On 26 November 2025, Chancellor of the Exchequer Rachel Reeves confirmed in the House of Commons what we’d read an hour beforehand, after the Office for Budget Responsibility (OBR) prematurely revealed the contents of the Autumn Budget on its website: that online gambling taxes are going to increase – and significantly.

Remote gaming duty on gross gaming revenue (GGR) will rocket from 21% to 40% as of 1 April 2026, while remote betting duty – excluding horseracing, pool and spread betting – is to rise from 15% to 25% from 1 April 2027. In the end, chatter about harmonisation of tax rates never materialised and instead operators are forced to stomach a distinctly unpalatable 90% and 67% hike in taxes on online gaming and sports betting, respectively. A nightmare scenario few predicted had come true.

“Self-defeating political theatre” was how analyst and consultancy firm Regulus Partners described the 19 percentage-point hike in remote gaming duty, a move that puts the UK among the highest tax rates in Europe. “I think I’m still in shock,” admits a visibly despondent Savvas Fellas, CEO of MrQ, on a video call with EGR from the online casino and bingo operator’s HQ in St Albans.

“I still can’t believe they made such a big change […] it’s hard to refute all this stuff because no one really cares about us. It’s an industry that won’t garner any sympathy and I completely understand that, but it doesn’t negate the reality of the change. Their [the government’s] heads are buried in the sand in the sense that they’re either misinformed, ignorant or stupid.”

As Fellas notes, the electorate probably isn’t going to be up in arms about the Treasury squeezing the gambling industry for more tax. Indeed, a YouGov poll published in the wake of the Budget found more than four in five (82%) Brits felt increasing duties on the sector was the right thing to do at this time.

Along with freezing rail fares, increasing gambling taxes received the most support of all the Chancellor’s announcements at the dispatch box. “An easy way to raise revenue but not to lose votes is bash the bookies,” decries Patrick Jay, a consultant with 30 years’ experience in senior sportsbook and trading roles at the likes of Ladbrokes, PENN Entertainment and Hong Kong Jockey Club.

The publicly listed companies were quick to denounce the tax hikes and outline the financial hit to their operations. The sector’s biggest player, Flutter Entertainment, said it expects an adjusted EBITDA impact (before mitigation) of $320m (£240m) in 2026, rising to $540m the following year.

Meanwhile, Entain anticipates annualised additional costs of £200m – again, before mitigation – for its UK and Ireland (UKI) online arm. The FTSE 100 firm said the EBITDA impact will be around £100m in 2026 and approximately £150m from 2027.

Evoke, which suffered a sharp sell-off in its shares following the Budget, said there would be an additional tax burden of £125m-£135m on an annualised basis after April 2027. Pre-mitigation in 2026 is expected to be in the region of £80m, though bosses at the William Hill, 888 and Mr Green parent firm hope to mitigate around 50% of the impact over the medium term.

Bad behaviour

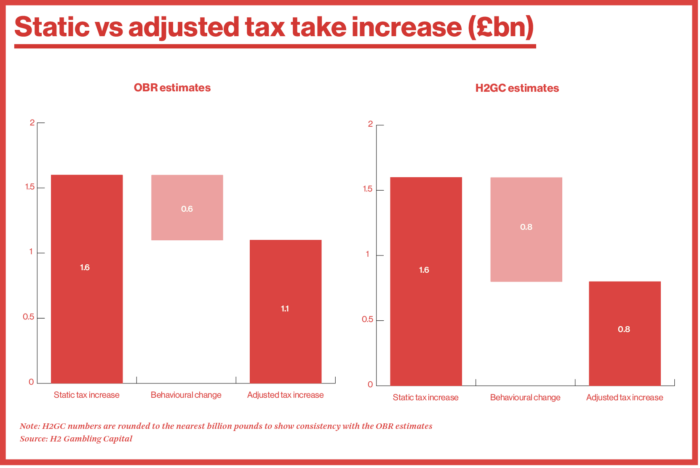

Based on estimates from the OBR, the government would, all being equal, collect an additional £1.6bn from operators in 2027-28, when both remote gaming and sports betting tax hikes have kicked in. However, this figure shrinks to a net yield of £1.1bn when accounting for behavioural responses.

