Following its merger with OPAP, Allwyn intends to list on the Athens Stock Exchange as part of its ambitions to become the world’s largest lottery and gaming entity. An investor presentation delivered last week indicates the firm means business. Allwyn, which runs lotteries across Europe, including in the UK, also has a minority stake in Betano and is snapping up PrizePicks and Novibet to further its ambitions.

Led by CEO Robert Chvátal and owned by Czech business magnate Karel Komárek, Allwyn’s net revenue for the year-to-date topped €2.99bn, up 5% year-on-year, with adjusted EBITDA for the nine months to September hitting €1.09bn. Here, EGR takes a look at the key insights gleaned from what was a marathon Capital Markets Day.

The Reeves reprieve

The Autumn Budget dealt a hammer blow to UK-facing operators with remote gaming duty set to be hiked from 21% to 40% from April 2026, before general betting duty leaps from 15% to 25% in April 2027. Chancellor Rachel Reeves’ move has drawn the ire of the industry, with warnings of operator exits, job losses and slashed investment.

However, Allwyn CFO Kenneth Morton painted a brighter picture for the National Lottery operator. It won’t be directly impacted by the tax changes and Morton said its instant win games could benefit from online casino cutbacks and promo restrictions.

He said: “I think there is actually an opportunity for the UK National Lottery from the increase in taxation on some forms of online gaming. One of the fastest growing segments in the UK has been what’s called instant win games, which are essentially e-scratchcards and e-instants.

“I guess you could say that on the very margin there is some kind of overlap between the gameplay and the audience of some forms of online gaming and the audience for online instant win games.

“To the extent that operators are required to reduce payouts because of the increase in tax or reduce bonusing or other promotional activities, that does, all other things being equal, make the National Lottery’s proposition more attractive for us.”

Hockey stick growth

Allwyn’s 36.75% stake in Betano, which it acquired for an initial €50m, is looking like a shrewd piece of business. The Kaizen Gaming-owned brand delivered total revenue of €2.7bn in H2 2025, with post-tax profit coming to €630m. That equates to revenue CAGR of 83% from 2022.

Kaizen Gaming is live in 19 markets, with Betano in 17. The business has more than 2,800 staff, more than 13 million active players and has several major sponsorships in place across the world to push the Betano brand. Allwyn also pointed to the fact the firm has more than 700 software engineers across five tech hubs as a key differentiator.

Still run by CEO George Daskalakis, Allwyn has not indicated its desire to acquire a majority stake as of yet. OPAP, which is now fully owned by Allwyn, did acquire Stoiximan from Kaizen Gaming earlier this year.

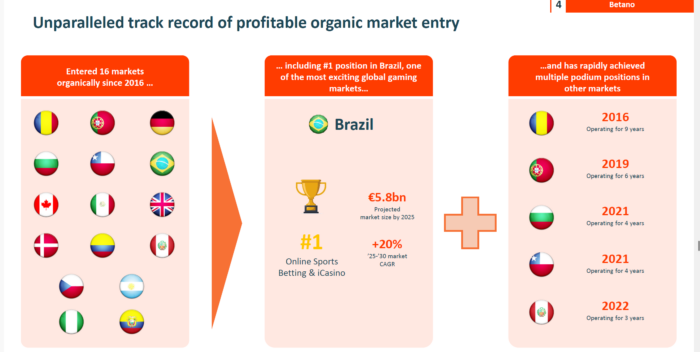

Chvátal said Betano has an “unparalleled track record in the industry” of organically entering new markets over the last five to 10 years profitably and moving forward to achieving leadership or podium positions in short timeframes

“We are excited about the outlook for the Betano business,” he added. “We see the further extension of market leadership and share, as well as profitably entering and scaling in new markets.”

Top pick

In September, Allwyn announced it would take a 62.3% share in PrizePicks for $1.6bn, with a further $1bn in earnouts baked into the deal, giving the business increased exposure in new verticals and the US.

