Better Collective has posted an 18% year-on-year (YoY) decline in Q2 revenue to €82m (£71m), with bosses citing tough comps in 2024 including Brazil, North Carolina and Euro 2024.

Management said the performance was “in line with expectations”, with Q2 2024 revenue amounting to €99.1m.

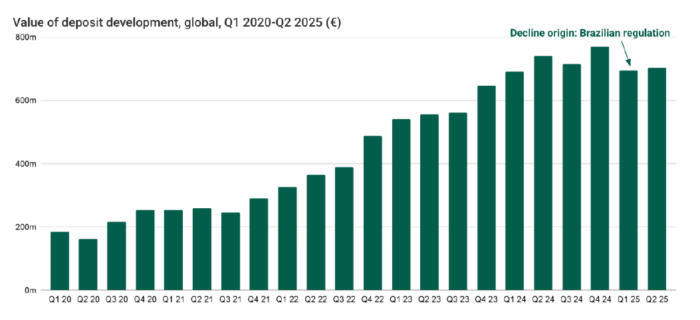

Similar drags the affiliate reported in Q1 were cited again, with Brazilian revenue down by €8m versus Q2 2024, although there was “stronger-than-anticipated player retention and wagering activity”.

The North American business also reported an €8m dip on the North Carolina market launching in March 2024 and an FX hit of €2m. Euro 2024 and Copa América translated to a €5m hit, too.

EBITDA before special items slid 21% YoY from €28.5m to €22.5m, while post-tax profit fell from €10.3m to €5.2m.

Costs were slashed 16%, or €12m, as a result of the restructuring the business undertook earlier this year.

New depositing customers (NDCs) reached 300,000 versus 501,000 in Q2 2024, with the latter driven by Euro 2024 which accounted for 100,000 NDCs alone.

Better Collective said that despite the decline, the value of those NDCS was returning to growth after the dip in Q1, steered by Brazil’s regulated market opening.

Breaking revenue down by business segment, publishing accounted for €51.8m of the group total, with the majority of that coming on a revenue-share basis.

The segment suffered a 22% YoY decline in revenue, with the US and Brazil cited as the major causes.

In paid media, revenue slipped 10%, again due to the transition in Brazil. The division’s revenue came to €11.3m.

The three months ending 30 June 2025 was also the first time the Danish firm split out esports as a standalone arm, which includes HLTV and FUTBIN. Revenue was up 4% YoY to €4.7m.

Geographically, North America revenue came in at €17.9m and Europe and the Rest of the World at €63.6m.

The full-year 2025 guidance remained unchanged, with revenue expected between €320m and €350m, and EBITDA before special items between €100m and €120m.

Jesper Søgaard, Better Collective co-CEO, said the company was “well-positioned to reaccelerate topline growth” next year.

He added: “As we close the first half of 2025, I’m pleased to report that developments have progressed as expected. The first half has marked the final stretch of a transition period, shaped by tough comparative numbers and structural changes in key markets such as Brazil.

“Looking ahead to 2026, and based on years of experience, we are confident that the 2026 World Cup, to be played in North America and Mexico, will be the largest sporting event ever.

“As such, it represents a major strategic opportunity for Better Collective as we own some of the leading sports media across the region and in Europe. Partner discussions are already progressing, product roadmaps are advancing and multi-channel campaign planning is underway across the business.

“With our global audience reach, we are positioned to translate record-level attention into meaningful, lasting value for our partners and Better Collective.”

The post Better Collective Q2 revenue slides 18% but bosses remain confident on future first appeared on EGR Intel.

“Stronger-than-anticipated” KPIs in Brazil show underlying performance for the business, as CEO says business is “well-positioned to reaccelerate topline growth” in 2026

The post Better Collective Q2 revenue slides 18% but bosses remain confident on future first appeared on EGR Intel.