The Optimove Latam iGaming Pulse Report – April 2025 analyses player behaviour and betting trends across Mexico, Brazil, Peru and Colombia over the past 12 months, based on an average of over 7.2 million active monthly players.

Key highlights:

- Mexico leads in both average deposit amounts and sports betting volume, though both metrics declined over time. In April, the average deposit dropped to $200 (from an 11-month average of $230), and sports betting fell to $624 (from an average of $818).

- Peru emerged as the leader in total monthly casino betting amounts, ending April at $621 (down from an average of $811), outperforming other Latam countries in this category.

- Brazil showed the strongest growth in player engagement and retention since January 2025:

- Activity days increased 30%, reaching 13.7 days per player in April (up from a 10.5-day average).

- Retention rate rose to 81% in April (up from a 70% average), reflecting a shift toward a more loyal player base.

- Colombia recorded the lowest overall averages across key metrics, with a sharp drop in retention to 46% in April (from a March peak of 74%), likely influenced by recent tax value-added (VAT) policy changes. Average deposit also declined to $48 in April (from an 11-month average of $53).

Conclusion:

Mexico remains the dominant market in terms of deposits and sports betting volume, while Brazil’s rising engagement and retention mark it as a fast-growing opportunity — likely driven by regulatory adaptation and stronger player loyalty. Peru demonstrates consistency across multiple metrics, especially in casino activity and retention. Colombia, however, presents a volatile landscape, with significant drops in retention and engagement in April 2025, reflecting the short-term impact of new taxation policies. These patterns emphasise the need for region-specific strategies that balance regulatory compliance with sustained player value.

Report metrics:

- Source: Betting trends in Latam in the trailing 12 months (April 2024-2025).

- Countries: Mexico, Brazil, Peru and Colombia.

- Database: A 12-month average of over 7.2 million active players per month.

