This report analyses key igaming metrics, comparing trends in Brazil against the global average. The analysis covers the 12-month period from January 2025 to January 2026 and is based on data from an average of 5.5 million active players per month in Brazil and 30 million globally. The metrics examined include deposit amounts, betting volumes for casino and sports, player growth trends, customer retention rates and player activity levels.

Key Findings and insights

- Distinct spending gaps: There is a disparity in spending power between the Brazilian and global markets. While global players deposit and bet higher amounts (especially in the casino sector), the Brazilian market remains robust with a very high engagement and lower amounts.

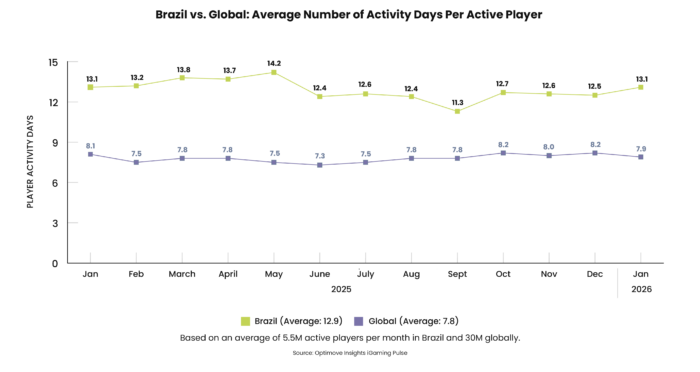

- High engagement levels in Brazil: Brazil maintains an average of 12.9 activity days per month compared to the global average of 7.8, suggesting that gaming is a more frequent, lower-stakes in Brazil rather than an occasional high-stakes activity.

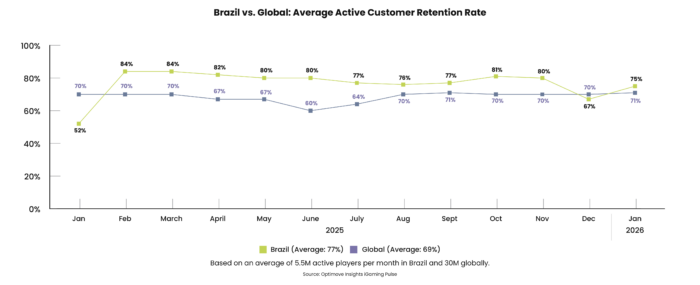

- Retention resilience: Brazil’s retention rate (Average 77%) consistently outperforms the global average (69%). A notable finding is the sharp retention dip in December 2025 (to 67%), which likely indicates an influx of seasonal/holiday players who did not continue, followed by a strong recovery to 75% in January 2026 among the core loyal base.

- Rise in commitment: Despite fluctuations in betting amounts, Brazil’s average monthly deposit has shown a steady upward trend since July 2025. This indicates increasing player commitment and a maturing market with growing financial potential.

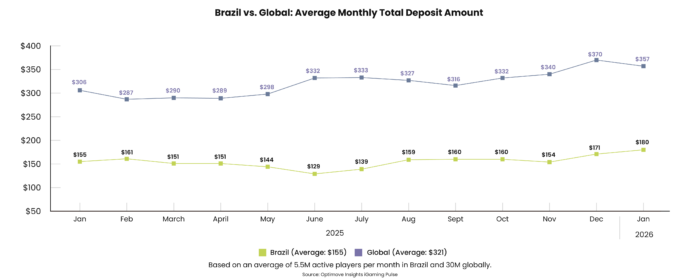

Brazil versus global: Monthly average total deposit amount

Over the last 12 months, the global average has consistently outpaced the Brazilian average, with both showing a generally upward trajectory in the second half of the year.

Comparing the most recent data, Brazil saw an increase from $171 in December 2025 to $180 in January 2026, marking a 5.2% growth. Conversely, the global average demonstrated a slight decline from its peak of $370 in December to $357 in January. This suggests that the positive momentum driven by year-end bonuses and holidays is being held.

Overall averages:

- Brazil:

January 2026: $180

12-month trailing average: $155 - Global:

January 2026: $357

12-month trailing average: $321

Definition of average deposit amount: The average deposit amount is calculated by taking the total sum of all deposits and dividing it by the number of Sports and Casino bettors (players) who have made at least one deposit.

