Is some football better than no football for sportsbooks? There have been several optimistic comments about the, at the time of writing, ongoing FIFA Club World Cup to fill the summer dearth of competitions. Here, I’ll take a look at some snapshot observations of operator activity, with some comments on apparent bettor interest.

As a non-football fan, it feels like there has been quite a bit of hype around the scope to advance the sport in the US, particularly with more accessible streaming options, but it seems these perspectives are driven more by hope than tangible fan enthusiasm.

While the tournament features 32 notable clubs from global FIFA confederations, the stakes don’t appear to be overly compelling despite the presence of international ‘names’ like Lionel Messi, Kylian Mbappé and Erling Haaland.

While football bettors do like having games to gamble on, plenty of fans also like having well-rested players and so are fairly ‘cool’ on the concept of the tournament. Yet, as we’ll see later in this article, US audiences may be taking a different view of this year’s US-based event.

FIFA Club World Cup search trends

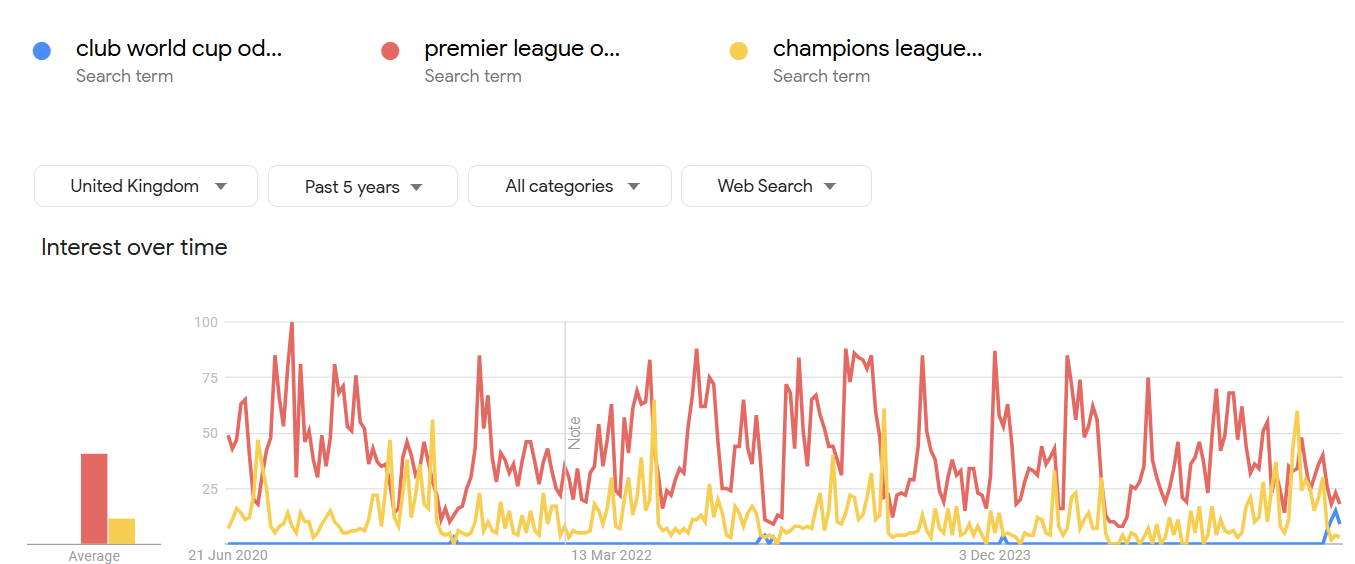

The tournament is underway, at the time of writing, and search trends differ globally, but with Chelsea and Manchester City in the running it might be expected for search interest in betting odds to be notable in the UK. Looking at Google Trends in the UK over the past five years, it’s clear to see that for ‘odds’ terms (often a big driver of experienced and newbie bettor traffic) that Premier League and Champions League-related searches wildly outstrip interest in the Club World Cup.

In regard to search volume for terms around particular teams, matchups, odds and bonuses related to the tournament, the interest doesn’t seem to be particularly compelling. The global view is similar. Despite a small spike in betting interest in the months leading up to the tournament, as of the end of May, total search volume for betting-related keywords was in the hundreds, rather than thousands.

