Rivalry has announced a “significant workforce reduction” as the business begins to assess a range of strategies, including asset-level transactions.

The Toronto-listed business said the board had approved a “significant reduction in operating activity” while the evaluation takes place.

Rivalry revealed in the announcement that it is in discussions with third parties regarding potential transactions.

Despite those talks, the board has reduced the scale of the company’s operations while “assessing whether a strategic transaction or other alternative can be advanced”.

These changes include “substantial cost reductions”, which will see a decline in the headcount and operating expenditure.

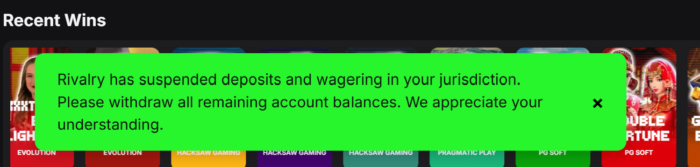

Rivalry has also paused player activity on its platform and is facilitating withdrawals.

The Rivalry website, when accessed with a Canadian VPN, reads: “Rivalry has suspended deposits and wagering in your jurisdictions. Please withdraw all remaining account balances. We appreciate your understanding.”

Rivalry said: “The company is assessing a range of potential alternatives, which may include asset-level transactions, corporate transactions, restructuring initiatives or other strategic outcomes.

“Given the company’s reduced operating scale and the ongoing evaluation process, there can be no assurance that any strategic alternative will be completed or that operations will continue in their current form.”

Rivalry’s stock dipped below C$1 per share in March 2024 and has failed to recover since.

The business went public in 2021 after raising $22m. The stock now languishes at just C$0.02.

Having started life as an esports-focused operator, Rivalry pivoted to focus on the VIP segment and explored crypto in the past 24 months.

In December, the business reported a record performance in Ontario for Q4, with all-time highs in active players and newly acquired players.

Management said the business was also on track to score new records in handle, gross revenue and net revenue.

Led by CEO Steven Salz, the operator reported Q3 net revenue of C$1.9m, while operating expenses fell by 58%.

The post Rivalry plans for potential sale after shuttering platform first appeared on EGR Intel.

Canadian operator to significantly reduce operating expenditure and slash workforce as review takes place with a view to sale or restructure

The post Rivalry plans for potential sale after shuttering platform first appeared on EGR Intel.