Entain

3 November closing: 789p

28 November closing:777p

Peak November closing: 789p

Entain was one of several UK-listed gambling businesses to be caught in the maelstrom that followed the Autumn Budget last week, but the Ladbrokes and Coral owner exited November on level ground. As seen across the sector, despite an initial drop in shares following Chancellor Rachel Reeves’ Budget, Entain recovered to close out 26 November at 772.40p. Still some way below the £10 mark reached earlier this year under CEO Stella David, investors were seemingly not too spooked by a hike in remote gaming duty from 21% to 40%.

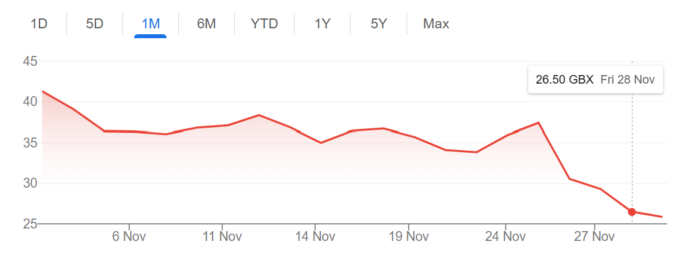

Evoke

3 November closing: 41.3p

28 November closing: 26.5p

Peak November closing: 41.3p

The William Hill, 888 and Mr Green parent company faced the brunt of investor concern following the Budget, with the group’s stock falling to a new low, and its market cap sitting at just £120m. Management have said duty costs will rise by £125m to £135m once all the tax increases are in effect, but 50% of these costs could be mitigated. Shop closures, reduced spend on marketing and customer proposition changes have all been floated as potential levers to pull. CEO Per Widerström said the government had “chosen not to listen” by implementing the new rates. “It is clear these changes will significantly harm businesses, employees and customers,” he added.

Rank Group

3 November closing: 118p

28 November closing: 118p

Peak November closing: 106p

Machine games duty being retained at 20% was a big win for Rank Group and its land-based empire during last week’s Budget. So much so, the business’ shares shot up to a monthly high of 118p, despite its online exposure. The Grosvenor and Mecca parent was also boosted by the abolition of the 10% bingo duty. A £40m cost to operating profit pre-mitigation has been communicated by management. Still, Rank’s share price over the past 12 months is up by a fifth.

Playtech

3 November closing: 255.5p

28 November closing: 283p

Peak November closing: 283p

The FTSE 250 supplier said it expects group adjusted EBITDA in 2026 to be hit to the tune of “high-teens millions of euros” pre-mitigation as a result of the UK tax hikes. The warning preceded a jump in the business’ share price, which is inching back to levels in October before the Evolution disclosure. Bosses added they were confident Playtech would “meet market expectations for the full-year 2026” despite the hikes. In other Playtech news, EGR revealed the firm is working with News UK to reintroduced Sun Bets in the UK next year.

DraftKings

3 November closing: $30.57

28 November closing: $33.16

Peak November closing: $33.16

DraftKings’ share price recovered towards the end of November, as investor sentiment around the Boston-based business improved. The impending launch of DraftKings Predictions has drummed up interest. A lift in the firm’s stock came as the Q3 earnings report was released, but headlines focused on the sports event contracts rather than financial performance. Both DraftKings and Flutter have seen market caps shrink as the prediction market boom rumbled on during the NFL season. The hope is that brand and tech will push DraftKings out in front above upstarts Kalshi and Robinhood.

The post Stocks Tracker: Budget delivers blows and booms first appeared on EGR Intel.

EGR analyses the share price movements of major industry players in November, including evoke, Entain and Rank Group

The post Stocks Tracker: Budget delivers blows and booms first appeared on EGR Intel.