Jump to:

Analytics and senior developers

Analytics and senior developers

Hiring is focused on mid-to-senior roles, with entry-level positions increasingly sidelined.

BI Analysts now need machine learning and AI skills – not just SQL and Tableau – even in organisations still cleaning their data.

Demand for data managers remains steady, while engineering roles are reducing due to automation. Return-to-office mandates are prompting senior resignations, making remote flexibility a key differentiator. Overall, employers want data teams who can do more, with less, and faster.

Gerry Riera

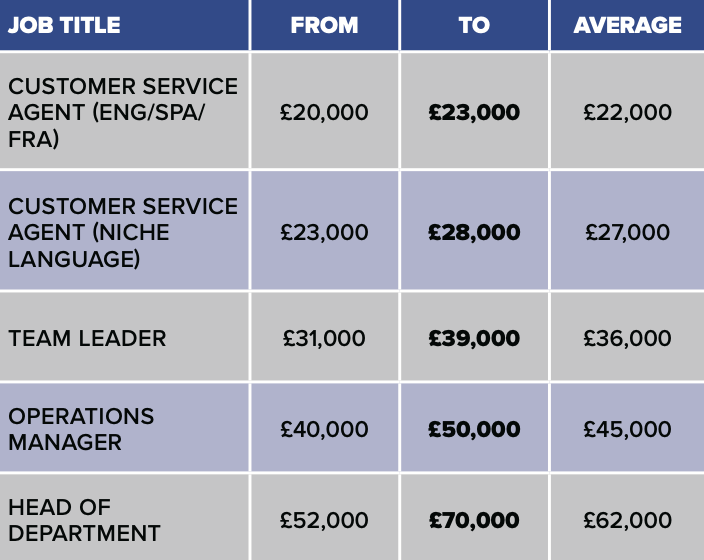

Customer services

Demand remains steady for multilingual customer service agents, with Dutch, Finnish and English speakers most sought after. Hybrid working remains common, though some roles require initial on-site training.

Live dealer positions are normally on-site, with relocation to hubs like Romania continuing.

Employers welcome candidates from outside iGaming for agent roles, though team leads are usually promoted internally or hired with industry experience. Translation tools are now widely used to support agents, boosting efficiency without replacing human input. Talent Retention remains a challenge.

Lucky Shankar

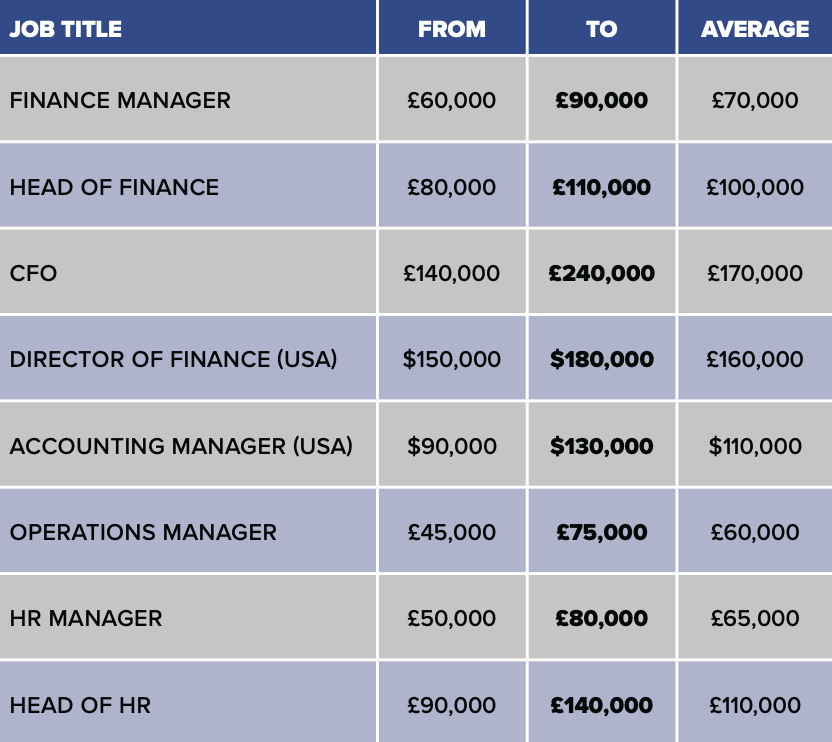

Finance and operations

Caution is the dominant theme across Finance and Ops in 2025. Businesses are restructuring; delaying launches and reticent to hire C-1 levels, they are favouring procedural managers over strategic leaders.

Salary growth has currently stalled, with no significant supply-demand pressure at senior levels. In the UK, obvious concerns around gambling tax reform are prevalent, adding to the uncertainty. Hybrid models are changing again, with many employers now expecting 3-4 days in-office.

Candidates remain selective: any move must suit their lifestyle, long-term goals and salary expectations. Without flexibility or progression, companies risk missing out on high-quality finance and operational talent.

Kerry Gillitt

Game design

Game design remains centred in Europe, with US land-based giants now building online studios around to European talent. Sweden continues to lead in creativity, though hiring there is costly.

Studios are shifting back to in-office work for better collaboration, particularly in Eastern Europe and the UK. While senior hiring has slowed, demand for game producers is rising.

With few experienced game mathematicians available, major providers are investing in graduate training to build future design capability.

