Sustainability is no longer a side quest for the regulated gaming sector. It is core to how capital flows, how brands are judged and, ultimately, company longevity. Investors and stakeholders are doubling down on demands for credible sustainability performance and transparent data.

Gaming industry followers of sustainability and ESG regulation could be forgiven for thinking that they could reallocate the valuable time and resources they had previously spent worrying about getting ready for significant EU disclosure rules this year. The same applies to non-EU companies and investors given political developments in the US and elsewhere.

Not so fast.

While the reporting load has suddenly gotten lighter the myriad benefits of demonstrating strong sustainability performance have intensified.

Phased timeline for sustainability reporting directive in Europe

The background: The EU’s Corporate Sustainability Reporting Directive (CSRD) was originally set to impose a slate of complex disclosures. This included “double materiality” which would force companies to report not only how sustainability issues affect them but also how they impact people and the planet.

Backlash over the depth and complexity of the European Sustainability Reporting Standards (ESRS) pushed policymakers to rethink the regime. This culminated in the European Financial Reporting Advisory Group’s (EFRAG) “Omnibus Simplification” package just announced this month.

Mandatory data points have been cut by around 61% and implementation now phased in through to 2028. For gaming operators and suppliers, this means fewer boxes to tick, more flexibility in what gets reported, and a little breathing room on timelines.

Why gaming can’t walk away

The temptation in some boardrooms is obvious: why not shrink sustainability teams, stop disclosing marginal metrics and focus strictly on short‑term financial performance?

That would be a costly mistake, especially in regulated gaming, where the perception is that sustainability reporting already lags behind peer “sin” sectors like alcohol and defence industries. The gaming industry has made strides in sustainability performance and companies would be ill-advised to drop the ball while the game continues.

Investors are increasingly integrating sustainability data into their models. Gaming companies that stop or shrink reporting risk a higher cost of capital, lower liquidity, tougher M&A approvals and growing stakeholder dissatisfaction. For gaming, the sector is under constant political, regulatory and media scrutiny, opacity reads as risk – and risk gets priced in.

A booming sector under the microscope

The regulated gaming industry generated roughly $540 billion in global revenues in 2025, up around 5% on 2024 thanks to digital and tourism growth.. That success only intensifies pressure on operators to show they can scale responsibly, rather than simply scale.

Problem gambling is widely presumed to affect 3%-5% of users, while anti‑money laundering failures and other governance breaches led to fines in the hundreds of millions last year alone.

Where sustainability is paying off

There is growing evidence that sustainability is not a compliance cost but a performance lever.

A 2025 PwC study found companies that were sustainability leaders delivered 12%–18% higher returns. Their commitments also acted as buffers against roughly 25% market volatility, a pattern that investors increasingly apply to companies in the gaming industry as well. Las Vegas Sands, for example, reported around $15 million in efficiencies in 2025 tied to energy and emissions reductions.

SustainabilityPlus has also found that strong performance in sustainability metrics also tends to align with lower regulatory fines and more successful brands.

Sustainability ratings and rankings updated;

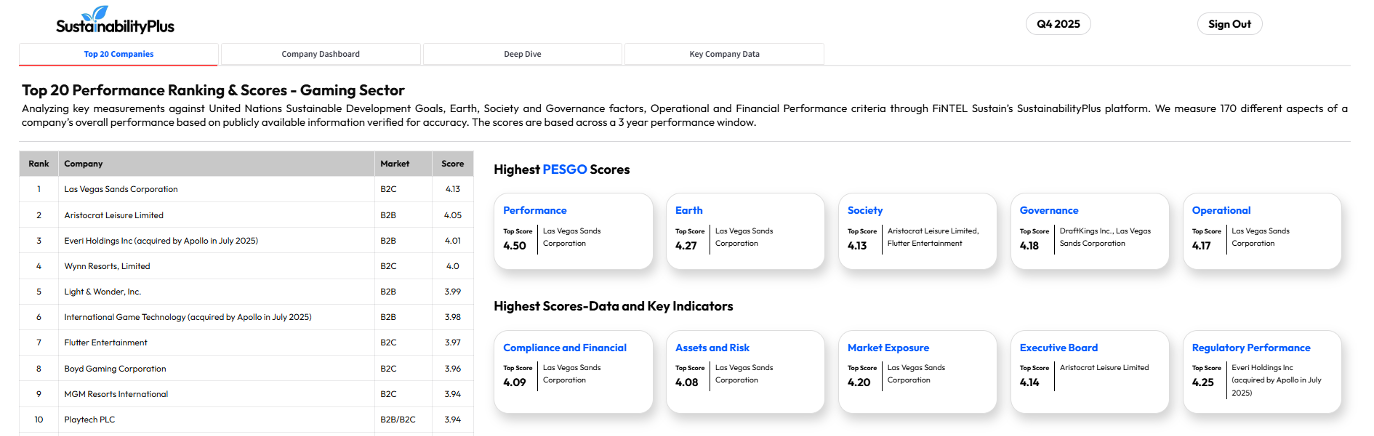

In a world of lighter reporting rules, external sustainability and ESG ratings take on even more significance as shorthand for performance and risk. The ‘SustainabilityPlus’ platform has built a gaming‑specific framework that covers 20 of the top regulated operators and suppliers, drawing on three years of public disclosures and industry‑specific factors powered by AI.