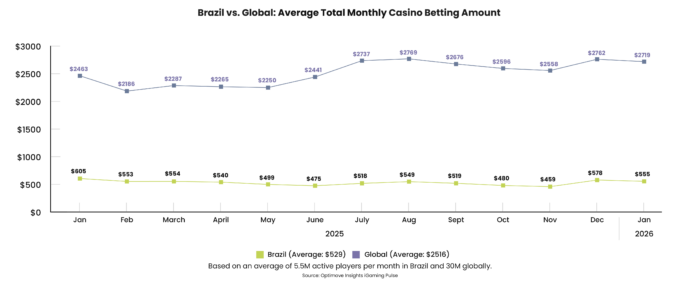

Brazil versus global: Average total monthly casino betting amount

Global players average over $2,500 in monthly bets, while Brazilian players average around five times less. Over the 12-month period, global betting saw growth starting in July 2025, while the Brazilian market remained relatively flat, hovering between $450 and $600 throughout the year.

In the most recent month-over-month comparison, Brazil’s average casino betting amount decreased from $578 in December 2025 to $555 in January 2026. The global market followed a similar trend, decreasing from $2,762 in December to $2,719 in January. This minor downturn in both markets likely reflects a post-holiday cooling-off period, despite the increase in deposits and engagement in Brazil.

Overall averages:

- Brazil:

January 2026: $555

12-month trailing average: $529 - Global:

January 2026: $2,719

12-month trailing average: $2,516

Definition of total monthly casino bet amount: The average casino bet amount is the total sum of all casino bets and divided by the number of bettors who have placed at least one casino bet.

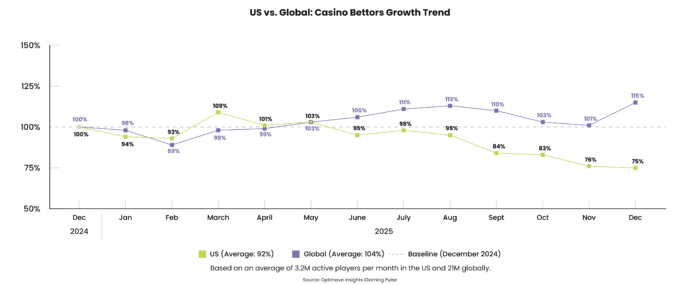

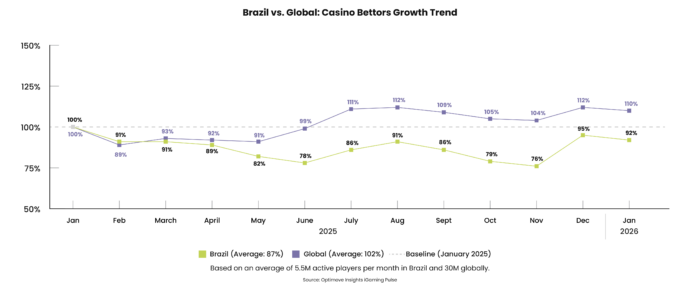

Brazil versus global: Casino bettors growth trend

Over the past 12 months, both markets have shown volatility, with the global market remaining above the benchmark level for most of the year, while Brazil remained below.

In comparison, between the two most recent months, Brazil’s active casino player index dropped from 95% in December 2025 to 92% in January 2026. The global index also saw a slight decline from 112% to 110%. While both are down, the global market remains above its starting baseline, while Brazil is working to recover fully.

Overall averages:

- Brazil:

January 2026: 92%

12-month trailing average: 87% - Global:

January 2026: 110%

12-month trailing average: 102%

Definition of casino bettors growth trend: the growth of the number of active casino bettors over the last 12-month period. It uses the first month of the analyzed period as a baseline (100%) and shows the percentage change in the number of active players each subsequent month for both the Brazil and global markets.