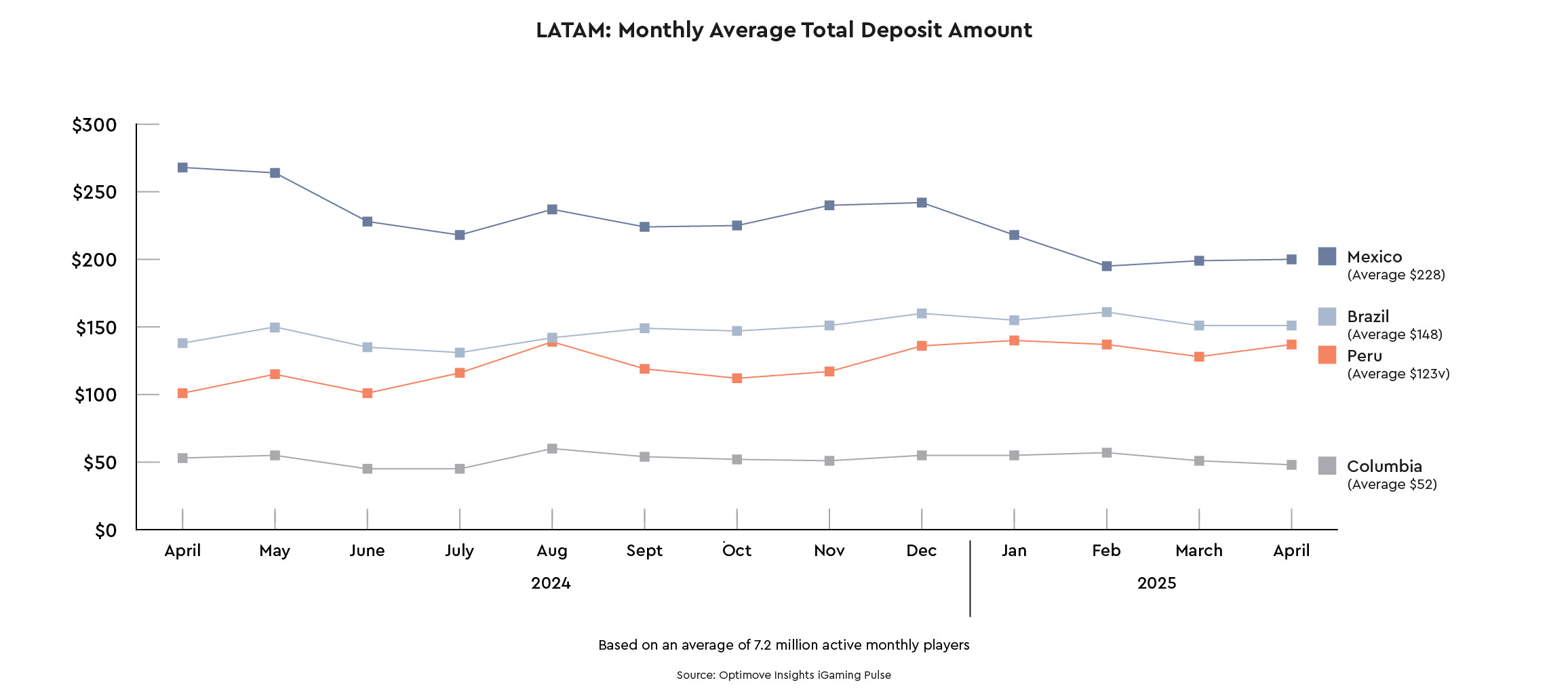

Category: Average deposit amount

Key finding: Average deposit amounts greatest in Mexico

Total monthly average deposit amount across Latam countries

Mexico consistently leads in average monthly deposit amounts, compared to the other Latam countries in this report.

The average monthly deposit amounts for each country are as follows:

- Mexico: The average for the trailing 11 months before April 2025 is $230. April average deposit was $200.

- Brazil: The average for the trailing 11 months before April 2025 is $148. April average deposit was $151.

- Peru: The average for the trailing 11 months before April 2025 is $122. April average deposit was $137.

- Colombia: The average for the trailing 11 months before April 2025 is $53. April average deposit was $48.

Definition of average deposit amount: The average deposit amount is calculated by taking the total sum of all deposits and dividing it by the number of sports and casino bettors (players) who have made at least one deposit.