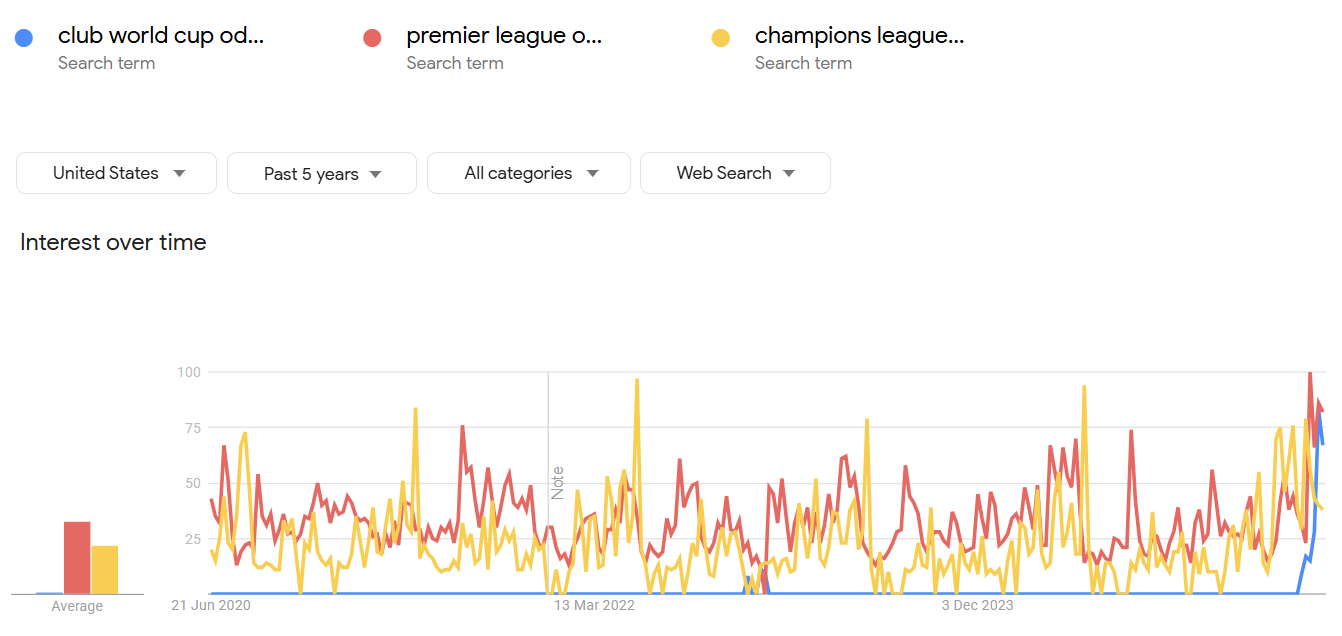

However, when we look at US trends, it could be argued that the event can support domestic interest in ‘soccer’, with a clear spike in searches that rivals interest in Premier League and Champions League odds.

In this respect, maybe the event is supporting FIFA’s wider goal of establishing football in the US – and giving US-based operators new scope to attract or cross-sell to bettors, even if NBA and NHL finals are likely to be a bigger draw in the month of June.

