DraftKings and Flutter Entertainment saw almost $7bn collectively wiped off their valuations in trading yesterday, with investors spooked by prediction markets continuing to make waves in the US.

DraftKings stock slumped 11.6% to $37.40 (£27.78), in the process reducing the Boston-based firm’s market cap by $2bn.

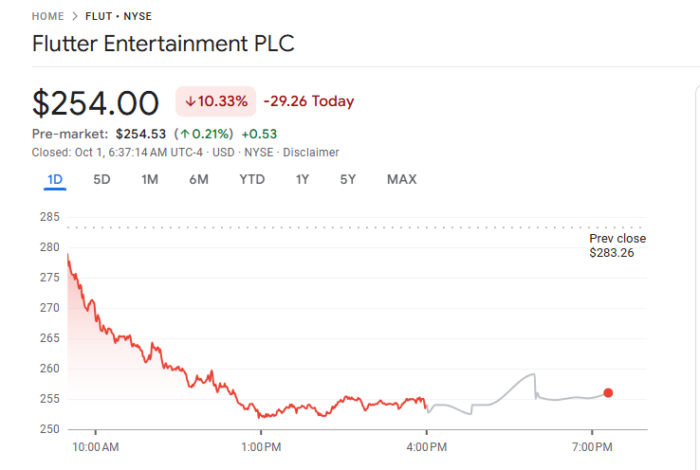

FanDuel parent company Flutter was down more than 10%, equating to a $5bn market cap decline, to $254.

The sell-off came as Kalshi announced a record weekend of NFL volumes, with $260m on Saturday and $275m on Sunday, while quietly rolling out same game parlays on Monday night.

The bet builder product debuted ahead of the Monday Night Football slate of the Miami Dolphins versus the New York Jets and the Cincinnati Bengals versus the Denver Broncos.

While it was launched without fanfare, the product allows users to pick a game winner, player to score a touchdown and total points.

On the stock sell-off, Citizens’ analyst Jordan Bender did state in an analyst note yesterday that DraftKings and Flutter shares tend to dip on Mondays post-NFL.

Bender wrote: “Volume for sports contracts is hitting all-time highs. Kalshi launched its first-ever sports betting combo (parlays) product last night and Robinhood prediction volumes were impressive, all contributing to the decline in online gaming shares.

“There appears to be a theme developing with trading on Monday after an NFL weekend, whereby stocks of the two major sports betting companies, DraftKings and FanDuel, sell off regardless of game outcomes over the weekend.”

Speaking to Bloomberg, Robinhood vice-president and general manager of futures and international JB Mackenzie said the company was looking at launching prediction markets outside of the US.

Posting on X, Robinhood CEO Vladimir Tenev said there was more than two billion event contracts traded during Q3, with more than four billion having been traded since the firm added the product earlier this year.

Mackenzie said Robinhood had been speaking to the Financial Conduct Authority in the UK to explore how prediction markets could be regulated in the market.

He added: “Right here in the United States, this is a federally regulated CFTC product. What we’d have to figure out is what does that mean? Whether it’s in the UK or if it was in the EU or so forth, why are they designated in such a way? And then what’s the regulatory rules for it

“We’re definitely looking to offer it globally, and my goal or focus is to make sure it’s a regulatory-compliant product everywhere we go.”

Robinhood uses Kalshi’s markets to deliver the product to its userbase.

In other prediction markets news, Brian Quintenz has had his nomination to chair the CFTC withdrawn by the White House.

Quintenz had long been the frontrunner for the chairmanship, but his ascension to the position has been consistently and repeatedly pushed back and delayed.

As per news site Politico, the Kalshi board member has is now out of the running. Three potential options have been flagged, including Milbank LLP partner Josh Sterling.

Sterling represents Kalshi in court cases, while Milbank is representing DFS+ firm Sleeper in its case against the CFTC.

The CFTC also released a note this week warning that sports event contracts have yet to be formally evaluated by the agency.

“The Commission has not, to date, been requested to take or taken any official action to approve the listing for trading of sports-related event contracts on any DCM [Designated Contract Market],” the statement read.

Reports from news outlet Front Office Sports this week also linked sweepstakes sports betting exchange Novig as an acquisition target for Kalshi and Polymarket.

The post Flutter and DraftKings shares slump after Kalshi debuts SGPs first appeared on EGR Intel.

A combined $7bn wiped off the value of the US market leaders on Monday in New York as NFL trading volumes with Kalshi and Robinhood hit record levels

The post Flutter and DraftKings shares slump after Kalshi debuts SGPs first appeared on EGR Intel.