Bet99 CEO Jared Beber seems excited summer has come to an end. While the nights are drawing in, temperatures starting to dip and suntans fading, September marks the return of the North American sporting calendar Beber and his team are relishing. As well as the NFL, there is also the NBA and NHL, the latter of which is lapped up by Bet99’s customer base.

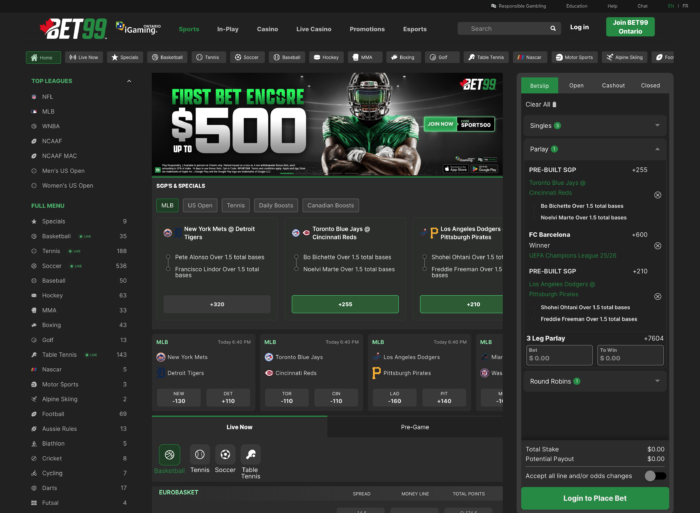

The operator positions itself as a “proudly Canadian” brand. It is live in the regulated Ontario market, as well as the rest of Canada. Privately owned, the business has tended to stay out of the spotlight. A planned merger with King’s Entertainment Group in 2022 sparked trade media headlines, yet the transaction ultimately fell through, leaving Beber and Bet99 focused on ploughing ahead. King’s Entertainment Group, which owned LottoKings and WinTrillions, has since sold those assets and wound down all operations.

Bet99’s blueprint is based on localisation. Beber takes aim at those companies he views as being complicit in “maple washing” – essentially slapping Canadian motifs and symbols onto a platform to come across as an authentic homegrown operator. Localisation, he explains, underpins the entire ethos and approach from the operator. Bet99 has sponsorship deals with the NHL, Canadian MMA legend Georges St-Pierre and semi-pro Ontario-based football club Simcoe County Rovers, which Beber says gives credence to the company’s claim it is a champion of Canada.

With Ontario now in its fourth year as a live regulated market, and Alberta due to follow in early 2026, Beber is adamant the transition from grey to white across the nation is a positive. He is hopeful that other provinces will follow the lead of Ontario and Alberta, and deliver a system that works for all stakeholders and consumers.

“Players deserve the same choice and protections and entertainment options that Ontarians can currently enjoy,” he states. And Beber insists Bet99 will be at the front of the queue to deliver.

EGR: Tell us about the origins of Bet99.

Jared Beber (JB): The whole genesis was based on the idea there was going to be some sort of federal legislation coming down the pipeline in Ontario. There had been a grey market [in Ontario] that existed for 30+ years, so there was going to be a large influx of competitors into this space. These were going to be European or US behemoths who would put a country manager in place and execute their US playbook.

Viewing Ontario as one large state doesn’t work; Canada is a cultural mosaic. Whether you’re looking at [Ontario’s] downtown Toronto or Sault Ste Marie, Sudbury or even Brampton, there are so many different pockets in which fundamental cultural nuances exist. It was about showing up as that local option. We didn’t create localisation, but we do understand those cultural nuances, and we felt we would be in a position to tailor our product, service and content as that local option.

The analogy I always give is [Toronto-headquartered retailer] Canadian Tire would have no shot at making it in the US, but their focus on hyper-localisation and grassroots has really allowed them to flourish in Canada. The genesis of Bet99 was about establishing a brand that played into that ‘local hero’ option.

EGR: Given the business was founded in 2020 during Covid-19 and is still remote-first, what has this meant for Bet99?

JB: There are, of course, pain points to being 100% remote, but we’ve overcome them. I would say the benefits are significantly greater than those pain points. What we can do is tap into a much broader talent pool. There is amazing talent that exists all over Ontario, for whom it may not be feasible to commute hours each day to be at some office in downtown Toronto.

Being remote has allowed us to tap into a pool of talent that’s vast, extremely knowledgeable and passionate. We’ve been able to implement a digital culture that mimics being in the office. That creates that internal community and camaraderie, but ultimately, is done remotely. It’s been an interesting journey, but it’s been fantastic.

EGR: You became CEO in March 2022, having previously served as COO and CFO. What is your blueprint for Bet99?

