Better Collective has reported a 13% year-on-year (YoY) decline in Q1 2025 revenue on the back of tough comparisons in the US and Brazil, as the affiliate gears up for its new era under a co-CEO model.

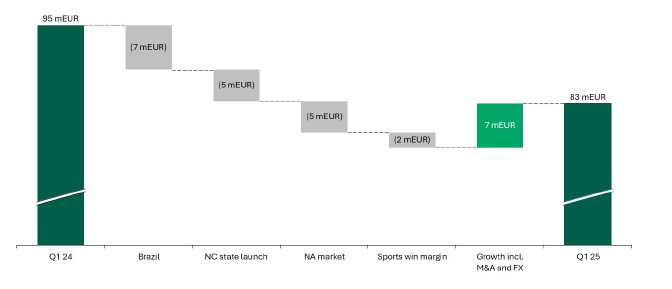

Revenue for the first three months of the year amounted to €82.6m, (£69.7m) down from €95m in Q1 2024, which the Danish affiliate said was driven by five core reasons.

While bosses said the revenue was in line with expectations, a €7m hit from Brazil after it regulated on 1 January was a blow for the business.

The market did return €10m in revenue, and performance has been “better than expected”, but there was still drag compared to 2024.

The North Carolina online sports betting launch in March 2024 resulted in a €5m revenue headwind in Q1, while wider US decreases in customer activity contributed another €5m blow.

Additionally, the sports win margin impacted revenue and adjusted EBITDA by €2.4m, while full impacts from previous M&A added €7m to the topline figure, but it wasn’t enough to report growth.

EBITDA before special items slipped from €29m to €22m, while post-tax profit fell from €7.6m to €3.6m during the reporting period.

Better Collective was also able to deliver 316,000 new depositing customers (NDCs), with 80% of those being sent to operators on revenue share deals.

However, the total number of NDCs declined 30% YoY due to slowdowns in the US and Brazil, although there were some positive shoots in the rest of in Latam.

Breaking revenue down by division, publishing accounted for €58m, down from €66.3m, although the arm’s share of group revenue remained flat at 70%.

Paid media revenue slumped 14% YoY from €28.7m to €24.6m, with both divisions caught up in Brazilian headwinds.

Geographically, Europe and the Rest of the World saw revenue dip 2% from €61m to €59.5m, impacted by Brazil once again.

In North America, revenue plummeted 32% YoY from €34m to €23m, although North Carolina accounted for half of the decline, bosses said.

Despite the declines across revenue, management have retained the full-year 2025 targets for revenue to hit between €320m and €350m and EBITDA (before special items) to range from €100m to €120m.

Looking ahead to the rest of the year, Better Collective will be running under its new co-CEO model, as revealed exclusively by EGR earlier this year.

Former COO Christian Kirk Rasmussen stepped up to become co-boss alongside Jesper Søgaard as part of the process.

Included within the earnings report, Better Collective said Sofie Ejlersen had been appointed as COO, having served as a strategic adviser to the company for the past six months.

Ejlersen most recently served as an associate partner at Bain and Company, and will be responsible for overseeing the “implementation and integration of the transformation” across the company.

From Q2, Better Collective will also report its revenue via its three new business units as per the structural shift: publishing, paid media and esports.

Looking to the future, Søgaard said: “These changes are not just about efficiency – they are about focus to ensure future growth.

“By doing fewer things, but doing them better, we are building a stronger, more aligned organisation with the clarity and scale needed to grow and lead in a competitive global landscape.”

On Brazil, he added: “We are pleased to report that the overall amount wagered in the player databases has increased, and the reduction in wagering activity is less than we initially expected.

“This demonstrates strong retention and loyalty from the players we have sent historically. However, the continued lack of welcome bonuses – prohibited under the new regulation – has led to a slower pace of NDCs than originally anticipated.

“Due to this, competition between sportsbooks has remained more muted than expected. We remain very optimistic about the long-term potential of the Brazilian market and our leading position within it.”

The post Better Collective Q1 revenue down 13% yet bosses remain confident on future first appeared on EGR Intel.

Affiliate giant says performance was in line with expectations, with silver linings seen in Brazil, while a new COO has been confirmed as part of restructure

The post Better Collective Q1 revenue down 13% yet bosses remain confident on future first appeared on EGR Intel.