As per the presentation, PrizePicks revenue for the 12 months to June was $863m, while adjusted EBITDA was $339m.

Since then, PrizePicks has partnered with Kalshi and Polymarket to launch prediction markets within its app

On the addition of PrizePicks and its move into prediction markets, Chvátal said: “This is going to be a very important part of the business, not only in the US, but for the overall group.

“The leadership position of PrizePicks is testament to its focus on product innovation and delivering a differentiated customer proposition.

“If you take a look at PrizePicks they are double of the next player which is Underdog. They are the undisputed market leader.”

“This is a fast-moving space, but PrizePicks is extremely well placed to be one of the winners from the development of prediction markets. It launched its prediction markets offering earlier this month.”

Morton added: “We think PrizePicks is in a very good position to be a net beneficiary of incremental business from prediction markets. They are liquidity agnostic, so they have their own deals with both Kalshi and Polymarket and can potentially incorporate other providers as well.”

Greek streak

Allwyn announced it was to acquire a 51% stake in Novibet in December 2024, with the deal scheduled to complete in “early 2026” following regulatory and anti-trust checks. Novibet, which has more than 1,000 employees and boasts proprietary tech, is live in several markets, including Brazil, Greece and Ireland.

When questioned what the backup strategy would be should the authorities not approve the deal, bosses were sanguine on the notion. That is despite the business originally expecting the move to finalise in H2 2025.

Morton said: “We think Novibet will be a very additive business in terms of the operational business and in terms of the sports betting platform.

“We have many other alternatives to develop or acquire that technology ourselves if, for whatever reason, the transaction wasn’t to be approved.”

Chvátal added: “Clearly [Novibet and Betano] and competitors in the Greek market and we respect that. We know from other markets where we as Allwyn as fine with a dual-brand strategy.

“If it would not be possible to extract synergies in the Greek market because they are competitors, then so be it, because the Novibet acquisition has more value than just the Greek market.”

Tech triumph

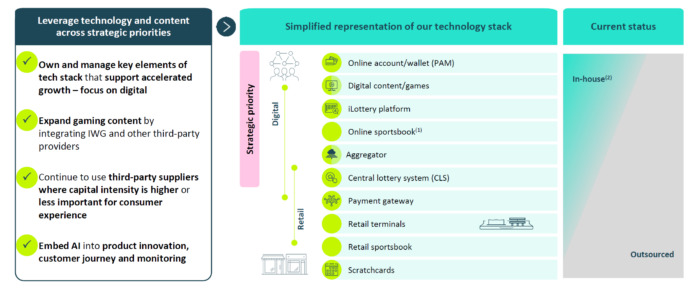

The presentation also featured Allwyn’s commitment to delivering on proprietary tech, with Chvátal stating the business is based on “technology and brand”.

Management noted the tech approach was based on three pillars: Proprietary stack, content and AI. Bosses said the “progressive rollout of proprietary tech [would] enhance key elements of the tech stack and drive competitive advantage”.

On the content front, Allwyn claimed to be exploring “innovative next-gen game concepts”, while AI will be used to deliver personalisation and responsible gambling efforts.

Chvátal said: “Owning these core technologies in each and every gaming vertical gives us control, gives us flexibility and speed, which enables faster innovation and reduces reliance on third parties.

“Across many of these functions, we have in-house capabilities, but currently, we have not rolled these out extensively across all of our markets. It is a strategic priority to do so and we see significant further value creation opportunity as we deliver this

“AI is a key engine of future growth in gaming as well. With even greater scale, we will be able to embrace AI at a much faster pace, a more professional pace, and thus unlocking new categories, delivering advanced personalised gaming experiences and advanced marketing.”

The post Five things we learned from Allwyn’s Capital Markets Day first appeared on EGR Intel.

News editor Joe Levy pulls key takeaways from the lottery and gaming giant’s investor presentation, including potential UK tax benefits and M&A plans

The post Five things we learned from Allwyn’s Capital Markets Day first appeared on EGR Intel.