JB: The blueprint from the start revolved around the localisation play. We have evolved by building something greater than just a betting app. The igaming space is no longer just about apps – it’s about building ecosystems. Players want platforms that bring together sports, casino, content and community in one place. We position Bet99 as this one-stop shop for entertainment. We’re not simply in the business of online betting and gaming; we’re building this community through entertainment.

We view this as a lifestyle flywheel. The premise of a lifestyle company is you’re not necessarily buying the product – you’re buying what it represents. It’s a feeling. It’s being a part of the culture. Gaming sits at the centre of it all, but it’s not about how much you bet. You don’t need to wager a single dollar to engage – whether you’re consuming our content, joining our digital community, attending one of our events or tournaments, wearing our merchandise, or connecting with fans. We want Ontarians to feel part of something bigger.

For those who do choose to wager, we have a world-class product. We say it’s ‘Vegas in your hand and Canada in your heart’. It’s a holistic entertainment ecosystem that fits into the bigger picture of a lifestyle company. And people can engage in any part of this ecosystem.

EGR: How is Bet99 performing in the province of Ontario?

JB: Anyone who looks at Ontario’s results can see it’s staggering how large this market is, and obviously there is room for different players to carve their respective niches. Even smaller market shares can build strong, large profitable companies. I believe, from a brand positioning standpoint, we’ve done a really good job at solidifying what we are. We have invested heavily and done a good job at building our brand.

We are growing very well in the face of massive competition within Ontario, where we are absolutely stealing market share at a rapid pace. However, we haven’t even scratched the surface of what we believe our true potential to be. I really think we’re in a unique position to fly right now. That comes back to servicing the customer and delivering something that is distinctly Canadian, not the maple-washing that some companies do.

EGR: Are there any internal targets you have set in what is Canada’s most populous province?

JB: Many public companies – and this is why we are very happy to remain private – are often short-sighted in terms of their ability to execute their vision because they have to hit certain arbitrary targets to appease financial analysts who may not necessarily understand what they’re building. We get to take a more long-term approach.

We get to consider our vision, and we don’t necessarily need to make short-term moves that are not going to be aligned with our long-term vision but might help drive profitability in that particular quarter. I’m not shy in saying we have every intention of being a podium player within Ontario and the rest of the Canadian market, as those provinces open, and we believe we have the strategy to support that.

We believe we have the brand perfectly positioned to do it. From our partnerships with the NHL to grassroots, we’re putting our money where our mouth is and showing up to service Canadian customers in the way they deserve.

EGR: Staying with Ontario, many licensees have sung the praises of this multi-vertical (sports, casino, poker) regulated market since its launch in April 2022. Do you also view it favourably, and is there anything you’d change?

JB: Not to repeat what other people have probably already said to you, but I think Ontario has set the gold standard for regulated markets in North America. Is any system perfect? No. But is there a willingness on all sides to have active engagement and collaboration, to continue to refine and improve? That has always been the case here.

Any province is going to have a different set of ‘whys’ when it comes to regulation. Is the ‘why’ to maximise taxation revenue? Is it consumer protection? Is it control from a marketing standpoint? Is it channelisation? Whatever the why is, the standards will be tweaked accordingly to address that outcome.

One thing I think is unbelievably impressive about what Ontario has done is they have guardrails, but they’ve been able to channelise close to 90% of the grey market that existed for 30 years prior. In the face of all of this, the [province-owned lottery operator] OLG has grown and continues to grow.

The idea that one provincial lottery is going to be able to appease and satisfy the preferences of every single unique Canadian that exists is not going to happen. As a result, there will never be 90%+ channelisation where there’s only one operator present. This has become abundantly clear in Ontario where OLG and private operators have thrived.

We all operate under a framework that the [regulators] AGCO and iGaming Ontario have set out for us. They’ve created a competitive, well-regulated market that protects players, that’s driving growth and creating jobs, and they’ve created an environment where the government and industry can win together – and the customer wins, too.

EGR: In April 2025, Ontario gross gaming revenue (GGR) hit C$313.3m, representing a 613% increase on April 2022, the market’s first month of operation. Did you ever think the province would be in this position in terms of numbers?

JB: It’s staggering. We knew the market was large in Ontario, but it is staggering how much it continues to grow. I think this growth is sustainable and will continue. Did I expect it to be a smooth process? Yeah. It was a great process all the way through. Did I expect the market to grow at this rate and consistently quarter over quarter, month over month? No, not to this extent. My initial expectation in terms of the market size, which was already significant, are going to be shattered in a much quicker timeframe.

EGR: Alberta is due to follow Ontario’s lead next year and transition to a regulated commercial market. What was your involvement as a stakeholder, and do you expect authorities there to use Ontario as the template?

