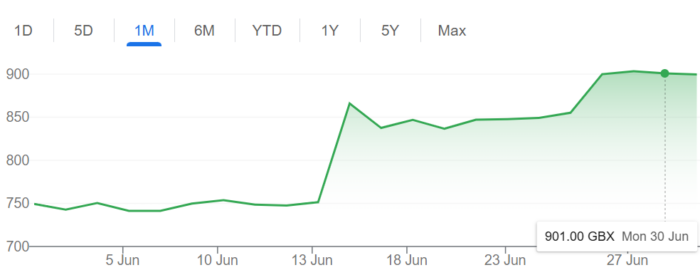

Entain

2 June closing: 749p

30 June closing: 901p

Peak June closing: 901p

Entain kicked the summer month’s off in strong style, with its shares rising around 20% during June on the London Stock Exchange. The spike was driven by the business upgrading its full-year 2025 guidance for its US- and Canada-facing JV BetMGM halfway through the month.

Revenue for the business, which Entain co-owns with MGM Resorts International, should hit $2.6bn this year while adjusted EBITDA is forecast to come in at $100m. Revenue was previously pegged between $2.4bn and $2.5bn, and adjusted EBITDA, alongside a merely positive EBITDA.

The update came after a productive Q1 showing from the operator, which had coined 2024 as an “investment year” as it looks to put distance between itself and the rest of the chasing pack stateside.

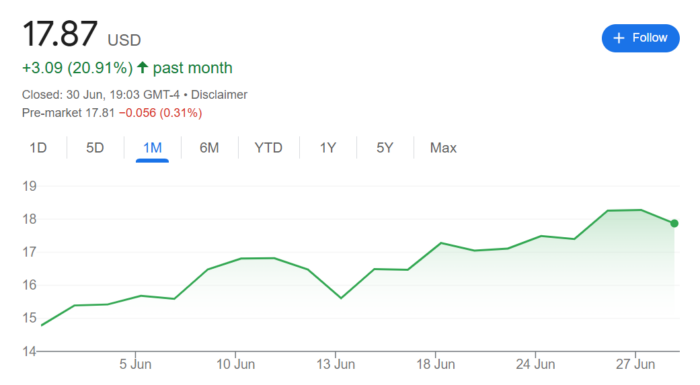

PENN Entertainment

2 June closing: $14.78

30 June closing: $17.87

Peak June closing: $18.26

A whirlwind June for PENN Entertainment saw shareholders finally elect two HG Vora candidates to the operator’s board in the shape of Johnny Hartnett and Carlos Ruisanchez amid a flurry of trade press headlines for the ESPN Bet operator. HG Vora, an activist investor, had agitated for former PENN CFO William Clifford to also be added to the board, but fell short in its aspirations.

Despite the back-and-forth between PENN and HG Vora, PENN’s stock ticked up well during June, rising more than 20% in the month. The operator has had a tough time in recent months, but the hope will be the boardroom battle is now in the rearview mirror and it can look ahead to the NFL season in September and its growing icasino efforts.

Citizens JMP upgraded PENN’s shares to “market outperform from market perform”, and introduced a $24 price target, as it said there was a “real possibility” ESPN Bet could be ditched with next year’s break clause looming.

Betr

2 June closing: A$0.35

30 June closing: A$0.27

Peak June closing: A$0.36

A protracted M&A battle Down Under between Betr and MIXI for the future of PointsBet reached farcical levels last month after the third party in charge of counting votes on MIXI’s bid failed to account for Betr’s 19.9% stake in PointsBet. Subsequently, MIXI is launching an off-market all-share takeover, which Betr will be looking to defeat once again. PointsBet’s board has recommended shareholders take the deal, as it had MIXI’s previous offer.

The original bid, once fully accounting for Betr’s vote, fell short of the required total needed. Despite that win, and Betr’s ability thus far to frustrate MIXI, its stock on the ASX has failed tick up, and is in fact down by almost a third.

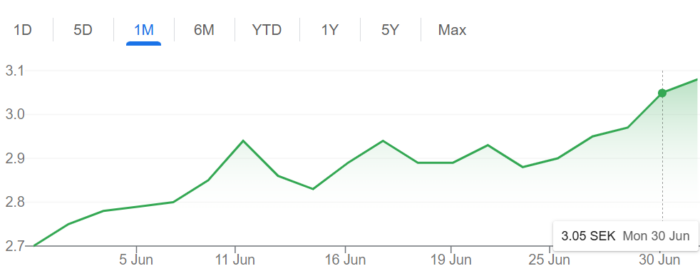

Raketech

2 June closing: SEK2.7

30 June closing: SEK3.13

Peak June closing: SEK3.13

June allowed for some green shoots and positivity for Malta-based Raketech after a tough H1 on the stock market. Last month, the affiliate sold its remaining US tipster business to an undisclosed buyer for €1.25m. Raketech had offloaded its US offline advisory sales operations for $2.25m in July 2024.

The slimming down of the business will allow Raketech to focus on its AffiliationCloud arm, bosses said. At close of trading on 11 June when the deal was announced, the company’s shares had risen a little over 3%.

The business also confirmed former Catena Media chair Kathryn Baker as its new chair, alongside Magnus Alebo as a new board member. Baker will replace Ulrik Bengtsson on 30 July. Bengtsson announced his decision to step down from the board earlier this year to take on the CEO job at Sun International.

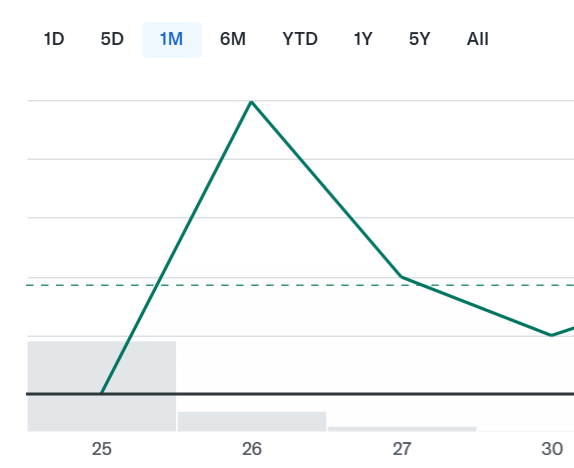

Hacksaw Gaming

25 June closing: SEK75

30 June closing: SEK76

Peak June closing: SEK80

Industry IPOs are few and far between these days after the heady heights of SPACmania and unlimited cash in 2020-21, so it would be rude not to include Hacksaw Gaming after its debut on the Nasdaq Stockholm at the end of the month.

Having set a share target price of SEK77, it closed out its first day of trading at SEK75. An initial 10% leap in early trading had seen the stock touch SEK86.50. The supplier is hoping to raise SEK3.3bn via the public listing, with the business being valued at more than SEK22bn.

CEO Christoffer Källberg said: “The listing on Nasdaq Stockholm is an exciting milestone in Hacksaw’s journey and a testament to the creativity, hard work and commitment of our entire team.

“Being a listed company not only enhances our visibility and credibility on the global stage, but also strengthens our company for continued growth as we deliver innovative gaming experiences to partners and players worldwide.”

The post Stocks Tracker: All smiles at start of summer for some first appeared on EGR Intel.

EGR analyses the share price movements of major industry players in June, including Entain and PENN Entertainment

The post Stocks Tracker: All smiles at start of summer for some first appeared on EGR Intel.