Online slots and games provider Hacksaw Gaming is preparing to float on the Nasdaq Stockholm, a move expected to beachieved by the end of June 2025.

While a guide price hasn’t been revealed, management said the listing was a “logical and important step” in the company’s development to expand its shareholder base and access Swedish and international capital markets.

The Malta-headquartered business’ IPO, which is being handled by joint bookrunners Citi, Jefferies and Carnegie, would be directed at institutional investors in Sweden, as well as the general public across Sweden, Denmark, Finland and Norway.

A press release disclosed that Hacksaw Gaming’s revenue more than doubled to €137m for full-year 2024, while EBITDA amounted to €117.6m, up from €57m for the same period in 2024.

Revenue for the first quarter of 2025 jumped 71% year on year to €45m – suggesting a run-rate of €180m for this year – and EBITDA came in at €38m, compared with €23.1m for Q1 2024. Can’t find

EBITDA margin has hovered between 83% and 87% between 2022 and 2024.

Looking ahead, the board has a long-term target to generate annual growth above 30% and to maintain EBIT margins above 80%.

In addition, at least 75% of net profits will be returned to shareholders through dividends and/or share buy-backs.

Christoffer Källberg, who was appointed group CEO in January and has a background in finance, said:“I am delighted to announce our intention to list on Nasdaq Stockholm.

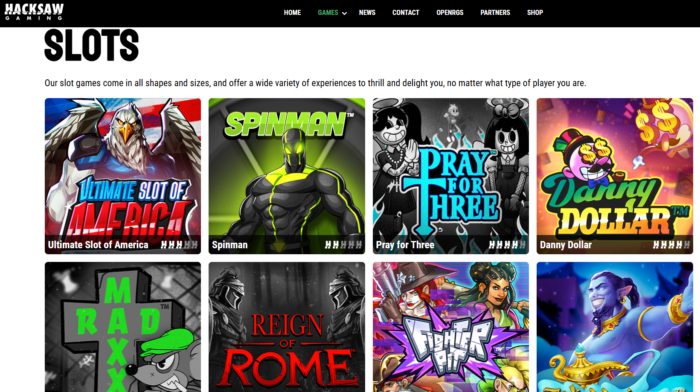

“We have established ourselves as a leading supplier to online casinos active on the global igaming market thanks to our strong, technology-driven offering and capabilities that enable us to create the best possible experience for our customers.

“We look forward to continue building on our strong foundation and to deliver high-quality experiences and bring value to our customers.”

In a note published today, 5 June, analyst firm Regulus Partners said Hacksaw Gaming had demonstrated “extraordinary” growth the past four years and now has an igaming content business that is “already over 60% the size of Evolution’s RNG business”.

However, Regulus Partners raised concerns about the possibility that grey and black markets have been “allowed to seep into the revenue stream”. Growth targets were also singled out.

“A long-term annual revenue growth target of over 30% looks rather unambitious, as does a stated aim to become an investor cash machine – 75% of net profit paid as dividends or share buy backs,” the note read.

“’Don’t worry about approaching maturity, just look at the moolah’is not a strategy the online gambling sector needs any more of, in our view.”

Regulus added: “Hacksaw’s prospectus will hopefully shed more light on exactly where Hacksaw makes its money and especially the countries it blocks and the systems and processes it has in place to ensure compliance.

“The visibility and potential costs of compliance is likely to be key to whether Hacksaw’s achieved margins and a premium multiple are sustainable, in our view.”

Listings in the igaming industry have been few and far between of late; last year, supplier Games Global suspended its $275m IPO a month after announcing plans to go public.

The post Hacksaw Gaming unveils plans to list on the Nasdaq Stockholm first appeared on EGR Intel.

Fast-growing games supplier reveals revenue and EBITDA more than doubled in 2024, though one analyst firm describes growth targets as “rather unambitious”

The post Hacksaw Gaming unveils plans to list on the Nasdaq Stockholm first appeared on EGR Intel.