JB: They’re still figuring out exactly what it is going to look like. What I’m hearing is there will be a similar entity to iGaming Ontario. I believe it will be iGaming Alberta. One thing they’ve made clear, though, is they want to ensure there’s a centralised self-exclusion scheme in place from the outset.

I have tremendous respect for their approach – to be willing to engage directly with industry stakeholders and operators in advance of the launch, because this is going to is eliminate future headaches. They’re going to foster the right amount of competition. They’re going to ensure there’s the right level of player protection and will be facilitating responsible growth from day one.

EGR: Which provinces do you think could regulate next?

JB: All provinces need more money. To turn a blind eye to the grey market is not going to address the issue. It goes back to the why. Kudos to Ontario for setting the precedent. I think Alberta now shows a clear pattern and I expect the province to be a success, just like Ontario. What I am hopeful is that on the back of Alberta, the benefits continue to become undeniable and, slowly but surely, we have more provinces following suit. We all want to be a part of the process to give feedback.

EGR: We’ve spoken about localisation, but French-speaking Québec would be another challenge in itself?

JB: Québec has a very strong gaming culture. They have an unbelievably deep sense of identity and passion for sports. These are some of the most passionate sports fans that exist. While those nuances are very different, you know how you’re going to service a Québec player versus an Ontario player. We believe those players deserve the same choice, protections and entertainment options that Ontarians can currently enjoy.

EGR: You mentioned the need for a “world-class” product. How is Bet99 delivering on that?

JB: We’ve built the product around three pillars: seamless navigation, deep personalisation and trust. From a sportsbook standpoint, the key is to be able to personalise. Players want to engage with their respective sports by telling their own stories. On the casino side, it’s not just necessarily about having the biggest library; it’s making sure it’s an engaging experience, whether it’s themed activations, exclusive releases, loyalty mechanics or leaderboards.

Most people are consuming this via mobile, so making sure it’s optimised is key. The core of personalisation is data and how we can leverage it to make better decisions, to better understand customers behaviours, to better interject if there are issues from a responsible gambling standpoint and provide them with a holistic experience.

On the customer-facing side, there is the data-driven personalisation. AI-driven optimisation tools can better understand player behaviour to fine-tune our product. These improvements will impact everything from onboarding to payment processing to customer service. We work closely with Amelco. They’ve been great partners and we innovate alongside them.

EGR: Is international expansion a potential option? And if so, where?

JB: We have a lot more to do here, and there’s tremendous room for growth. Our priority will be to continue to build and take market share in Ontario. That said, we do see international expansion as a natural next step. Executing a similar playbook to what we have built here and replicating that in other markets is something intriguing to us.

We keep all doors open. We don’t want to tip off our competitors of course, but we feel very confident in replicating what we’ve done here in other markets. And that does not just include US markets; it’s a large world out there.

EGR: Is there any appetite to revisit M&A following the Kings Entertainment process failing to come to fruition?

JB: We’re open and opportunistic. Any partnership, acquisition or collaboration needs to fit our vision. It needs to strengthen our ecosystem and add clear value for players. I’m an accountant by trade and spent a lot of years in M&A, so I’ve seen many acquisitions fail because there was not enough due diligence done on the actual synergies.

How do these [companies] fit together? How do they support each other? How do they create value? And how are they integrated? If you make a misstep, it can occupy a lot of time and create a lot of headaches. We are open and opportunistic, but we also don’t want to get distracted. We approach everything cautiously optimistic but are always open to having conversations.

EGR: You’ve spoken about the benefits of being private. Is there an aspiration to go public in the future?

JB: We’re definitely proudly private. Anything is possible, right? We have numerous stakeholders and shareholders. People make investments because they expect a return, and we are very committed to ensuring any investment yields great benefit for them.

Being a private company allows us to execute with a long-term mindset. Living quarter to quarter and being reactive to how the market perceives your results, while they may have no idea of the bigger picture, is disruptive. There are numerous benefits of being a public company, don’t get me wrong, but from our current perspective, the benefits of being a private company significantly outweigh those of being a public company.

The post Homegrown hero: how domestic operator Bet99 resonates with Canadians first appeared on EGR Intel.

While the battlefield of US igaming has become a duopoly, with FanDuel and DraftKings hoovering up much of the market, there’s a different story north of the border. The regulated Ontario market and grey provinces that make up the rest of the Great White North are fertile ground for challengers. As Bet99 CEO Jared Beber tells EGR, this “proudly Canadian” operator understands that better than most

The post Homegrown hero: how domestic operator Bet99 resonates with Canadians first appeared on EGR Intel.