Polymarket offers a series of markets on its site that allow users to predict military action in Ukraine and Israel, and could face sanctions under US laws.

The platform is preparing to officially relaunch in the US after being cleared for entry by the Commodity Futures Trading Commission (CFTC).

However, the Commodity Exchange Act (CEA), which serves as the rulebook for CFTC-licensed companies, prohibits contracts involving war.

A key provision in the CEA, added as part of the Dodd-Frank Act in 2010, states that, “The Commission shall determine that any agreement, contract, or transaction that involves…

(I) activity that is unlawful under any Federal or State law;

(II) terrorism;

(III) assassination;

(IV) war;

(V) gaming; or

(VI) other similar activity,

is contrary to the public interest and shall not be listed or made available for clearing or trading.”

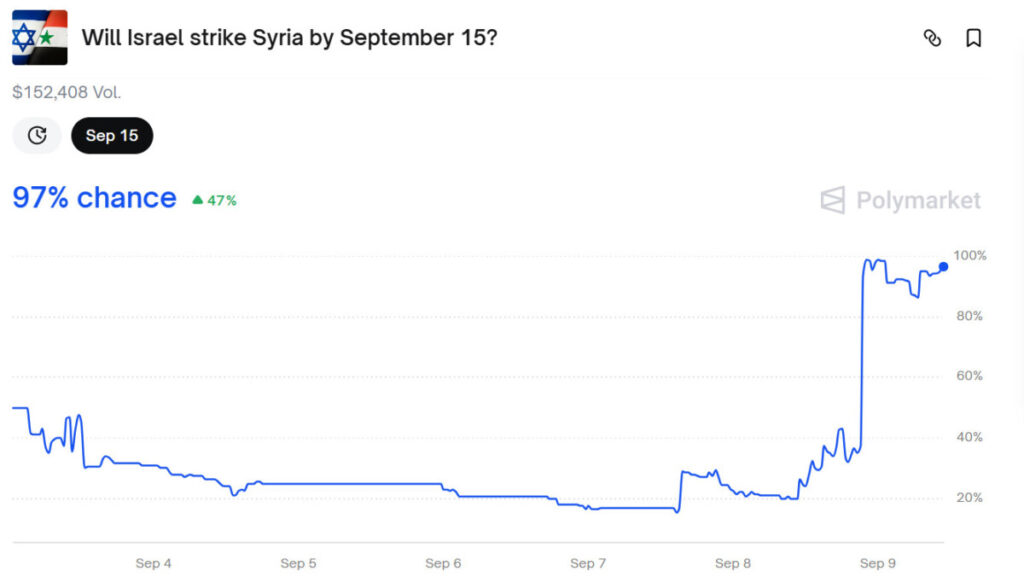

Polymarket’s site has several markets on the war in Israel, such as “Will Israel strike Syria by September 15?”

Other markets allow users to predict an Israeli strike on Yemen and a Houthi strike on Israel, among others.

The markets have already raised suspicions of insider trading. It was noted that some accounts were opened, traded on Israeli strikes hours before they occurred, cashed out, and then disappeared.

Ukraine Conflict Open for Trading, Germany Warns Users

In addition to the markets on wars in the Middle East, the site also allows users to trade on the conflict in Ukraine.

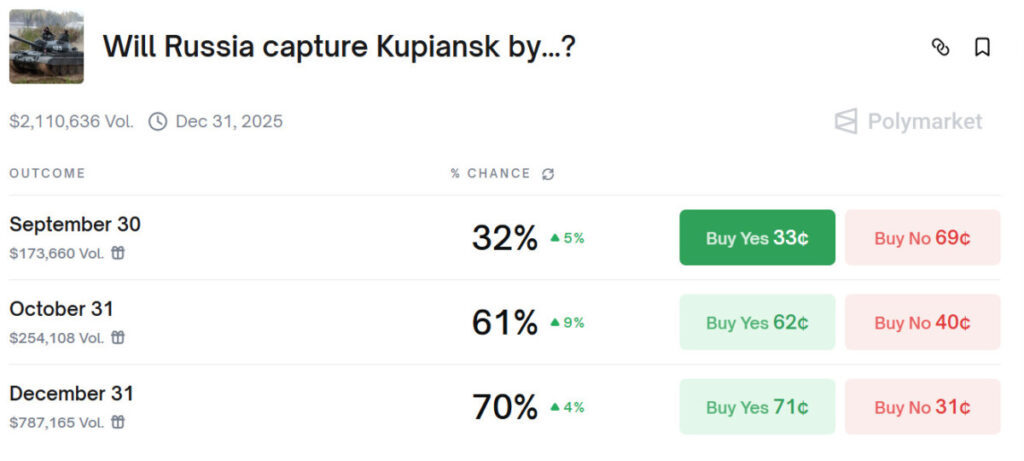

For example, the market titled “Will Russia capture Kupiansk by…?” has seen over $2 million traded.

