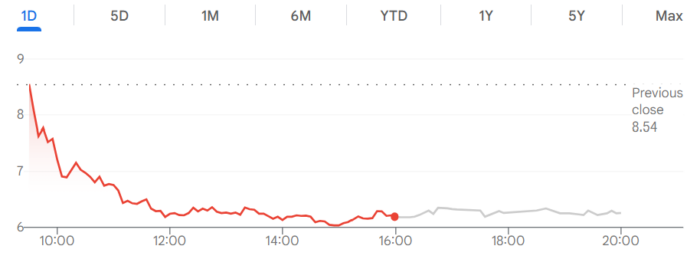

Genius Sports’ shares were down 27% at the close of trading on Thursday, 5 February, after the New York-listed supplier giant announced its $1.2bn move for Legend.

The firm’s stock has slid to $6.19 (£4.56) a share after announcing the acquisition worth an initial $900m in cash and stock, was made public at 6am ET.

Citizens’ Jordan Bender said the market’s reaction was due to a “misunderstanding of the Legend business model, in our view, which is not a pure-play affiliate model”.

In a note, Bender wrote: “This is a type of acquisition that will require investor education around the unique dynamics of the business.

“The 8.5x EBITDA all-in multiple, or 6.4x before the earnout, would represent a premium multiple to affiliate businesses, yet only 36% is paid, which would imply the business is not apples-to-apples with affiliates, trading at depressed EBITDA multiples and higher quality media platforms and marketplaces.”

Legend, which runs a host of sports betting and gaming sites including Casino.org, Covers and Casino Guru, could see the deal rise thanks to a further $300m in earnouts.

Genius Sports bosses delivered a presentation following the announcement, as CEO Mark Locke and co lifted the lid further on the Jersey-based business.

As per the deck, Legend has more than 800 staff in 13 countries, while there were more than 320 million annual visits to its sites from 118 million unique visitors in 2025.

During the call, Locke said: “To put that in perspective, one of the leading rideshare apps reaches 151 million unique users, while a major US food delivery app averages closer to 53 million.”

Bosses said engagement on Legend sites resulted in revenue per unique visitor of more than $2 compared to the average of less than $0.50.

Using data from Covers, a longstanding US-based sports betting site, the presentation stated that user return rates sit at around 75%, with average site visit times landing at nine minutes.

Management noted that Legend would add around $500m in annual revenue to the business, with 2028 revenue to come in at $1.6bn, a 21% CAGR from 2026.

CFO Bryan Castellani revealed Genius Sports had reviewed nearly 100 M&A opportunities over last 18 months.

Providing further details on the Legend business model, chief revenue officer Josh Linforth said the stability of revenue share agreements meant it was an “exciting” addition.

Linforth remarked: “The vast majority of revenue is from North America. North America over the last sort of two years has grown by over 75%, so it’s an ever-increasing area for [Legend].

“We’ve got some other European countries in there that are regulated and a good mix across betting and gaming.

“75% of contracts are recurring revenue, so that’s been a big focus for us. It’s one of the main things that differentiates Legend’s business model from other media players in the sector.

“One of the reasons we’re excited about it is because we’ve got very predictable revenue from it. We know exactly how much money we can make per user. The historical revenues that are coming through the business give us a huge amount of predictability about the future growth.”

When asked about the disruptive nature of AI in the affiliate sector, Locke replied Genius Sports was comfortable with the potential risk.

The CEO said: “On the disruption point, we’re pretty comfortable with the risk profile.

“The distinction is that Legend is not a traditional publishing business dependent on SEO or single traffic sources.

“It comes with a massive network, and the demand is coming directly from sportsbooks and advertisers who are buying outcomes and not impressions.”

The post Genius Sports shares down 27% as bosses lift lid on Legend deal first appeared on EGR Intel.

Supplier takes a hit in New York after announcing $1.2bn acquisition, while management shed light on unit economics behind acquired publisher network

The post Genius Sports shares down 27% as bosses lift lid on Legend deal first appeared on EGR Intel.