Online companies could, the government acknowledges, pass on around 90% of the duty rises through higher margins, the consequence being that gambling demand falls. Yet industry observers question whether even the projected £1.1bn is over-optimistic, based on the effects of the Laffer curve (correlation between tax rates and resulting revenue collection). One such sceptic is H2 Gambling Capital (H2GC). Modelling undertaken by the consultancy firm suggests “adverse behavioural change” will mean direct tax generation for state coffers increases by around £800m.

“I’m not an economist but I definitely think it could be a lot less [than £1.1bn],” says Nigel Birrell, CEO of bet-on-lottery and casino operator Lottoland. Besides increased spend heading offshore (more on that later), Birrell says the major operators will naturally switch their attention and investment elsewhere. “The big boys will focus on other markets, so you could see gaming going down. Even with a higher tax rate, the overall tax [take] could come down.”

In fact, Jay argues that a rate of, say, 30% for remote gaming duty would have raised “a very similar amount” to 40%, largely because of the Laffer curve and because 30% doesn’t trigger the same degree of leakage to the black market as the government’s announced increase.

Moreover, he says that he finds the lack of awareness “staggering” when it comes to the fundamentals of the industry, particularly the symbiotic relationships between products and verticals. “[It’s] not just governments and regulators, but also internally at some of these companies there is a lack of understanding about the ecosystem – retail taxes, horseracing levies and taxes, sports betting and remote gaming – these products don’t exist independently of each other. You don’t need to be a fan of David Attenborough on a Sunday evening to know that if one part of the ecosystem has its legs removed, the whole ecosystem quickly falls down.”

Two think tanks – the Social Market Foundation (SMF) and the Institute for Public Policy Research (IPPR) – had called for even more punitive tax rates, with both suggesting remote gaming duty soar to 50%. Then, last August, former Labour Prime Minister Gordon Brown penned an article for The Guardian in which he backed the SMF and the IPPR’s proposed hike and suggested the funds raised would cover the cost of scrapping the two-child benefit cap.

More than 100 Labour MPs supported his cause to pull the gambling tax lever to alleviate child poverty, despite the fact any additional taxes handed over by the industry would end up in a central pot to pay for government expenditure and public services. The child poverty narrative, plus gambling duties being viewed by some as Pigouvian taxes (tobacco, alcohol, sugary drinks, etc), put the industry in an awkward spot, though there was a sense – even quiet optimism – in the run up to the Budget that the government was cognisant of the fallout from jacking up taxes.

“I think there was a degree of confidence,” says Birrell, “but I don’t know where it came from – clearly it was misplaced in the end. It would have been sensible that market forces and economics would dictate, and the Treasury would be sensible about what companies could afford to pay […] 40% is verging on the existential.”

If there was to be any rise, around 25% and some degree of harmonisation on tax rates across product verticals was generally what the sector had hoped for. “All the operators I speak to did scenario planning,” relays Fellas of MrQ, “but they never scenario planned for 40% because they didn’t think the government would be that reckless.”

Cut your cloth

The harsh reality for those UK-licensed operators – or more specifically, those that can afford to remain in the UK or even in business – is all about trying to figure out how they adapt. These hikes being additional top line costs magnifies the burden. “It’s on free money, bonuses, everything – it’s coming out at the very top of the funnel,” emphasises Simon Collins, former director of gaming at News UK. It means some are now faced with an effective tax rate of 80% to 100%, when including all other costs.

Vaughan Lewis, the former chief strategy officer at evoke, says the revised tax regime “wipes out the profits of the UK industry”. Pre-mitigation, 40% tips MrQ into loss-making territory, Fellas insists. “There are a lot of costs – marketing, payroll, operational expenditure – so everyone is scrambling around trying to figure out their new reality,” he says. “I don’t know any operator who can plug in 40% and say the bottom line still looks good. We are pretty lean and I can tell you when you run the numbers from our perspective, we are hugely in the red.”

Staff layoffs will, unfortunately, be an unavoidable consequence of increased tax burden, as firms look to cut operating expenditure to balance the books. Industry trade body the Betting and Gaming Council (BGC) commissioned EY (Ernst & Young) earlier this year to model the impact of the SMF and the IPPR’s’ proposals, resulting in the accounting giant forecasting tax increases could cost nearly 17,000 jobs.

