This analysis reviews European gaming data from January 2025 to January 2026, based on an average of 6.2 million active players per month. The report covers four key markets: Spain, Greece, Italy, and the UK. It tracks five key indicators: monthly deposit amount, sports betting amount, casino betting amount, player activity days and customer retention rate.

Key findings and insights

- The post-holiday effect: A consistent trend across metrics was a peak in December 2025, followed by a small contraction in January 2026. This seasonal pattern suggests increased player spending during the holiday period, followed by a natural correction at the beginning of the new year.

- Product preferences split: There is a clear split in product preference between nations. Spain and Greece lead the market in casino betting volume, whereas Italy is the sports betting leader ($1,361), significantly outpacing other nations.

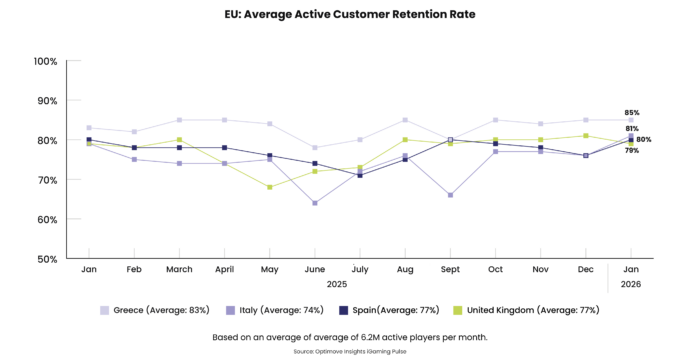

- Retention convergence: While historical averages differ, January 2026 shows a remarkable convergence in retention rates. All four nations are now clustered between 79% and 85%, with Italy showing the most dramatic improvement from its 12-month average of 74% to a current 81%.

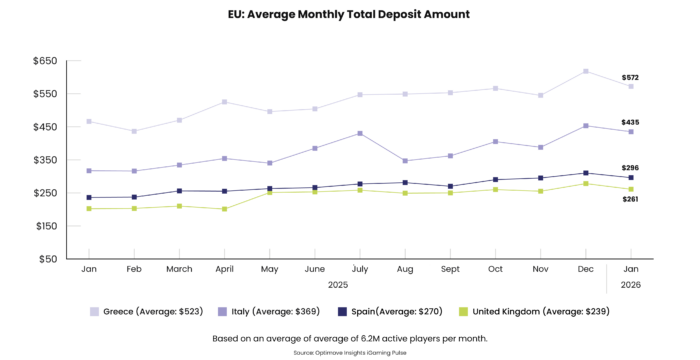

Average monthly total deposit amount

Over the last 12 months, the trend lines show a general upward trajectory across all analysed markets, though at different rates. Greece and Italy exhibit strong growth with more volatility, while Spain and the UK display a more gradual, consistent rise throughout the year. Greece consistently maintains the highest deposit levels, while the UK has the lowest levels.

January 2026 saw a general decrease in average deposits compared to December 2025. Greece dropped from a peak in December to $572, and Italy experienced a similar decline. This contraction is typical of post-holiday seasonality when consumer spending tightens. Despite the month-on-month dip, the January 2026 figures remain well above the 12-month trailing averages for all four countries, indicating sustained long-term growth across the entire region.

Countries’ overall averages:

- Greece:

January 2026: $572

12-month trailing average: $523

- Italy:

January 2026: $435

12-month trailing average: $369

- Spain:

January 2026: $296

12-month trailing average: $270

- UK:

January 2026: $261

12-month trailing average: $239

Definition of average deposit amount: The average deposit amount is calculated by taking the total sum of all deposits and dividing it by the number of sports and casino bettors (players) who have made at least one deposit.

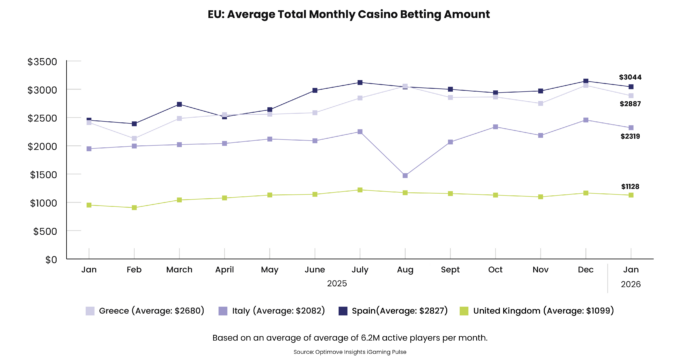

Average total monthly casino betting amount

The 12-month trend reveals Spain and Greece as the heavyweights in casino turnover, with Spain securing the lead in the recent months. In contrast, the UK remains lower and flatter than the other three nations, indicating a different player profile or regulatory environment regarding casino spend.

The transition from December 2025 to January 2026 shows a small decline in betting volume across all surveyed countries, with Greece and Italy displaying a retraction from their year-end peaks.

Countries’ Overall Averages:

- Spain:

January 2026: $3,044

12-month trailing average: $2,827

- Greece:

January 2026: $2,887

12-month trailing average: $2,680

- Italy:

January 2026: $2,319

12-month trailing average: $2,082

- UK:

January 2026: $1,128

12-month trailing average: $1,099

Definition of total monthly casino bet amount: The average casino bet amount is the total sum of all casino bets and divided by the number of bettors who have placed at least one casino bet.

