On January 28, 2026, the Coalition for Prediction Markets (CPM) published a full-page ad in the Washington Post to show support for strict industry standards and transparency. The coalition includes operators like Kalshi, Coinbase, Robinhood, Underdog, and crypto.com, and their latest move aims to respond to backlash over the integrity of event-based contracts. The ad

On January 28, 2026, the Coalition for Prediction Markets (CPM) published a full-page ad in the Washington Post to show support for strict industry standards and transparency.

The coalition includes operators like Kalshi, Coinbase, Robinhood, Underdog, and crypto.com, and their latest move aims to respond to backlash over the integrity of event-based contracts.

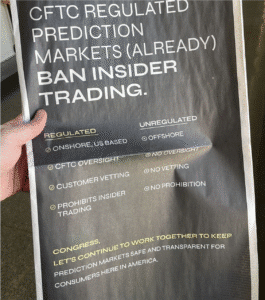

The ad is the beginning of a big PR and marketing campaign that is set to be realized in the coming months. Meanwhile, the Washington Post ad clearly states that the Commodity Futures Trading Commission (CFTC) bans insider trading and makes a distinction between regulated and unregulated markets.

The concerns with insider trading increased after an anonymous bettor placed $30,000 in wagers and received $400,000 connected to Maduro’s removal. Later, the bet on Polymarket triggered an insider trading bill to be introduced.

Polymarket CEO Shayne Coplan responded that insider trading can help spread data more broadly and raise the accuracy of market signals. He also said that prediction markets are a superior method for price discovery and real-world forecasting.

Polymarket is not a member of the coalition. In the ad, the CPM argued that prediction markets have to follow the same anti-manipulation rules as other bodies in order to work as legitimate financial tools.