The BGC reiterated in December that “almost 15,000 high-tech jobs” are at risk from the hike to remote gaming duty, while 1,750 roles could disappear with sports betting going to 25%. These jobs potentially include higher-than-average to well-paid salaries in places like Stoke-on-Trent (bet365), Manchester (Betfred and bet365), Leeds (Flutter and evoke) and the North East of England (Flutter and LeoVegas Group).

Evoke, which in a statement branded the tax rises “ill-thought through, counterproductive and highly damaging”, said “several thousand” jobs will be lost across the UK sector. As part of mitigation plans, the London-listed operator flagged supplier and operating cost savings, reduced marketing, shop closures as well as “potential changes to the customer proposition”.

The consequences of the government’s actions will ripple far and wide, Lewis asserts. “It will have a significant impact on the supply chain and industries that rely on gambling for their income, like racing, advertising businesses, affiliates and suppliers on the sports data side. It’s a seismic change and all bad news that puts a massive dent in what up until recently was a world-class industry based out of the UK.”

Of course, customers will feel the impact of what’s set to morph into an inferior offering. For a start, operators will be forced to slash generosity such as bonuses and free bets, which are also subject to tax rises under the UK’s regulatory framework. “If I gave you a £10 casino bonus, I’d be paying the government £4,” says Collins, underlining the incoming additional costs, as operators reassess the unit economics of a vertical that accounts for almost two-thirds of remote gambling in the UK.

Bonusing will become a problem for sports betting, too; Regulus Partners pointed out in a note that a sportsbook offering 20% of GGR as bonuses will face an effective tax rate of 31%, which will “almost certainly need to be cut giving the operating costs of offering sports betting”, the firm wrote.

While UK operators pay tax on GGR, the Gambling Commission’s reported data refers to gross gaming yield (GGY), which strips out bonuses like free bets and free spins. Calls are now growing louder for betting and gaming to be taxed on GGY to help cushion the fiscal blow. Collins says: “It seems a little bit crazy to be charging tax on free money, the bonuses.”

Lewis expands further: “When the tax rate goes as high as 40% and you continue to offer bonuses around 20% it means your effective tax rate is 50% of your revenue. This makes it harder to compete with the black market and harder to have margin left over to invest in marketing to attract and retain punters.

“So, changing the economics from GGR to GGY would even out that competitive distortion with the black market, bonuses and free spins. It’s still not even but it would remove one of the main distortions,” he points out.

The government clearly looked to protect the High Street in the Autumn Budget; the 10% duty on bingo venues will be abolished from April 2026 (few, if any, saw that coming), machine gaming duty (MGC) was held at 20%, and bets placed over the counter and on self-service betting terminals are to remain at 15%. While the announcements were a win for betting shops, retail isn’t immune to the impact of online tax hikes. Plus, shops had already been disappearing – their number falling from 7,315 in 2019 to 5,825 in March 2025, according to the Gambling Commission. In October, Paddy Power announced the closure of 57 outlets across the UK and the Republic of Ireland.

Tight margins and rising costs mean retail can struggle to break even. A good proportion of the land-based estates remain open for branding and omnichannel benefits, rather than their profitability. Indeed, Betfred owner Fred Done told the BBC just prior to the Budget that 300 of his 1,287 shops were “currently losing money”. Vaughan Lewis, ex-chief strategy officer at evoke, says: “That’s 20% to 25% of Fred’s estate, so I would guess most estates aren’t dramatically different and 10% to 25% are marginal to loss-making. You’re probably looking at somewhere between 500 and 1,000 shop closures over the next 18 months or so,” he forewarns.

Faced with increased tax pressures, Jay wonders whether it is time to deploy improved and more efficient targeting around generosity. “A significant amount – and it might be as much as 50% – of bonus spend is wasted,” he claims. “There’s a theoretical argument that half the people who receive bonuses shouldn’t and the half who don’t should receive them.

“Marketing and bonus spend is not as well understood or optimised as it should be […] while mitigation will be done, I would focus heavily on re-engineering marketing into a data science operation so that you implicitly understand every customer on your database. If you have a million actives, who needs a bonus and how much, and who doesn’t,” Jay explains.