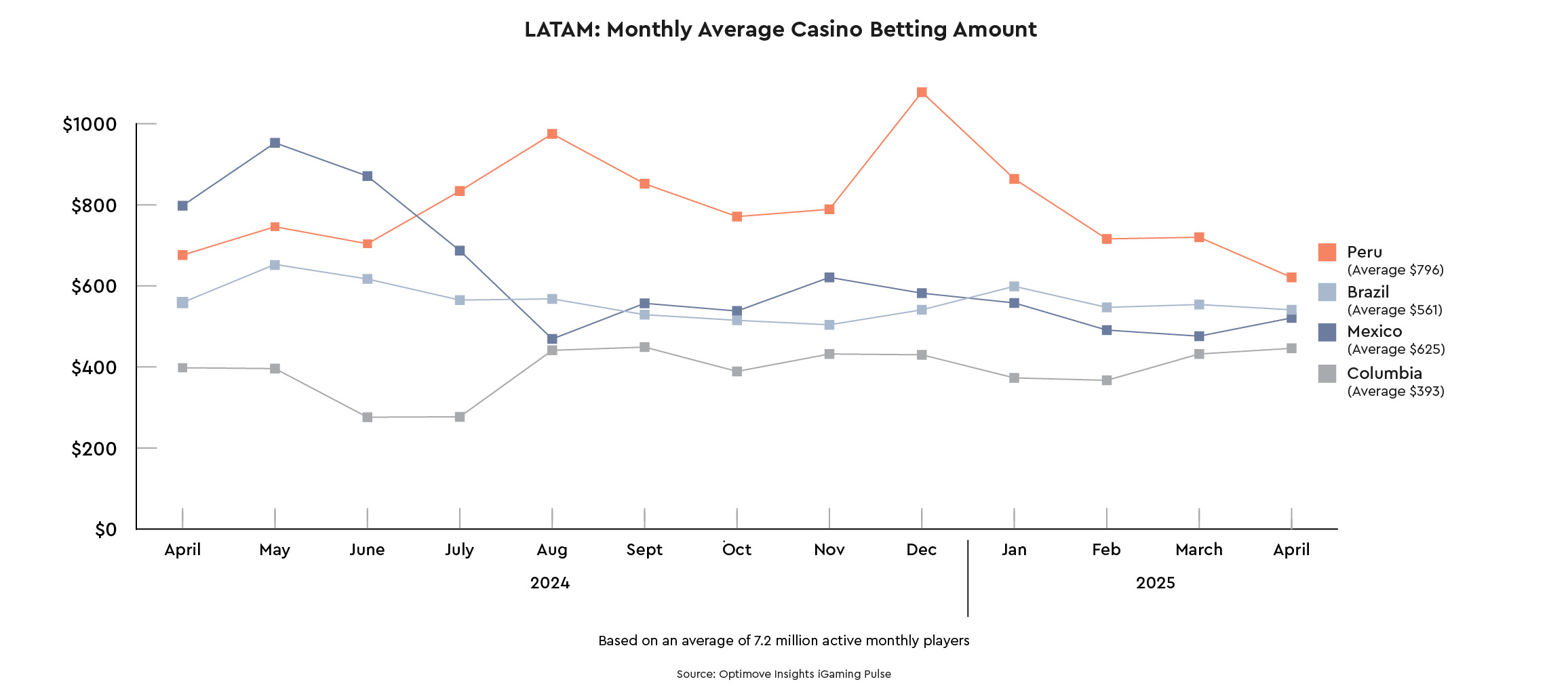

Category: Total monthly casino betting mount

Key finding: Peru has highest total monthly casino betting amount across Latam countries

Peru consistently leads in average monthly total casino bet amounts, maintaining the highest values among the four Latam countries tracked in this report.

Mexico started the period with the highest values but declined steadily, ending below both Peru and Brazil.

Brazil remained in the middle range, showing relatively stable fluctuations throughout the year.

Colombia continues to have the lowest average casino bet amounts, maintaining a consistently low and stable trend.

The average monthly total casino bet amounts for each country are as follows:

- Peru: The average for the trailing 11 months before April 2025 is $811; the April average was $621.

- Mexico: The average for the trailing 11 months before April 2025 is $633; the April average was $521.

- Brazil: The average for the trailing 11 months before April 2025 is $563 April; the average was $541.

- Colombia: The average for the trailing 11 months before April 2025 is $388 April average was $446.

Definition of total monthly casino bet amount: The average casino bet amount is the total sum of all casino bets and divided by the number of bettors who have placed at least one casino bet.

