This report analyses player behaviour across key Latam markets – Brazil, Mexico, Peru and Colombia – from December 2024 to December 2025. The insights are derived from data based on an average of 7.2 million active monthly players. The analysis covers average deposit amounts, betting patterns in casino and sports, player activity days and customer retention rates.

Key findings and insights:

- Mexico’s recovery from November lows: Mexico staged a significant comeback in December. The market saw a strong rebound across multiple metrics: average deposits regained the top spot, casino betting surged to record highs and player activity days increased from November lows, signalling a renewed momentum to close the year.

- Brazil’s financial growth: Brazil maintains the highest engagement levels (12.7 activity days) despite a slight dip in retention rates. Crucially, the active player base is driving an upward trend in financial metrics (deposits and betting), indicating that players are spending more, likely capitalising on end-of-year bonuses.

- Colombia’s consistent 12-month growth: Throughout the entire 12-month period, Colombia demonstrated a reliable and steady upward trajectory. Unlike the fluctuation seen in other markets, Colombia achieved consistent month-over-month growth in both deposits and betting volumes, culminating in peak performance by December 2025 and signalling a maturing, sustainable market environment.

- Casino market stratification: A clear two-tier convergence emerged in casino betting. Mexico and Peru synchronised at a high-value tier (>$1000), likely driven by high-rolling VIP segments, while Brazil and Colombia converged at a steady mass-market tier (~$600), indicating distinct player profiles in these regions.

- Financial convergence (deposits and sports): By December 2025, Mexico, Peru and Brazil converged tightly in both deposit amounts (~$175) and sports betting (~$350). This synchronisation suggests a unified seasonal behaviour or market maturity where player spending power and betting habits across these major economies are aligning.

- Engagement alignment: In non-financial metrics, Mexico, Peru and Colombia converged at eight activity days, suggesting a standardised level of habitual play for the average user. Similarly, retention rates for Brazil, Peru and Colombia aligned closely at 67%, pointing to a baseline ‘healthy’ retention standard for the region and similar betting behaviour on the end-of-year period.

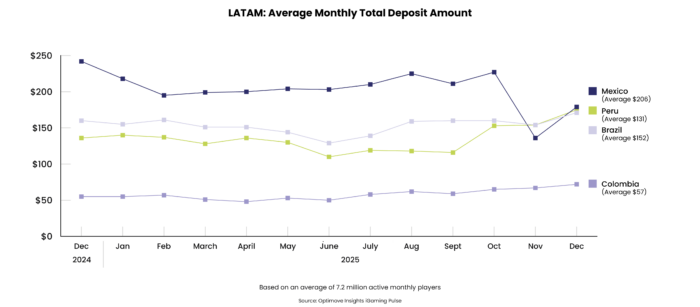

Average monthly total deposit amount

Over the last 12 months, Mexico led with deposits over $240 but trended downward, stabilising near $200 before a late-year dip. In contrast, Peru, Brazil and Colombia displayed flatter trendlines until September, when a rising trend started, converging notably in December 2025. This indicates that the historical gap between Mexico and other markets is narrowing rapidly.

December 2025 showed a universal positive uptick versus November. Mexico rebounded from a low of $135 to regain the lead position. Peru and Brazil also saw increased activity, ending the year on a strong note, while Colombia continued its stable growth, reaching a period high.

Countries’ overall averages:

- Mexico:

December 2025: $179

12-month trailing average: $206 - Peru:

December 2025: $175

12-month trailing average: $131 - Brazil:

December 2025: $171

12-month trailing average: $152 - Colombia:

December 2025: $72

12-month trailing average: $57

Definition of average deposit amount: The average deposit amount is calculated by taking the total sum of all deposits and dividing it by the number of sports and casino bettors (players) who have made at least one deposit.

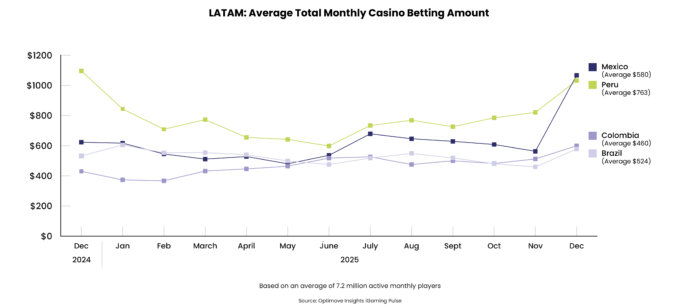

Monthly average casino betting amount

The 12-month trend highlighted volatility in high-value markets. Peru followed a distinctive ‘U’ shape, starting high, dipping mid-year, then recovering strongly, while Mexico remained fluctuating until a spike in the final month. Conversely, Brazil and Colombia maintained more flat trajectories, with Colombia slightly outpacing Brazil by year-end, signalling consistent market maturation.

December 2025 proved to be a breakout month. Mexico’s average grew from to over $1050, effectively overtaking Peru, which also saw a jump from to over $1000. This surge underscores December as an important revenue period for the region, likely driven by holidays or bonuses.

