This report analyses player behaviour across the US, Europe and Latam regions, drawing from a dataset of over 3.2 million active players per region, per month. It focuses on five key metrics: average deposit amount, average casino and sports betting amounts, average days active and active retention rate.

US

The US remains a high-value market, though August reflected seasonal cooling. The number of sports bettors rose 17% year on year (YoY), but betting amounts declined by 2.3%. Casino spending per user fell 13.3% YoY, though the number of bettors rose 24%. Retention improved to 70%, matching the global average for the first time this year.

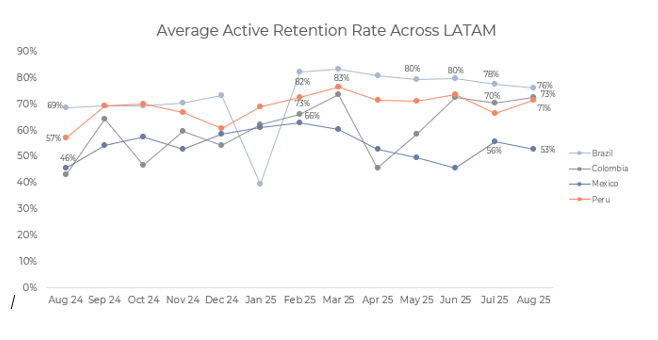

Latam

Latam markets continue to mature, showing more stable and consistent player behaviour. Brazil maintained high engagement (12.1 days versus 7.6 global) and strong retention (76%), supported by regulatory reforms introduced earlier this year. While betting amounts in Brazil remained modest, consistent user activity and loyalty point to a strengthening player base.

Mexico led in deposits and sports betting amounts, while Peru continued to dominate in casino. Colombia showed broad-based improvement across most KPIs, reflecting early signs of recovery – though casino spend dipped. Overall, the region reflects a shift from early 2025 volatility toward a more regulated, predictable environment.

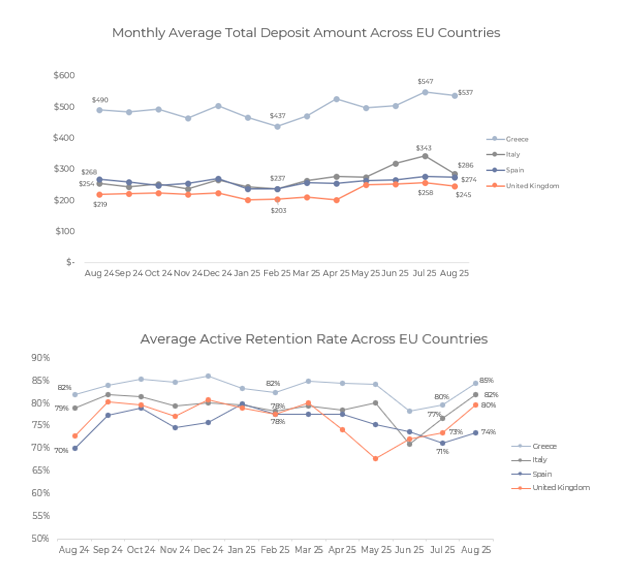

Europe

Greece leads in deposits, sports betting and retention (85%), and continues to perform strongly across the board. Spain remains competitive in casino activity, mirroring Greece’s trend. In sports betting, both Greece and Spain showed an increase in August, while Italy and the UK experienced a slight decline – a shift that may reflect seasonal patterns or evolving regulatory impacts. The UK shows stable performance overall, aside from this dip in sports betting, possibly reflecting ongoing regulatory adaptation.

Overall

Global trends continue to highlight how regulation, user behaviour and seasonal shifts are shaping igaming markets. In the US, sports and casino betting amounts declined slightly in August, but strong user growth and improved retention (up to 70%) signal resilience ahead of peak season, as historically seen during the return of major leagues like the NFL.

In Latam, Mexico leads in deposits and sports betting, while Brazil maintains the highest engagement and retention, driven by maturing regulatory impact.

In the EU, Greece stands out with top deposit levels, sports activity and the highest retention rate, while the UK remains stable across most KPIs, aside from a slight drop in sports betting. Across all regions, the data points to a move toward more consistent and loyal user bases, with regulation playing a key role in driving stability and long-term value creation.

Methodology

The global trend report is based on bets across the US, EU and Latam. For each region we analysed at least 3.2 million active players on average per month per region from August 2024 to August 2025.