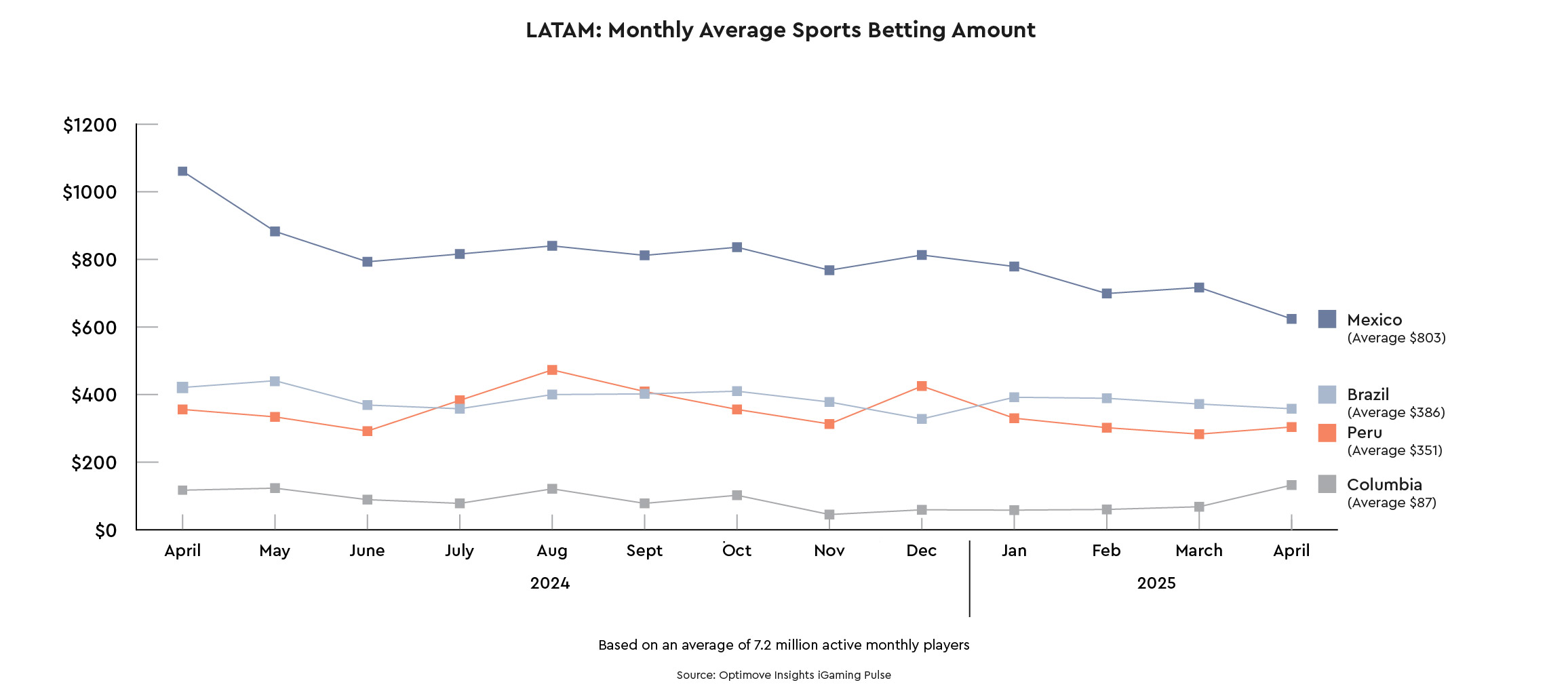

Category: Total monthly sports betting amount

Key finding: Mexico leads, despite a decline from April 2024

Mexico consistently leads in average monthly total sports bet amounts, maintaining the highest values throughout the period despite a gradual decline from April 2024.

Brazil remains in the middle range, with relatively stable fluctuations over the year.

Peru showed moderate performance, peaking in mid-2024 before declining and ending slightly below Brazil.

Colombia continues to have the lowest average sports bet amounts, with consistently low values and minor fluctuations throughout the period.

The average monthly total casino bet amounts for each country are as follows:

- Mexico: The average for the trailing 11 months before April 2025 is $818. April average was $624.

- Brazil: The average for the trailing 11 months before April 2025 is $388. April average was $358.

- Peru: The average for the trailing 11 months before April 2025 is $355. April average was $304.

- Colombia: The average for the trailing 11 months before April 2025 is $83. April average was $132.

Definition of total monthly sports bet amount: The average sports betting amount is the total sum of all sports bets and divided by the number of bettors who have placed at least one sports bet.

Category: Average number of activity days per active customer

Key finding: Brazil has continued to experience a notable spike since January 2025

Brazil consistently leads in average activity days per active customer, showing a significant increase starting in January 2025 and maintaining the highest engagement levels across the region.

Mexico started as the top performer but gradually declined over the year, ending in second place.

Peru remained stable throughout the period, with engagement levels hovering around eight days.

Colombia continues to show the lowest activity levels, with a clear downward trend and minimal recovery in early 2025.

The average activity days per country are as follows:

- Brazil: The average for the trailing 11 months before April 2025 is 10.5 days. April average was 13.7 days.

- The 30% increase compared to the average; we believe indicates that since the new regulation started in January 2025, operators retained higher-loyal players compared to casual players proportionally.

- Mexico: The average for the trailing 11 months before April 2025 is 10 days. April average was 9.3 days.

- Peru: The average for the trailing 11 months before April 2025 is 7.8 days. April average was eight days.

- Colombia: The average for the trailing 11 months before April 2025 is six days. April average was five days.

Definition of average activity days: The average number of activity days is the total number of activity days divided by the number of bettors who have at least one activity day.

Category: Average active retention rate

Key finding: Brazil keeps outperforming since February, showing a strong core player base

Brazil showed a strong increase in average active retention rates throughout the period, with a sharp dip in January 2025 followed by a significant spike, ending with the highest rate across the region at 81% in April.

Peru maintained consistently high retention, ranking among the top performers in most months and ending at 71%.

Colombia experienced wide fluctuations, peaking at 74% in March before dropping to 46% in April.

Mexico remained relatively stable at lower retention levels throughout the year, showing modest gains but finishing with the lowest rate among the four countries at 53%.

The average active retention rates for each country are as follows:

- Mexico: The average for the trailing 11 months before April 2025 is 57%. April average was 53%.

- Brazil: The average for the trailing 11 months before April 2025 is 70%. April average was 81%.

- 15% increase compared to the average; we believe this increase highlights the most loyal customers who remained active in April despite regulatory challenges.

- Peru: The average for the trailing 11 months before April 2025 is 67%. April average was 71%.

- Colombia: The average for the trailing 11 months before April 2025 is 62%. April average was 46%.The 27% decrease compared to the average might be connected to a new value-added tax (VAT) on players’ deposits in recent months.

Definition of active retention rate: The percentage of bettors who were active in the preceding month and remained active in the current month.

For more insights visit iGaming Pulse.

The post Optimove Insights: Peru leads in average monthly casino bets first appeared on EGR Intel.

In this month’s article, Optimove explores four key Latam markets, with Mexico out in front for sports betting volume

The post Optimove Insights: Peru leads in average monthly casino bets first appeared on EGR Intel.