Another knock-on effect is return to player (RTP) rates on slots will almost certainly have to be lowered. Sure, most players won’t realise their favourite games have been trimmed from their current levels of roughly 95% to 97%, yet they might soon spot they’ve lost £20 in five minutes when it previously lasted 10 minutes. Suddenly player churn rates accelerate. Slots dominate online casino in the UK, with these games generating 84% – or £4.2bn in GGY in the 12 months to March 2025 – of the vertical’s £5bn during the same period, so lower RTPs will negatively impact GGY to some (unknown) extent.

Francesco Postiglione, CEO of casino-led Casumo, likens the UK’s upcoming tax regime to Germany with its punishing 5.3% turnover tax on slots. “If you do a simple equation, 5.3% translates to 50% GGR,” he says. “In Germany, RTPs are 84% and 85% in some places, so RTPs will get worse for UK players.”

However, Casumo’s boss doesn’t expect RTPs to go sub-90%. Similarly, Fellas stresses MrQ wouldn’t drop below 90%. “It will be higher than 92%,” he confirms. Another line Fellas isn’t willing to cross is pulling back on marketing spend because, for him, brand and storytelling will be more important than ever (MrQ recently underwent a brand refresh supported by a TV ad campaign). “That’s a bit of a contrarian view and I’m OK with that […] I’m big on brand and big on above-the-line [marketing] and I’m not going to stop that until I have to,” he says.

MrQ could be an outlier, though; most businesses will have to be disciplined with advertising and sponsorship. That could end up benefiting some affiliates, suggests Martyn Hannah, founder and managing director at casino affiliate Comparasino, who points out: “Operators might ultimately lean on affiliates more heavily, particularly those cutting marketing spend across TV, radio, out of home and sponsorships […] for the affiliates that can deliver high-value players for a sensible price, demand for their services could be higher than ever before.”

Shadowy figures

Tax hikes heighten fears that licensed operators will seriously struggle to compete with those black market sites boasting slots RTP rates as high as 99% and able to offer the moon on a stick for acquisition and retention purposes. “Bonuses are a huge part of casino play, so a lack of a bonuses will drive people offshore,” Jay warns.

What’s more, of course, illegal UK-facing operators also have no stake limits on slots (£5 caps for over 25s and £2 for adults aged 18 to 24 came into force in spring 2025) and allow auto-spin and ‘buy the bonus’ features – both of which are not permitted in the UK.

H2GC has concluded from its own calculations that online channelisation in terms of GGR will fall from 93% in 2025 to 84% post-tax rises, including igaming slumping to 80%, as a portion of reduced onshore spend shifts to illicit operators. The consultancy firm also expects the black market to double in size. Even the OBR has acknowledged around £500m of the expected yield from the tax hikes will be lost to the black market by 2029-30. Hence why Entain said in its response to the Budget that the black market “had hit the jackpot”.

Offshore operators continue to roll out the welcome mat for UK players – including shamelessly targeting those who have self-excluded with licensed firms via GAMSTOP – while crypto gambling sites are easily accessible with a virtual private network (VPN). For this article, EGR was able to access most leading crypto casinos from the UK by masking our location as Norway. “I’m pretty confident if I set up a VPN I could play on any website anywhere in the world,” says Collins.

More broadly, VPN usage in the UK jumped last summer, following the introduction of onerous age-gating linked to the Online Safety Act. With a slew of VPN providers reporting a surge in downloads this year, borderless gambling products are mere clicks away for more Britons than ever. “No one has a monopoly over the consumer, and I don’t think governments around the world have figured that out yet,” says Matt Davey, CEO of financial advisory firm Tekkorp Capital.

As part of the Budget, it was announced the Gambling Commission will be allocated a further £26m to strengthen the fight against the black market. But this sum is far from adequate, warns Collins: “£26m sounds like quite a small amount compared to what these [crypto casino] guys are paying their streamers,” he says. The BGC called the additional capital a “drop in the ocean given the scale of the threat”.