This week, Germany’s gambling regulator warned residents about participating in Polymarket’s markets on the conflict in Ukraine.

On its website, it states, “The Joint Gambling Authority of the German States (GGL) strongly warns against participating in so-called social betting.”

It goes on to define social betting as “events in public or social life, such as political elections, court rulings, natural disasters, social events, or other non-sporting developments.”

It adds that these markets “offered on the Polymarket platform, are not permitted under current German law and are therefore illegal.”

War Trading Opposed by Regulators

The GGL states that it prohibits trading on war and other social events as the markets “are particularly susceptible to manipulation because they are often based on unclear, subjective, or influenceable events.”

As has been seen with markets on the conflict involving Israel, it may be possible for those with inside information to trade on outcomes.

Additionally, trading on such events has been discouraged by the CFTC. A statement in 2012 noted: “The Commission considers agreements, contracts, or transactions involving war, terrorism, or assassination as contrary to the public interest. Such contracts could incentivize harmful behavior and are inherently unsuitable for trading.”

State regulators in the US have taken a similar stance and explicitly prohibit betting companies from offering markets on war. The New Jersey Division of Gaming Enforcement (NJDGE) states: “Betting on matters of national security or war is prohibited. Offering wagers on such matters is considered against public policy and not licensable.”

While sports prediction markets face their own legal challenges, since the 2018 PASPA ruling, it is socially acceptable to bet on sports. Trading on war brings up a host of other issues.

Kalshi Markets More Acceptable; Will Polymarket Step Back?

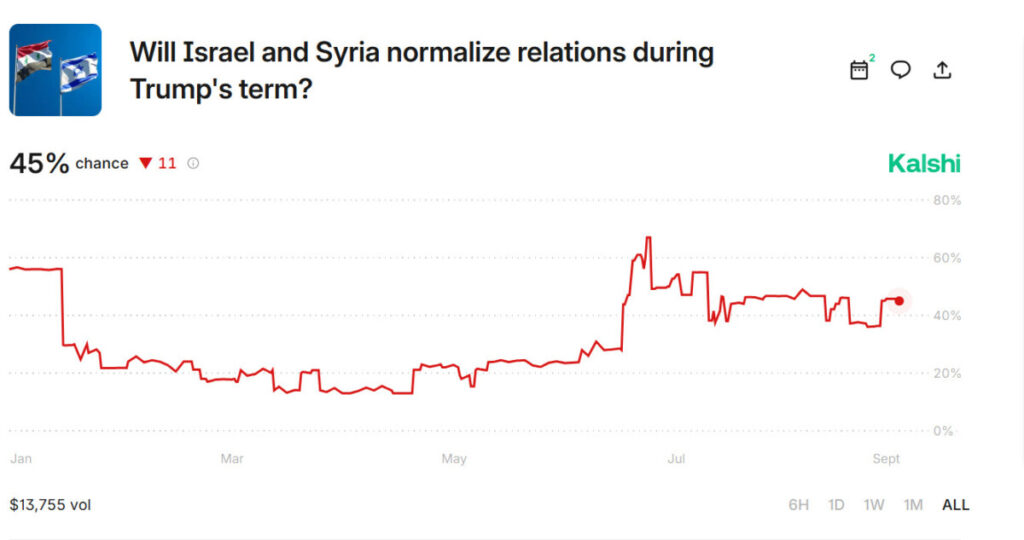

Kalshi also offers some markets on Israel and Ukraine, but draws the line at predicting military strikes. Its markets include “Will Israel and Syria normalize relations during Trump’s term?” and markets on whether Ukraine will hold an election or join NATO.

The volume traded on this market pales in comparison to the market predicting Russia’s military success on Polymarket. The platform must decide on whether to scale back its controversial markets as it re-enters the US.

Founder and CEO Shayne Coplan had his home raided by the FBI last year over allegations that the platform continued to accept US users. On the raid, Coplan recently posted on X: “While traumatic, it etched the story of Polymarket’s accuracy, and the ensuing resistance, into the history of American politics.”

The investigation by the FBI, in conjunction with the CFTC, ended with no charges brought in July. This has paved the way for the company’s re-entry into the country.

The platform has also made partnerships with those in powerful places, signing a deal with Elon Musk and xAI, as well as making Donald Trump Jr. a strategic advisor. On the imminent relaunch in the US, Coplan said: “I’ve waited a long time to say this: Polymarket is coming home.”

Whether it can stay home or not remains to be seen.

The post Polymarket War Markets Could Lead to Increased Conflict as Platform Relaunches in US appeared first on CasinoBeats.

Polymarket offers a series of markets on its site that allow users to predict military action in Ukraine and Israel, and could face sanctions under US laws. The platform is preparing to officially relaunch in the US after being cleared for entry by the Commodity Futures Trading Commission (CFTC). However, the Commodity Exchange Act (CEA),

The post Polymarket War Markets Could Lead to Increased Conflict as Platform Relaunches in US appeared first on CasinoBeats.