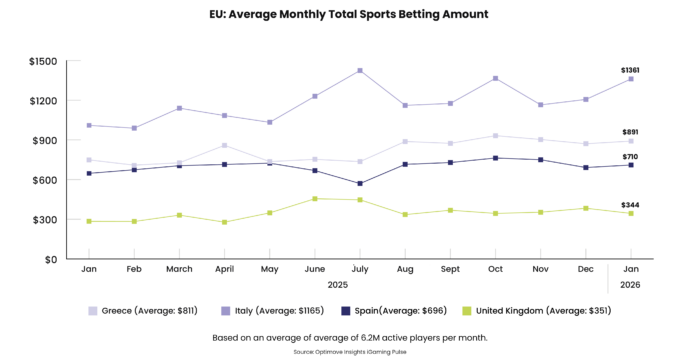

Average total monthly sports betting amount

Italy is the undisputed leader in sports betting spend, maintaining a significant gap above the other nations, showing a great surge in the latter half of the year, despite some downfalls. Greece and Spain trade places in the middle tier, while the UK remains at the bottom.

Comparing December 2025 to January 2026, there is a slight divergence from casino and deposit trends. Yet sports betting saw growth in three of the four markets. This resilience in January likely correlates with the resumption of major European football leagues after brief winter breaks, keeping engagement high despite the post-holiday spending fatigue seen in other verticals.

Countries’ overall averages:

- Italy:

January 2026: $1,361

12-month trailing average: $1,165

- Greece:

January 2026: $891

12-month trailing average: $811

- Spain:

January 2026: $710

12-month trailing average: $696

- UK:

January 2026: $344

12-month trailing average: $351

Definition of total monthly sport bet amount: The average sport betting amount is the total sum of all sports bets divided by the number of bettors who have placed at least one sports bet.

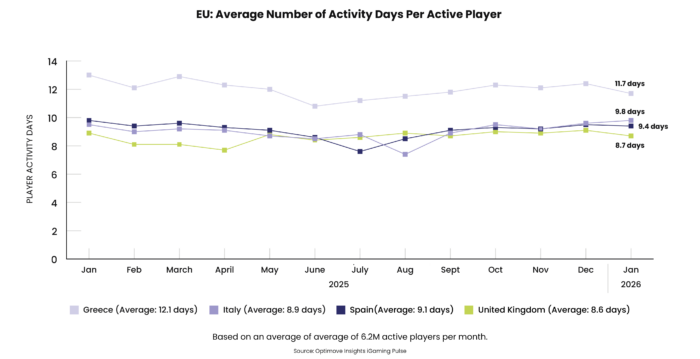

Average number of activity days per active player

Over the 12-month period, Greece has consistently held the top spot for engagement, frequently exceeding 12 active days per month. Conversely, Italy has shown a positive trend, steadily increasing its engagement days from mid-2025 to surpass Spain and the UK.

Looking at the shift from December 2025 to January 2026, the trends are mixed. Greece saw a decrease to 11.7 days, continuing its slight downward trajectory. Italy continued its positive momentum, rising to 9.8 days. Spain also saw a slight uptick, while the UK dipped slightly to 8.7 days.

Countries’ overall averages:

- Greece:

January 2026: 11.7 days

12-month trailing average: 12.1 days

- Italy:

January 2026: 9.8 days

12-month trailing average: 8.9 days

- Spain:

January 2026: 9.4 days

12-month trailing average: 9.1 days

- UK:

January 2026: 8.7 days

12-month trailing average: 8.6 days

Definition of average activity days: The average number of activity days is the total number of activity days divided by the number of bettors who have at least one activity day.

Average active customer retention rate

Throughout the last 12 months, Greece has maintained the highest retention stability, rarely dropping below 80%. Italy, on the other hand, displayed volatility earlier in 2025 (dropping as low as ~64% in June), but has staged a recovery in the second half of the year. Spain and the UK have shown moderate volatility, but are generally in the 75%-80% range.

Comparing December 2025 to January 2026, the data indicate a stabilisation and convergence of retention rates. While Greece held steady at the top with 85%, Italy’s recovery continued, hitting 81%, effectively erasing its mid-year slump. Spain (80%) and the UK (79%) are also performing strongly. The fact that all nations are near or above their 12-month averages in January suggests a very healthy start to the year for player retention across the board.

Countries’ overall averages:

- Greece:

January 2026: 85%

12-month trailing average: 83%

- Italy:

January 2026: 81%

12-month trailing average: 74%

- Spain:

January 2026: 80%

12-month trailing average: 77%

- UK:

January 2026: 79%

12-month trailing average: 77%

Have Your Say

Take our short customer survey on EGR’s content and data offering for the chance to win a £100 Amazon voucher. It will take less than three minutes, with the findings used to inform our plans to improve the platform.

The post Optimove: Retention rates converge across key European markets in January first appeared on EGR Intel.

Data shows Italy is the “undisputed leader” in sports betting spend, while Greece consistently tops engagement metrics, frequently exceeding 12 active days per month

The post Optimove: Retention rates converge across key European markets in January first appeared on EGR Intel.