Stocks Tracker: Talk of tax hikes spark share slumps

Entain

1 August closing: 1,005p

29 August closing: 878p

Peak August closing: 1,014p

The standout from Entain’s busy August came in the form of strong H1 2025 results, which included NGR of £2.6bn, marking a 3% rise on a reported basis when pitted against the first six months of 2024.

That positive display was inspired by an “outperformance” of the group’s UK and Ireland (UKI) arm, while company-wide underlying EBITDA ticked up by 11% to £583.4m, alongside a rise in underlying operating profit, which surged 52% to £437.6m.

However, despite the strong display, Entain’s share price has been on a largely downward trajectory since H1 results were released on 12 August.

In large part, that is because of lingering speculation that Chancellor Rachel Reeves could include gambling tax increases in the UK as part of her Autumn Budget, with several operators seeing share prices slide as a result.

The UK government recently closed its consultation into introducing a Remote Betting and Gaming Duty (RBGD) that would unify general betting, pool betting and remote gaming duty into one single tax rate – a proposal that has been met with backlash from multiple industry figures.

Concerns have been raised that the unification to a single rate of 21% could also see a hike above that level.

Entain struggled to shake off shareholder concerns regarding the tax raise for the majority of August, closing the month out at a stock price of 878p per share, marking a value decline of more than 10%.

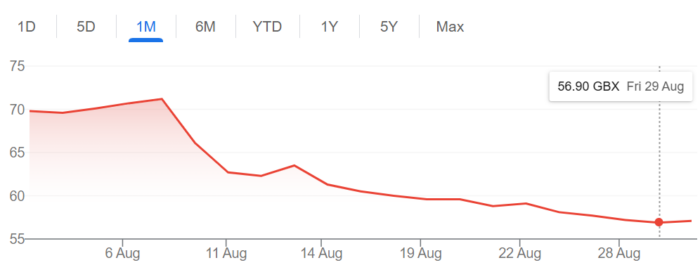

Evoke

1 August closing: 69.80p

29 August closing: 56.90p

Peak August closing: 71.20p

Evoke endured a difficult August that was marred by tax hike rumours, despite also recording H1 revenue growth of 3%.

Evoke’s H1 results also included a 44% year-on-year (YoY) climb in adjusted EBITDA, alongside a steep 55% fall in post-tax losses to $64.7m.

CEO Per Widerström credited the display to “substantial strategic progress, focusing resources on our core markets and executing a short-term turnaround”.

However, the same tax concerns that blighted Entain’s share price were suffered by evoke, though CFO Sean Wilkins issued an emphatic response to the rumours when talking to analysts on the firm’s H1 earnings call.

“The way we see it in the business is that the chancellor and the government does need some cash and I think the gaming industry is an easy target,” he explained.

“The caveat I would put to that is increased tax beyond a certain point, it’s very clear that it leads to black market growth, and black market growth leads to lower tax take and I was going to say less player protection, but zero player protection actually, and so it is completely against the objectives of the government.”

By the end of August, evoke’s stock had fallen 18% since the month’s opening day.

Rank Group

1 August closing: 155.40p

29 August closing: 134.80p

Peak August closing: 160.60p

UK-based casino and bingo operator Rank Group also suffered a slump in share price over the course of August, falling by 13%.

This was despite full-year 2024-25 results that featured an 11% increase in NGR and a 38% rise in underlying operating profit, which totalled £795.3m and £63.7m, respectively.

The results highlighted that Rank’s digital efforts now contribute 42% of the group’s profitability, though headwinds worth £4m to that profit are expected due to the UK’s imminent online slots stake limits.

Rank Group CEO John O’Reily was calm when tackling the topic of tax hikes with EGR, explaining: “You’ve got to think it’s going to be a ‘better than even money’ chance that it’s harmonised at 21% rather than 15%. If that is the case, it’s not that material to the group – it would be about £1m a year, something like that.

“I’d rather they didn’t do it because sports is an area that we would like to further develop. We’d like that not to happen but if it happens, it happens, so be it. Ultimately, the Treasury will recognise that businesses like ours today pay an awful lot of tax.”

Flutter Entertainment

1 August closing: $299.62

29 August closing: $307.17

Peak August closing: $308.60

It was a contrasting August for the industry’s biggest operator, with Flutter Entertainment shrugging off UK-related tax hike concerns to ensure its shares in New York increased in value by the end of the month.

The company announced Q2 2025 revenue of $4.2bn (£3.1bn), a YoY increase of 16%, while adjusted EBITDA climbed 25% from $738m to $919m. In turn, adjusted EBITDA margin expanded from 20.4% to 21.9%.

The FanDuel parent company expanded into the prediction markets sector in the US, via a joint venture with CME Group, hailed by the operator as a “groundbreaking alliance”.

On the other side of the pond, CEO Peter Jackson explained that the group is better equipped to deal with the potential tax rise than its competitors, despite the speculation sparking a 5.5% drop in Flutter’s share price on the London Stock Exchange in early August, alongside an 8% drop in New York.

He said: “We’ve got a lot of levers to pull from a cost perspective that our competitors don’t. We’ve seen time and again in these markets that when there are tax changes, the winner ends up capturing a disproportionate share of the economics.

“Some of our competitors in the UK have very stretched balance sheets. If there are tax increases, they’ll have to react with reductions in marketing and generosity, while pushing up prices to try and compensate.”

Better Collective

1 August closing: SEK137.50

29 August closing: SEK118.20

Peak August closing: SEK137.50

Better Collective’s Q2 report saw the affiliate post an 18% YoY decline in Q2 revenue to €82m (£71m).

The slump was “in line with expectations”, according to management, with tough comps in 2024 including Brazil, North Carolina and Euro 2024 playing a significant part in the results.

Having opened August trading at SEK137.50 per share, Better Collective’s shares were valued at the same price on the day of its Q2 earnings release, before a significant fall ensued.

By the end of the month, the stock had declined by more than 12% to SEK118.20.

Co-founder and co-CEO Jesper Søgaard reflected on the revenue dip to EGR, explaining: “It was very much as expected. The biggest market transition we’ve ever seen – from a dotcom market to a local licensed market in Brazil – I think we’ve managed that that well.

“There was a lot of uncertainty heading into this year; we tried to guide on that and we are now basically seeing it panned out more or less as we expected and guided for.”

The post Stocks Tracker: Talk of tax hikes spark share slumps first appeared on EGR Intel.

EGR analyses the share price movements of major industry players in August, including Entain, evoke and Flutter

The post Stocks Tracker: Talk of tax hikes spark share slumps first appeared on EGR Intel.