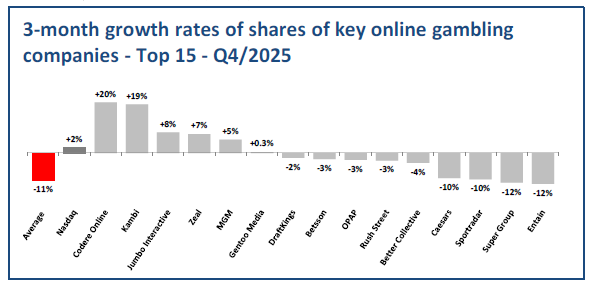

According to analysis undertaken by Online Gambling Quarterly, the biggest leap among pure online gambling companies was Codere Online, while Evolution and Gambling.com stock went south

Key developments

• ‘Winner’ – The biggest leap in the sample of online gambling-focused companies was Codere Online with an increase of +20% over the past three months. This was followed by Kambi (+19%).

• ‘Loser’ – Evoke and Gambling.com had the worst three-month performance in the analysis with a decrease of 56% and 32%.

• Average growth – On average, share prices analysed fell by 11%.

• Comparison to Nasdaq Composite – Compared to the three-month development of the Nasdaq Composite (+2%), the average growth of the online gambling industry looks ‘worse’.

• Multi-channel operators – Among the multi-channel operators that also operate a relevant retail business, MGM Resorts International is the ‘winner’ with a share development of +5% over the past months.

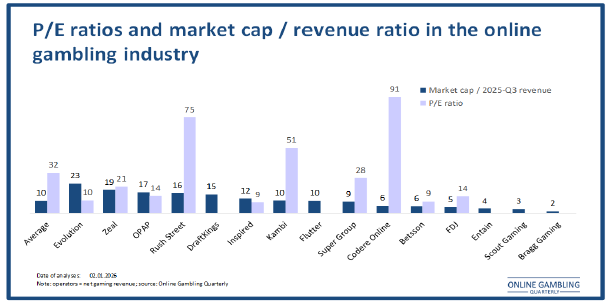

P/E ratios

Online Gambling Quarterly also analysed the current P/E ratios for several companies. The ratio provides a good picture of the value of the company.

• Codere Online leads the ranking with a P/E ratio of 91.

• Average P/E ratio of the sample analysed is 32 (median of 17).

Market capitalisation in relation to Q3 2025 revenues

Traditionally, market capitalisation is correlated to earnings-related figures. But in times of rapidly changing markets and a relevant number of new and growing market players, earnings-related analyses may be less conclusive. Therefore, the researchers also set the market capitalisation in relation to the most recent quarterly revenues (in this analysis: revenue in Q3 2025).

For operators, the Online Gambling Quarterly took the net gaming revenues, and for all others (tech providers, affiliates, etc) took the revenue related to online gambling (if reported).

In some cases, the revenues reported might not be entirely comparable, but the analysis indicates the market dynamics.

• Evolution has the highest market cap/revenue ratio – Evolution leads the ranking in market capitalisation in relation to the most recent quarterly revenue with 23. It is followed by Zeal (19) and OPAP (17).

• Average ratio – The average ratio of the companies analysed is 10 (median of 10).

The post OGQ: Codere Online and Kambi were the top growth shares in Q4 2025 first appeared on EGR Intel.

Online Gaming Quarterly assesses how the leading companies performed on the public markets at the end of last year

The post OGQ: Codere Online and Kambi were the top growth shares in Q4 2025 first appeared on EGR Intel.