Countries’ overall averages:

- Mexico:

December 2025: $1067

12-month trailing average: $580 - Peru:

December 2025: $1032

12-month trailing average: $763 - Colombia:

December 2025: $599

12-month trailing average: $460 - Brazil:

December 2025: $578

12-month trailing average: $524

Definition of total monthly casino bet amount: The average casino bet amount is the total sum of all casino bets divided by the number of bettors who have placed at least one casino bet.

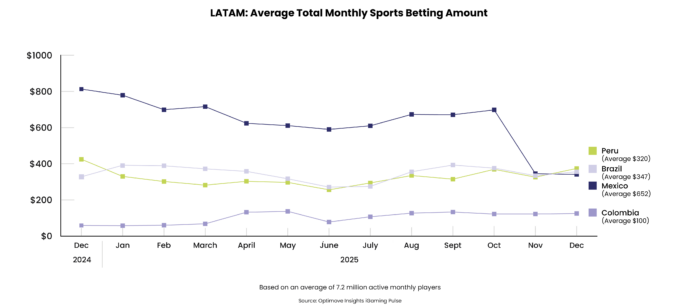

Monthly average sports betting amount

For most of the year Mexico dominated, with average monthly bets initially exceeding $800, but the market experienced a decline in November 2025. Meanwhile, Brazil, Peru and Colombia displayed flat trendlines, suggesting a consistent and stable core bettor base.

December 2025 showed stagnation compared to November. Mexico stabilised at $341 after a steep drop, while Peru and Brazil fluctuated slightly around the $350-$380 range. Crucially, the previous gap has closed, with Mexico, Peru and Brazil now converging around the same average.

Countries’ overall averages:

- Mexico:

December 2025: $341

12-month trailing average: $652 - Peru:

December 2025: $374

12-month trailing average: $320 - Brazil:

December 2025: $356

12-month trailing average: $347 - Colombia:

December 2025: $125

12-month trailing average: $100

Definition of total monthly sport bet amount: The average sport betting amount is the total sum of all sports bets divided by the number of bettors who have placed at least one sports bet.

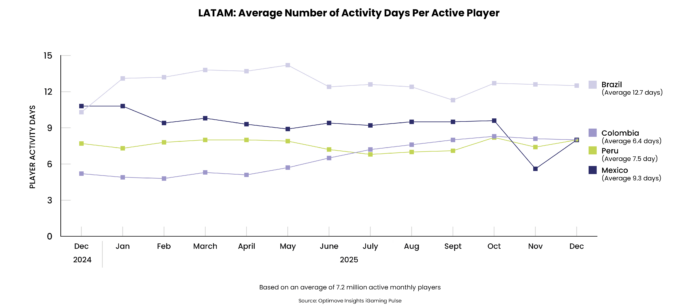

Average number of activity days per active player

Brazil remains the undisputed leader, consistently averaging over 12 activity days monthly, significantly outpacing its peers. Mexico, Peru and Colombia have converged at eight days, with relatively flat trends indicating established player habits.

Comparing December to November 2025 shows slight convergence. Mexico recovered to eight days/player, while Peru experienced a slight uptick. Brazil remained steady at its high level. This indicates that despite broader retention challenges, active players in December remained frequently engaged.

Countries’ overall averages:

- Brazil:

December 2025: 12.5 days

12-month trailing average: 12.7 days - Mexico:

December 2025: 8 days

12-month trailing average: 9.3 days - Peru:

December 2025: 8 days

12-month trailing average: 7.5 days - Colombia:

December 2025: 8 days

12-month trailing average: 6.4 days

Definition of average activity days: The average number of activity days is the total number of activity days divided by the number of bettors who have at least one activity day.

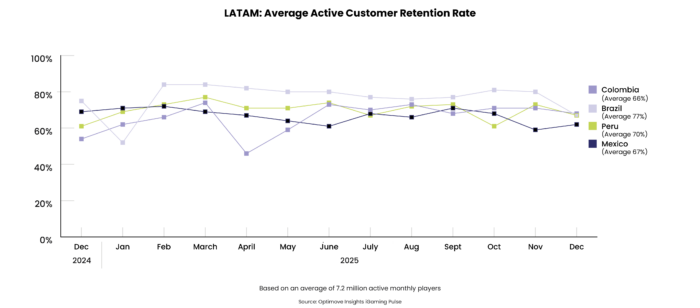

Average active customer retention rate

Throughout the year, trends remained largely stable, with Brazil consistently leading, often exceeding 80% retention. Colombia stabilised in the second place, after early volatility.

Comparing December to November 2025 highlights: Mexico’s retention slightly recovered from a November low. In contrast, Brazil, Peru and Colombia saw minor dips, clustering tightly around 67%-68%.

Countries’ overall averages:

- Colombia:

December 2025: 68%

12-month trailing average: 66% - Brazil:

December 2025: 67%

12-month trailing average: 77% - Peru:

December 2025: 67%

12-month trailing average: 70% - Mexico:

December 2025: 62%

12-month trailing average: 67%

Definition of active retention rate: The percentage of bettors who were active in the preceding month and remained active in the current month.

The post Optimove: Mexico showed “strong rebound across multiple metrics” in December first appeared on EGR Intel.

Analysis of four key regulated Latam markets also finds Brazil maintains the highest engagement levels with an average of 12.7 activity days per player

The post Optimove: Mexico showed “strong rebound across multiple metrics” in December first appeared on EGR Intel.