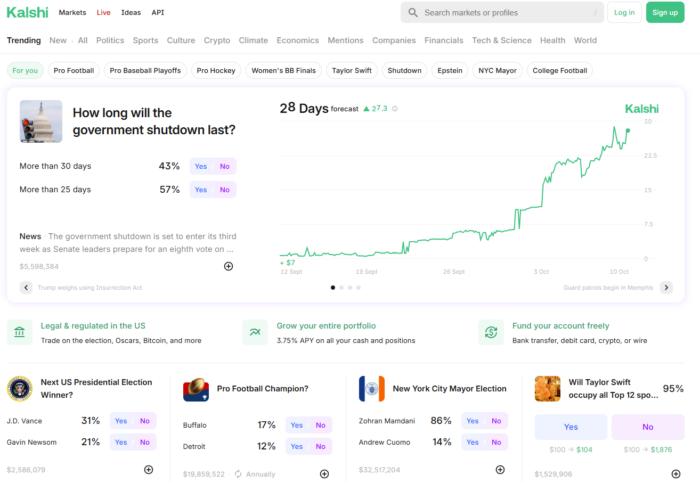

US prediction market Kalshi has announced that it is available in more than 140 countries through a single liquidity pool.

Confirming the news on X and LinkedIn, CEO and co-founder Tarek Mansour stated, “Kalshi goes global”, while revealing that the prediction market had recently raised $300m (£225m), valuing the business at $5bn.

He added: “Since then, we’ve grown over 3x, hit $50bn of annualised volume and became the largest prediction market in the world.”

News of Kalshi being available in 140+ markets sparked excitement on social media and led to an immediate 5% drop in DraftKings’ share price.

The platform is not yet available in the UK, Australia, France or Canada, but the world’s two most-populous countries, India and China, are not on the banned list – nor is most of Latam, including Brazil.

The Series D funding round was led by Sequoia Capital and a16z Capital Management. It also included funding from the likes of Paradigm, Coinbase Ventures and General Catalyst.

American comedian and actor Kevin Hart and basketball star Kevin Durant also participated in the raise, according to Mansour.

VC firm a16z Capital Management wrote on X: “Prediction markets have established themselves not only as a new asset class, but as an extremely useful tool for predicting the future. And Kalshi is the leading company in the space.

“Not only does it have more volume than every other prediction market combined, but it’s the fastest growing tech company in the world outside AI.

“Kalshi also announced today that they’ve expanded globally to 140 countries, making them the world’s only unified global prediction market.”

Flurry of investments

There has been a flurry of investments in the prediction market space of late, with Kalshi announcing in June a $185m Series C raise that valued the company at the time at $2bn.

Meanwhile, Polymarket – a decentralised prediction market running on the Polygon blockchain – announced a $2bn investment earlier this week from NYSE’s owner, Intercontinental Exchange.

Confirmation of the deal, which valued Polymarket at around $8bn, triggered a sharp sell-off in FanDuel parent company Flutter Entertainment and DraftKings stock, with both New York-listed firms ending the day down 3.7% and 5.8%, respectively.

Almost $7bn was recently wiped off the value of Flutter and DraftKings when fellow prediction market Kalshi rolled out same game parlays for the NFL.

In July, New York-headquartered Polymarket accelerated its return to the US by snapping up exchange QXC and clearing house QC in a deal worth $112m.

Meanwhile, DFS operator Underdog plans to enter the increasingly crowded prediction markets space after striking a deal last month with crypto exchange Crypto.com, while FanDuel is to expand into financial future markets via a joint venture with CMG Group, operator of the Chicago Mercantile Exchange.

Following news of Kalshi’s expansion, Pet Berisha, creator of Sporting Crypto newsletter, questioned if countries would look to block the platform.

Taking to LinkedIn, he wrote: “Kalshi’s legal bills must be huge. They are constantly fighting, suing and being sued by states in the US.

“Expanding to 140 countries is going to open 140 cans of worms. It will be interesting to see how many countries of those 140 geolock Kalshi over the next six months.”

The post Kalshi raises $300m and expands platform to more than 140 countries first appeared on EGR Intel.

Founder of prediction platform reveals news of major overseas expansion on socials and how latest funding round values the New York-based company at $5bn

The post Kalshi raises $300m and expands platform to more than 140 countries first appeared on EGR Intel.