Analysis of the ‘SustainabilityPlus’ 2024 versus 2025 ratings and rankings shows an average uplift in scores to around 4.03, primarily due to environmental progress, with social metrics improving more slowly.

The top performers tend to share a similar profile: aggressive emissions reductions, renewable energy commitments, tighter compliance systems and more mature responsible gaming strategies, with new entrants to the top tier reflecting the rise of listed online groups and digital‑first operators.

The investor lens: Survival and spread

For equity and debt investors alike, sustainability performance in gaming now functions as a proxy for long‑term viability. Equity investors look for upside: high performing companies are increasingly treated as potential alpha-generating plays, especially where sustainability efforts clearly link to regulatory resilience, operational efficiency and brand strength.

Debt investors focus more on downside protection. They favour issuers whose sustainability record signals lower default and headline risk, as illustrated by tighter pricing on green or sustainability‑linked bonds issued by leading operators.

Regulated vs unregulated: The widening gap

One of the clearest storylines emerging from recent data is the widening gap between regulated and unregulated gaming. Regulated operators are pushing deeper into sustainability, broadening their definition beyond narrow ESG metrics to encompass wider issues like black‑market displacement, community impact and data ethics.

At the same time, the growth of grey and black markets continues to cast a long shadow over the reputation of the entire sector. Governments and regulators continue to struggle to understand and act on the nuances.

Friction points: Lack of standards and M&A

Reporting requirements continue to remain fragmented across jurisdictions. Different markets demand different formats, metrics and assurance levels. This creates a patchwork that is resource‑intensive to manage and can be confusing for investors who are looking for trust data to make decisions around.

Meanwhile, M&A risk remains high as companies wrestle with questions around exposure to grey or black markets, legacy compliance issues and the sustainability performance of target companies or joint‑venture partners. Last year we saw more moves towards new listings or full ownership structures from major players such as Flutter and Allwyn, in part to manage these risks more directly.

Smaller and mid‑tier operators can now join the party

Paradoxically, the simplification of CSRD and related standards may be a big opportunity for smaller and mid‑cap gaming companies relative to the larger companies that had already invested heavily in complex reporting capability. With fewer mandatory datapoints and more flexibility to focus on material issues, leaner organisations can move faster to build credible, decision‑useful sustainability reporting without the overhead of a sprawling compliance bureaucracy.

The priority list for these companies is increasingly clear:

- Build a concise, consistent sustainability narrative anchored in a small set of material KPIs that investors can track over time.

- Disclose clearly on responsible gambling strategy and outcomes, including measurable indicators such as interventions, self‑exclusions and customer engagement with safer‑play tools.

- Demonstrate a path on emissions and energy – even basic efficiency measures and renewable sourcing commitments can move the dial with ratings agencies and lenders.

- Clarify exposure to grey or black markets, and articulate a roadmap for derisking or exiting non‑compliant revenues where feasible.

- Consider the wider ramifications of sustainability such as financial and operational performance and act accordingly.

Done well, these moves can help unlock lower borrowing costs, broaden the pool of potential investors and smooth future M&A discussions in a sector where consolidation is far from over.

The road to 2026: Data, discipline, differentiation

Heading into 2026, regulated gaming finds itself at a sustainability crossroads. While regulators have dialled back some of the more onerous disclosure demands, investors, employees and communities are holding operators to a higher standard than ever. They are using increasingly sophisticated tools to separate genuine performance from PR.

The companies that will win the next phase are likely to be those that treat sustainability as a strategic discipline: targeted, data‑rich, integrated into product and compliance pipelines, and clearly tied to financial outcomes.

For a sector built on understanding risk and probability, the odds strongly favour those who stay in the sustainability game – and play it well.

SustainabilityPlus, part of Fintel Sustain, provides sustainability ratings for 20 of the top regulated gaming companies using focused datapoints, three years of public data and AI-powered analysis. Ratings enable companies and investors to make better strategic, operational, and financial decisions. Learn more at sustainabilityplus.ai

Sustainability performance is more important than ever. New gaming industry rankings reveal better scores across the board.

By Robert Montgomery and Steven Myers.