With the black market expected to grow and channelisation likely to fall, plus legal operators already struggling to find ways to absorb the added costs and still balance the books, UK exits seem a foregone conclusion. More specifically, a good chunk of the hundreds of longtail brands with less than 1% share in the heavily fragmented casino market could decide to pack up shop. Or they’re snapped up amid a fresh wave of consolidation to sweep the sector.

With the likes of Entain, bet365 and BVGroup having long-established operations in the British Overseas Territory, tax increases are a huge concern for all businesses and the 3,400+ people employed there in online gambling. To underscore the industry’s importance, Gibraltar’s minister for justice, trade and industry, Nigel Freetham, told Gibraltar’s parliament on 1 December that betting and gaming accounts for 30% of GDP and generates one-third of tax receipts through a combination of corporate and personal income tax, social insurance and local gaming duties. He also said UK-facing firms licensed in Gibraltar already pay £750m in annual gambling taxes to the UK Exchequer.

“It’s going to be bad, let’s not sugarcoat it,” acknowledges Nigel Birrell, Lottoland CEO and chair of the Gibraltar Betting and Gaming Association, regarding tax rises. An over-reliance on the UK market spells trouble for certain firms on the Rock. Birrell adds: “Some don’t have such internationally diversified businesses as others. Those with very UK-focused businesses will struggle to survive.” However, more geographically diverse firms now have less incentive to remain in Gibraltar, while the benefit of not paying VAT on UK-facing marketing will diminish for those forced to slash advertising budgets. Gibraltar’s gambling minister, Andrew Lyman, stated in a LinkedIn post that the industry “will sustain in Gibraltar”, but conceded it will be “much, much leaner and much less profitable”.

With potential bargains to be had, acquirers are circling. UK operator SkillOnNet, which owns dozens of gaming brands – including PlayOJO and Megaways Casino – told EGR in December that the market is entering a consolidation phase and that management are exploring M&A opportunities. Discussions are already taking place with “multiple parties in the UK”, according to the firm’s senior vice-president of corporate development, Maor Nuktevitch, yet he stressed the importance of identifying the right “strategic fit”.

Fellas can envisage “most of the longtails dropping out”, though he thinks much depends on their risk appetite as well as whether they are able to “ride it out”. As for MrQ itself, Fellas adds: “We will survive and we will win […] but we’ll unfortunately have to lower the quality of our offering.”

Casumo, which also holds licences in Sweden, Spain and Ontario, is reviewing its plans but, for now, is committed to the market. “Pulling the trigger and getting out of the UK could be a mistake,” Postiglione remarks.

Meanwhile, Birrell is confident Lottoland can retain similar profitability beyond April 2026 in the UK, a market that accounts for less than 15% of group revenue. “We’ve done the numbers and by taking a more direct marketing approach and cutting out more of the brand marketing, reducing the return to player and perhaps adjusting the cost base a little bit, then we can still make a similar sort of profit. I think it’s going to be tough, but we have to see how it plays out.”

Further up the food chain, debt-laden evoke announced on 10 December the board had commenced a strategic review of the business, with a full sale or sale of assets under consideration. With more than half of total group online revenue generated by its UKI unit, evoke is particularly exposed to tax hikes.

Elsewhere, tier-one operators have the chance to leverage their economies of scale and strong brand awareness to solidify their respective positions. In fact, Flutter has suggested that, as the largest UK operator (Sky Betting & Gaming, Paddy Power, Betfair and tombola), there is an opportunity for “market share gains”.

As for bet365, Regulus Partners wrote in a note after the privately owned online giant published its latest set of accounts just before Christmas that bet365 will be a “material net beneficiary” from the 90% gaming duty rise given its “heavy skew to betting”.

Coping mechanism

Listed firms face a “tough balance” on messaging around 40% remote gaming duty, Alun Bowden, senior vice-president of strategic insight at analyst firm Eilers & Krejcik Gaming, wrote on LinkedIn. “Too confident of mitigating the impact and you leave yourself open to further tax rises. Too worried and you spook the market,” he noted. And that’s the real concern; this government could pull the tax lever once again some time down the road if the industry seems to be coping with 40%. How about 50%?

Licensed operators argue they are already handing over enough tax to the Exchequer. For example, evoke said it paid £329m in taxes and duties in 2024, equivalent to more than 60% of its UK profits.

