. Just make sure the reward justifies the ride.

BEN ROBINSON is managing partner of Corfai and an entrepreneur, investor and adviser with over 25 years of experience in iGaming, payments, tech and media. Since entering iGaming in 2009, Ben has led a global publishing business, co-founded and exited a crypto exchange and, through establishing RB Capital and Corfai, completed over 20 transactions and raised millions in investment capital.

Is the sector losing its appetite for licensed M&A as nimble crypto giants promise buyers high double-digit growth, minimal capex and borderless reach? Ben Robinson offers his opinion.