Steve Kirk

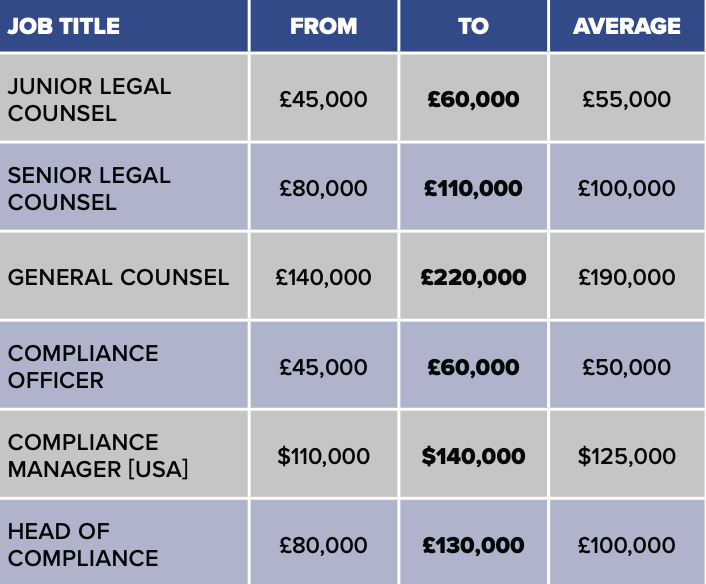

Legal and compliance

Hiring in compliance and legal remains steady but cautious, with operators prioritising risk mitigation over headcount growth. Hefty fines and licence withdrawals in Europe have prompted more conservative approaches, particularly from startups underestimating regulatory complexity.

Fractional hiring has gained significant traction – used to clear backlogs, update policies and manage regulator relationships cost-effectively. While movement at C-level is rare, we expect C and C-1 level roles to see a shift. Manual processes often still dominate AML and Fraud teams, however operators must review part automation.

Flexible benefits and work-life balance are now essential for mid-level retention, especially as teams consolidate and restructure.

Kerry Gillitt

Marketing

Marketing remains essential to iGaming growth, with crypto, sweepstakes and social gaming experience in high demand. The April 2025 Google algorithm update triggered a drop in affiliate traffic, accelerating consolidation and forcing CMOs to do more with leaner teams.

Startups in Web3 and crypto gambling are driving demand for marketers who understand unique acquisition models and can quickly deliver against clear KPIs.

Remote roles dominate in Eastern Europe, while hybrid working is common in Malta and Gibraltar. ROAS remains high and marketing is still seen as a core business driver, making iGaming an attractive sector for ambitious, tech-savvy marketers.

Gareth Mulley

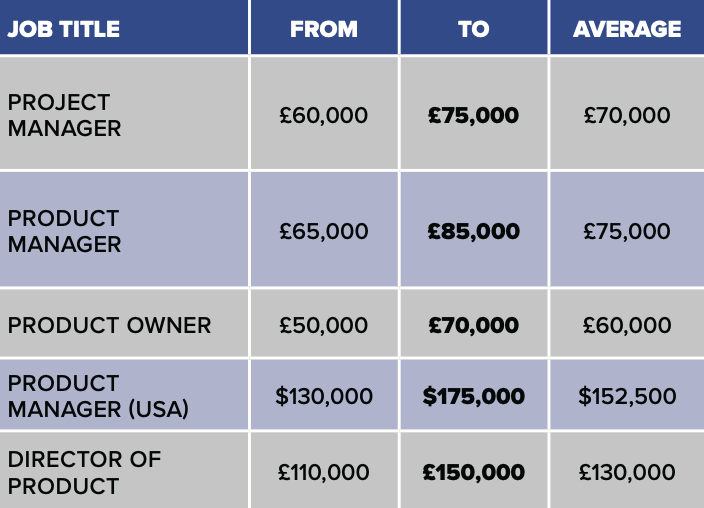

Product and project

Demand remains steady across Product and Project roles, especially at mid-level for Product Owners and Managers.

As businesses pursue innovation, there’s growing interest in candidates from outside iGaming – particularly those with experience in fintech or crypto – who bring fresh ideas and less reliance on legacy approaches. Fully remote roles are still available, but hybrid working (typically 3 days in-office) is becoming the norm.

Salaries remain stable overall, with compensation packages increasingly shaped by flexibility and pace of innovation rather than seniority alone. Employers are moving quickly to secure adaptable, forward-thinking talent in this diverse and evolving field.

Olly Dendy

Sales and account management

Demand remains high for experienced sales professionals with strong networks, particularly in emerging regions like Asia, the Middle East and LatAm.

While Europe has remained stable, restructures have led to an influx of senior commercial talent, creating a competitive landscape at the £120K+ level. Mid-level BDM roles (£60-80K) are still in demand, especially where language skills such as Russian, Portuguese and Spanish are needed.

Hybrid work is common, with remote options still available, especially in startup environments. Industry experience remains non-negotiable, as professionals with pre-existing networks and strong relationships continue to be in high demand.

Karl Harenburg

Technology

Senior tech hiring remains strong across the iGaming sector, with ongoing demand for CTOs, DevOps engineers, cloud specialists and senior developers.

AI-related roles, such as AI automation engineers and Heads of AI, have emerged as a growing niche: often filled by candidates from fintech or neobank backgrounds rather than iGaming. However, AI use in interviews is controversial, with candidates penalised by some companies for using tools during assessments.

Mid-level roles are widely available, with employers open to training the right candidates. Entry-level hiring is quieter, as companies can typically manage early-stage recruitment themselves. Game development continues to drive demand, alongside Java and cloud engineering.

Remote work remains the preferred model, especially in B2B tech, though new studios and offices in Georgia, Dubai, and parts of Eastern Europe are pushing hybrid setups.

Salary expectations are rising for top-tier candidates, and while some employers resist stretching budgets, the competition for specialist tech talent remains fierce.

Chris Gyere

iGB-Pentasia_Salary Survey 2025

The grand finale of the iGB-Pentasia Salary Survey! A full breakdown of gaming industry pay, broken down by seniority and position.