Rank Group – the omnichannel business behind the Grosvenor and Mecca brands – welcomed the abolition of the 10% bingo duty for land-based venues but pointed to the fact it coughed up £188m in taxes while posting a post-tax profit of £44.6m in the year ending 30 June 2025. The duty rises announced by the government increases the financial burden by £40m (before mitigation), bosses at the FTSE 250 firm said in a statement to the market following the Budget.

The people EGR spoke to for this article seem resigned to the fact this decision will probably not be reversed – or partly reversed – even if projected tax revenue fails to materialise, channelisation slides and gambling-related harm increases. It may require a change of government to lower remote betting and gaming taxes, yet the next General Election is scheduled for no later than 2029. “Maybe another government might listen to the rationale and be a bit more level-headed,” Fellas ponders. “Would the government in power revert this? No, because it’s an admission of guilt and of getting it wrong.”

British horseracing lobbied hard to be exempted from duty rises, including descending on Westminster with jockeys in tow and a plastic horse emblazoned with ‘Axe the Racing Tax’. Yet a carve-out (online and offline stays at 15%) may be a pyrrhic victory seeing as bookmakers – the sport’s main funders via the levy (10% of racing profits), media rights and sponsorship to the tune of £350m a year – have to tighten their belts. “Myopic” was how one industry source described back-slapping among racing figures over the carve-out.

BetGoodwin CEO Julian Head criticises racing’s decision not to lobby “as a united front” with the betting industry, while underlining the cost of offering the product, largely due to turnover-based media rights. “We work to a gross profit margin of around 8% on racing,” he says. “The majority of our racing is supplied by Arena Racing Company, who charges us 3.6% on turnover, which includes unrecoverable VAT. On an 8% model this equates to 45% of our profits.

“We then pay 15% duty, 10% levy, 1.1% safer gambling levy – before the many other outgoings of running our business. All this made racing very marginal, but if customers were betting on other sports or games, it could prove worthwhile.” Head adds: “As part of our Budget response, we will exit all racing sponsorship activity and reinvest these funds into areas that deliver stronger commercial returns.”

Regardless of whether you think a good enough job was done persuading the Treasury not to raise duties, Casumo’s Postiglione is of the opinion the sector needs to shoulder some of the blame – and not just in the UK. “It’s like a sugar rush for a person who suffers with diabetes,” he explains.

“You have a spike and everything goes well and people gamble, but then the politicians or governments come in and it all collapses. It’s always the same mistake – we are simply too loud and we are everywhere. We annoy the politicians. We break our social agreement, and these are the consequences.”

As well as the upcoming 90% hike in igaming tax, Postiglione notes that “another small earthquake” is the ban from 19 January on ‘mixed product’ cross-sell promotions. It means operators won’t be permitted to offer bonuses that require a user to engage in more than one different type of gambling product to qualify for the bonus – the thinking being the ban will reduce gambling-related harm. He warns: “Together with the taxation, this is going to be a perfect storm.”

For years, the UK’s robust and sensibly regulated online gambling market was considered the gold standard. Other jurisdictions used it as a template for their own regulatory frameworks. As the industry flourished, the country became the home for some of the largest and most successful operators, collectively employing tens of thousands of people.

The clear danger is the latest tax increase on online casino (the vertical went from 15% to 21% in 2019) and sports betting increasing in 2027 will clip the wings of already heavily taxed industry. In Collins’ view, it will “kill innovation”. “That was one of the great things about the UK – we led the world in terms of innovation in the sector. It now feels like we won’t be able to do that anymore,” he sighs.

There’s no doubt the UK industry is facing its most challenging period since the online market regulated nearly two decades ago. An ominous and uncertain future awaits for all.

The post Heavy duty: the fallout from the UK’s punishing tax hikes first appeared on EGR Intel.

The decision by the UK government to nearly double remote gaming tax to 40% from April 2026, as well as hike remote betting duty to 25% from the following April, sent shockwaves through an online sector worth almost £8bn. But once the dust settles, what are likely to be the repercussions for operators, consumers and the health of the UK market?

The post Heavy duty: the fallout from the UK’s punishing tax hikes first appeared on EGR Intel.