Super Group

3 January closing: $6.20

31 December closing: $11.95

Peak 2025 closing: $14.09

A significant share price surge for Super Group in 2025 capped off a strong year for the Betway and Spin parent company. Moving up one place to fifth in the EGR Power 50, the New York-listed giant also reported record financials amid a renewed focus on Africa. Podium positions across the continent, as well as growth in Canada and Europe, have helped the business this year. Add in an Investor Day that took a look at the engine powering the company in September, and a new cryptocurrency pegged to the South African rand, and it was a busy 12 months for Super Group.

Flutter

3 January closing: $256.76

31 December closing: $215.04

Peak 2025 closing: $308.60

A falling share price for Flutter in 2025 came amid the rise of prediction markets, driven by Kalshi and Robinhood. The New York-listed giant has now got in on the act via a JV with CME Group. FanDuel Predicts launched last month in a handful of states, with US-wide expansion on the cards. Continuing to dominate both sides of the Atlantic, Flutter’s Q3 revenue was up 17% to $3.8bn. Acquisitions in Brazil and Italy have further strengthened the footprint.

DraftKings

3 January closing: $37.45

31 December closing: $34.46

Peak 2025 closing: $53.49

DraftKings was also hit by a perceived lack of action in the prediction markets space, before it proceeded to snap up Railbird and launch DraftKings Predictions in December. While a less stark sell-off compared to Flutter, the Jason Robins-led business was still down on its peak of around $53. DraftKings will be hoping that alongside FanDuel, the pair can replicate their online sports betting dominance in the prediction markets arena.

Entain

3 January closing: 676p

31 December closing: 766p

Peak 2025 closing: 1,022p

A whirlwind 2025 for Entain saw the FTSE 100 firm appoint Stella David as its permanent CEO after the unexpected departure of Gavin Isaacs in February. David, a former Bacardi exec who has been interim CEO at Entain twice, has been a steady hand, with the operator’s stock breaching the £10 mark in the summer. However, much like other UK-facing brands, Entain was hit by the Autumn Budget, especially in the run-up to the announcement. The hike in remote gaming duty (21% to 40%) and remote general betting duty (15% to 25%) spooked investors ahead of this. However, in the days after the Budget, Entain’s stock was relatively unmoved, with investors calmed by the company’s mitigation plans.

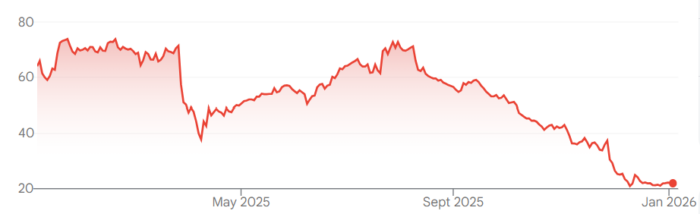

Evoke

3 January closing: 61.50p

31 December closing: 22.2p

Peak 2025 closing: 73.80p

A business that struggled on the stock market last year, evoke announced in December that it had tapped bankers to support on a potential full sale of the group or asset divestment. The William Hill, 888 and Mr Green parent company is laden with debt, and its share price has tumbled, putting its market cap below £100m. Heavily impacted by the Autumn Budget given its strong exposure to the UK, the operator will be hoping for a kinder 2026.

The post Stocks Tracker: 2025 in review first appeared on EGR Intel.

EGR analyses the share price movements of major industry players in 2025, including DraftKings, Entain and Flutter

The post Stocks Tracker: 2025 in review first appeared on EGR Intel.