Countries/jurisdictions analysed by region:

- Europe – Greece, Italy, UK, Spain

- Latam: Brazil, Colombia, Mexico, Peru

- US: In casino, a focus on the seven states where casino gambling is legal New Jersey, Delaware, Pennsylvania, Michigan, West Virginia, Connecticut and Rhode Island. This compares to online sportsbooks where 39 states plus DC and Puerto Rico have legalised sports betting in some form, including retail (in-person) sportsbooks.

For each region we measured trends for average deposit amount, average casino betting amount, average sports betting amount, average number of days players are active and average active retention rate.

Detailed highlighted trends by region:

US – high spend persists, but growth momentum slows amid seasonal lull

The US market continues to demonstrate strong player value, but August reflected signs of seasonal slowdown across key metrics. With major sporting events like the NFL and NBA still in offseason, sports betting activity remained soft.

Although the number of sports bettors rose 17% YoY, the average monthly betting amount declined slightly, from $1,013 in August 2024 to $990 in August 2025, or a 2.3% drop. This suggests a solid player base but with reduced per-user activity during the seasonal lull.

Casino betting followed a similar pattern: while the number of active casino players climbed 24% YoY, well above global growth, the average bet amount per player dropped 13.3%, from $8,691 to $7,531. This points to sustained user interest in the casino vertical but tempered individual spending.

On the engagement and retention front, August brought positive momentum. US retention jumped to 70%, aligning with the global average for the first time in 2025. However, engagement remained lower: US players averaged 7.1 active days in August versus 8.6 globally, a 21% gap that has persisted throughout the year.

Overall, the US remains a high-value market characterised by strong acquisition and spend, but recent data highlights a dip in per-user betting activity. Encouraging improvements in retention, alongside growth in player volume, set the stage for potential reacceleration as the core sports season approaches.

The sport bettors growth trend: calculated by dividing the total number of sport bettors each month by the number of sport bettors in August 2024, which serves as the baseline (100%).

Latam – sustained momentum driven by engagement and regulatory maturity

In Latam, August data reinforces the region’s continued shift toward greater stability and maturity. Brazil remains the market leader in player engagement and retention, with consistently high activity levels and a loyal core user base. While both metrics dipped slightly from July, they remain the strongest across the region.

Markets like Mexico and Colombia showed renewed momentum. Mexico continued to lead in deposits and sports betting, while Colombia advanced gradually, showing modest but steady improvements in both engagement and retention. Peru stood out in casino performance – consistently leading in betting amounts and showed average sports betting levels, closely aligned with Brazil.

These trends reflect a regional evolution: from early 2025 volatility to more consistent user behaviour, driven by regulatory progress and improving fundamentals. As Latam markets deepen engagement and strengthen player loyalty, the foundation is being laid for long-term, sustainable growth.

Definition of average activity days: the average number of activity days is the total number of activity days divided by the number of bettors who have at least one activity day.

Europe – UK’s regulatory environment supports stability, with signs of gradual improvement

The UK market continues to show gradual signs of stabilisation in the wake of recent regulatory changes. While August saw a slight dip in deposit amounts and a decline in sports betting, there was a modest increase in casino betting, and activity levels remained stable.

Most notably, retention improved to 80%, reflecting a strengthening core player base despite mixed trends in spending. These patterns suggest that while the market still trails others in volume, regulatory maturity is helping build a more loyal and consistent user base over time.

Across the region, Greece maintains its leadership, showing strength in both deposits and sports betting, while retaining the highest customer retention rate at 85%.

Spain continues to excel in casino betting, closely tracking or even surpassing Greece in some metrics. After slight declines in engagement and retention earlier in the quarter, both indicators began to rebound in August, suggesting renewed user momentum.

Italy experienced a decline across all spend-related metrics, including deposits, casino betting and sports betting, yet it saw a notable increase in retention, signaling improved user loyalty despite reduced spending.

Taken together, these country-level trends highlight the importance of market-specific strategies tailored to each region’s unique strengths and challenges, enabling operators to align growth efforts with evolving player behaviours across the European landscape.

Definition of average deposit amount: the average deposit amount is calculated by taking the total sum of all deposits and dividing it by the number of sports and casino bettors (players) who have made at least one deposit.

The post Optimove Insights: How regulation, user behaviour and seasonal shifts shape markets first appeared on EGR Intel.

Marketing research analyst Oren Elias analyses and compares KPIs from across the US, Europe and Latam to see how each region stacks up

The post Optimove Insights: How regulation, user behaviour and seasonal shifts shape markets first appeared on EGR Intel.