FIFA Club World Cup – an advertising snapshot

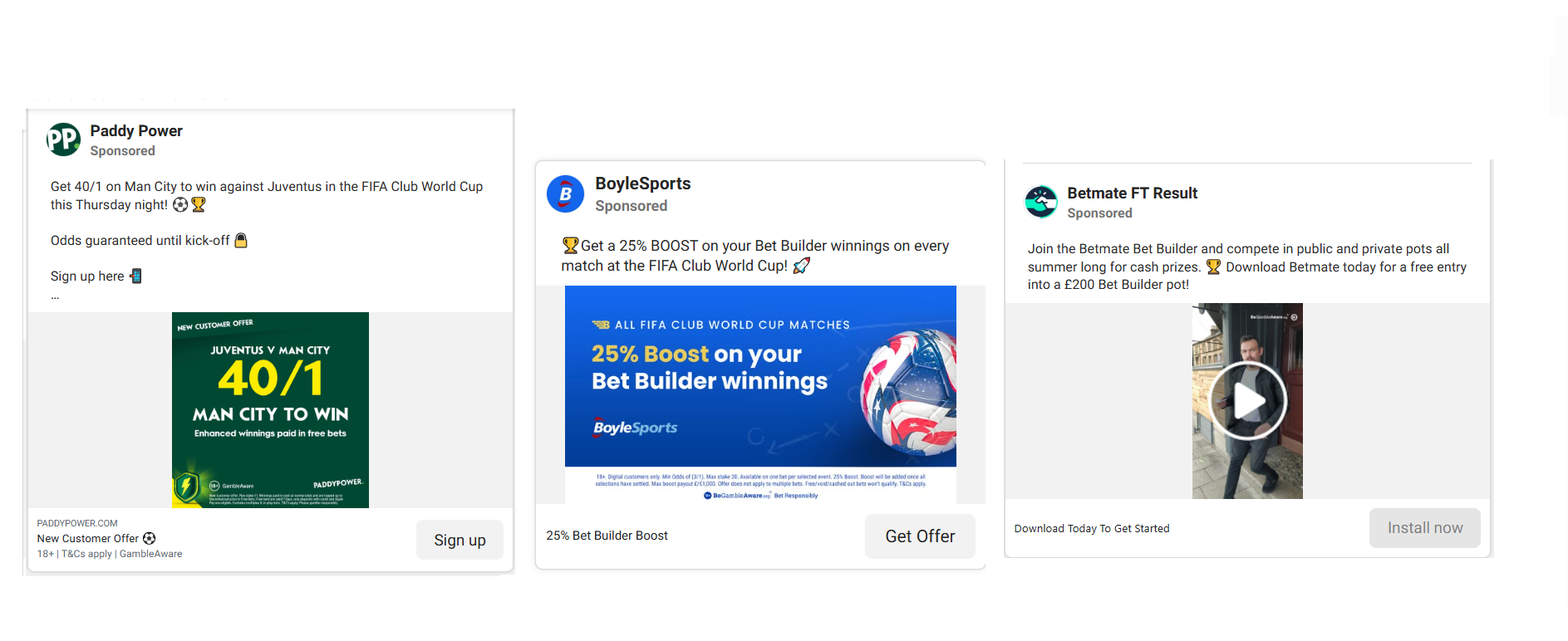

With the above stats in mind, it feels like the event is not a major organic opportunity for established European operators, and they’re not putting particular energy behind it in terms of custom offers or a larger advertising push. Using Meta’s Ad Library to compare and contrast activity, there is a comparative lack of live ads about the tournament at all in the UK, with betting-focused ads limited to familiar sign-up offers and enhanced odds.

ICS-digital head of market growth (and sportsbook specialist) Tom Wardman’s analysis is blunt:

“Most of the operator ads we’ve seen are just their regular offers for sign-up, skinned with the Club World Cup incentive.” In contrast, it seems like FIFA themselves are really keen to drive interest in the tournament, with multiple ads live, responding to how teams are progressing.

Clearly, there are also key efforts being made to drive value for sponsors. Though it is unclear what the expectations are from a brand like Budweiser, betting brands are often less concerned about visibility and more concerned about FTDs (first time depositors) and active players.

With that in mind, we’re just not seeing that much activity from a paid media perspective, or an organic search perspective.

As such, it can feel less like betting brands capitalising on an established opportunity, than the tournament organisers still in the phase of establishing its purpose, its stakes, its entertainment value and place in the calendar … while giving sponsors visibility across PPC (pay per click) advertising and social – and presumably hoping they renew and extend their agreements in future.

The Club World Cup opportunity

Where then, are the opportunities for operators and affiliates? At present it appears the opportunities are fairly narrow but, for opportunity-seeking affiliates, it may be that tournaments like the Club World Cup provide an opportunity to compete for (albeit limited) betting traffic, where, due to established competition, rankings for more mainstream leagues and tournaments (and in the US – sports) will take longer to earn.

Taken in this way, the Club World Cup is just one of many smaller opportunities that could amount to a profitable and scalable organic SEO strategy. Particularly in 2025, there is no shortage of opinions about what constitutes ‘good’ SEO and how to build up credibility with search engines. In this regard, ability/propensity to rank (for anything in a competitive niche like sports betting) could make it easier to rank for more competitive terms in the future and so the Club World Cup could be seen as a stepping stone to greater rewards.

For those looking for rapid ROI and FTDs, this may not be a very satisfying notion, but hobbyist affiliates that might be able to afford to be more patient and flexible could consider taking this on board. In terms of the type/nature of traffic, this may also be less profitable than milestone events that drive traffic from less-savvy bettors. In the case of the Club World Cup, predicts that some sharper bettors may take an interest.

He says: “There are some limited areas where I could see interest bubbling up, if, for example, unique weather conditions in the US might cause favoured teams to actually underperform to the point that value-seekers could try to strategise around this – but this is only a specific proportion of bettors.

“Sharper bettors may also onside that where some teams are playing teams that are objectively much worse than them (eg Bayern Munich vs Auckland City), bookmakers could over or understate a team’s quality difference due to the very nature of the tournament”. So, does all this amount to a compelling proposition for betting brands more generally, or is it better to view the event through the lens of tertiary sport in the US?

A test run for US Soccer betting?

With FIFA pushing the event heavily and the comparative (albeit still low level) traction in the US for the event in terms of search interest, operators and affiliates alike could be using the Club World Cup as a way to experiment with how they talk about soccer and the type of betting options they offer.

In general terms, prop betting is on the rise and, with the presence of ‘name’ players, the Club World Cup could be a good opportunity to see how bettors respond to the chance to gamble on specific events rather than scores – from shots on target and goals to assists and player actions.

Again, treating the event as a low-level testing opportunity doesn’t seem too compelling. For now, it may be that a wait-and-see approach is best for most operators and affiliates – particularly internationally – but for those targeting North America, there may be some useful insights to shape their approach to soccer for bigger and better tournaments.

Prioritisation is key when it comes to sportsbook marketing and, with FIFA putting a big push of their own behind the event, as well as large operators devoting a percentage of activity to the event for the sake of completeness, it is important not to get carried away. Instead, brands need to evaluate search trends, the total size of the prize and the particular opportunities open to them – beyond the hype and dazzle of premium players in a non-premium event.

The post FIFA Club World Cup: a missed opportunity for betting brands? first appeared on EGR Intel.

Martin Calvert, marketing director at ICS-digital, examines how seriously the industry has taken this summer’s club competition

The post FIFA Club World Cup: a missed opportunity for betting brands? first appeared on EGR Intel.