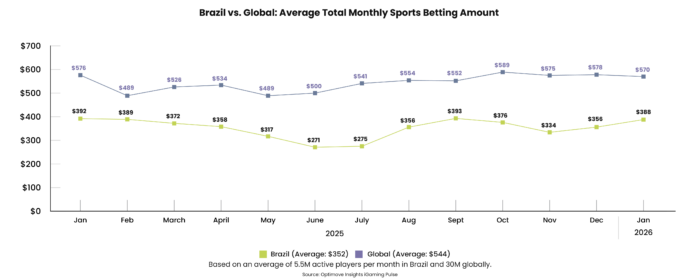

Brazil versus global: Total monthly sports betting amount

The 12-month trend for Brazil shows more fluctuation than the global market. After starting the year strong at $392, wagers dipped to a low of $271 in June (likely during the off-season for many major leagues) before climbing back up. The global average remained more stable but also trended upward in the latter half of 2025.

Recent data shows that Brazil’s sports betting volume rose from $356 in December 2025 to $388 in January 2026, nearly returning to its January 2025 levels. Meanwhile, the global average saw a slight decrease from $578 to $570 in the same period. This indicates that the start of the year is a particularly strong period for sports engagement in Brazil.

Overall averages:

- Brazil:

January 2026: $388

12-month trailing average: $352 - Global:

January 2026: $570

12-month trailing average: $544

Definition of total monthly sport bet amount: The average sport betting amount is the total sum of all sports bets divided by the number of bettors who have placed at least one sports bet.

Brazil versus global: Sports bettors growth trend

The 12-month trend shows fluctuations in both regions, probably related to sports calendars. Comparing the most recent months, there was a significant jump in Brazil from 91% in December 2025 to 99% in January 2026, nearly reaching a full recovery to its original baseline. The global trend remained almost flat, moving from 100% in December to 99% in January. This suggests that January is a key month for re-engaging sports bettors in the Brazilian market.

Overall averages:

- Brazil:

January 2026: 99%

12-month trailing average: 90% - Global:

January 2026: 99%

12-month trailing average: 94%

Definition of sports bettors growth trend: the growth of the number of active sports bettors over the last 12-month period. It uses the first month of the analysed period as a baseline (100%) and shows the percentage change in the number of active players each subsequent month for both the Brazil and global markets.

Brazil versus global: Average number of activity days per active player

Over the last 12 months, Brazil has shown remarkably higher engagement frequency than the global average. While the global player base remains stable near 7.8 days, Brazilian players started the year at 13.1 days and peaked at 14.2 days in May. There was a dip toward the end of the third quarter, reaching a low of 11.3 days in September, before trending upward again.

Comparing the most recent data, Brazil’s activity days increased from 12.5 in December 2025 to 13.1 in January 2026. In contrast, the global average experienced a slight decline from 8.2 days in December to 7.9 days in January. This reinforces the insight that the beginning of the year is a high-engagement period for the Brazilian audience.

Overall averages:

- Brazil:

January 2026: 13.1

12-month trailing average: 12.9 - Global:

January 2026: 7.9

12-month trailing average: 7.8

Definition of average activity days: The average number of activity days is the total number of activity days divided by the number of bettors who have at least one activity day.

Brazil versus global: Average active customer retention rate

Over the period, Brazil has generally maintained a higher retention rate than the global average, except in January and December 2025, possibly because of summer holidays (Brazil being in the southern hemisphere). In the most recent month-over-month comparison, Brazil showed a strong recovery, with retention climbing from 67% in December 2025 to 75% in January 2026, which was a very different pattern than last January.

The global market also displayed a slight improvement, going from 70% to 71%. The rapid rebound in Brazil suggests that the December dip was an anomaly, potentially due to holiday-specific churn that was quickly recovered in the new year.

Overall averages:

- Brazil:

January 2026: 75%

12-month trailing average: 77% - Global:

January 2026: 71%

12-month trailing average: 69%

Have Your Say

Take our short customer survey on EGR’s content and data offering for the chance to win a £100 Amazon voucher. It will take less than three minutes, with the findings used to inform our plans to improve the platform.

The post Optimove: Brazilian players averaged 12.9 active days per month in 2025 first appeared on EGR Intel.

Engagement and retention in the regulated South American market consistently outperform the global norm, according to new data from research analyst Roni Karmi

The post Optimove: Brazilian players averaged 12.9 active days per month in 2025 first appeared on EGR Intel.